top headlines from today:

World & Market

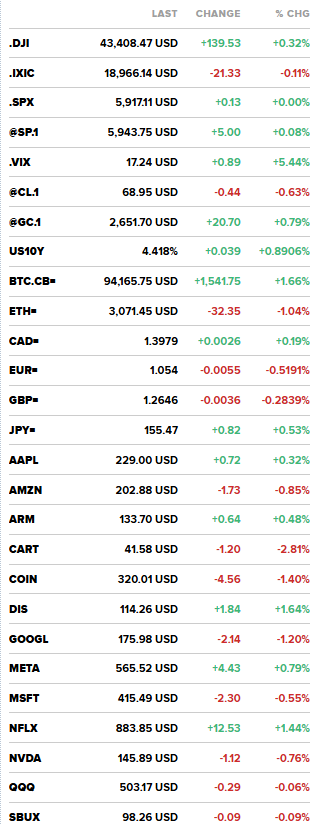

- S&P 500 closes little changed as Nvidia’s big earnings report looms

- US markets closed: ⬆ S&P 500 – 5,917.22 (+0.00%)⬆DOW 30 – 43,408.47 (+0.32%) ⬇ NASDAQ – 18,966.14 (-0.11%) ⬇ Russell 2000 – 2,319.14 (-0.24%) ⬆ CBOE Volatility – 17.37 (+6.24%)

- DOW JONES UNOFFICIALLY CLOSES UP 109.14 POINTS, OR 0.25%, AT 43,378.08

- S&P 500 UNOFFICIALLY CLOSES DOWN 3.02 POINTS, OR 0.05%, AT 5,913.96

- NASDAQ UNOFFICIALLY CLOSES DOWN 26.48 POINTS, OR 0.14%, AT 18,960.99

- US markets closed: ⬆ S&P 500 – 5,917.22 (+0.00%)⬆DOW 30 – 43,408.47 (+0.32%) ⬇ NASDAQ – 18,966.14 (-0.11%) ⬇ Russell 2000 – 2,319.14 (-0.24%) ⬆ CBOE Volatility – 17.37 (+6.24%)

- *NVIDIA 3Q ADJ EPS 81C, EST. 74C

- *NVIDIA 3Q DATA CENTER REVENUE $30.8B, EST. $29.14B

- *NVIDIA 3Q ADJ GROSS MARGIN 75%, EST. 75%

- *NVIDIA SEES 4Q REV. $37.5B PLUS OR MINUS 2%, EST. $37.1B

- POLL: THE FED ARE TO CUT FED FUNDS RATE BY 25BPS IN DECEMBER TO 4.25%-4.50%, SAY 94 OF 106 ECONOMISTS.

- Fed’s Bowman Highlights Cautious Monetary Policy Approach, Notes Inflation Concerns, Higher Neutral Rate Estimate, And Economic Strength Amid Labor Market Stability And Housing Demand

- FED’S COOK: IF INFLATION PROGRESS SLOWS WITH THE JOB MARKET STILL SOLID, COULD SEE A SCENARIO FOR PAUSING.

- The US Department of Education forecasts that by 2027, 70% of jobs will require schooling or training beyond high school.

2024 Politics

- President-elect Trump picks TV personality and former Senate candidate Mehmet Oz to run agency in charge of Medicaid and Medicare.

- US President-elect Donald Trump has named former wrestling executive Linda McMahon as his pick to head the Department of Education, which he said he wanted to abolish, per AFP

- JIM CRAMER SPECULATES TRUMPS CHOICE FOR TREASURY WILL BE KEVIN WARSH: CNBC

- SACRAMENTO, Calif. (AP) — California voters reject ballot measure that would have raised state’s minimum wage to a national high of $18 per hour.

- Senate Democrats seek evidence from FBI sex-trafficking probe of Trump AG pick Matt Gaetz

Conflict

- *PUTIN OPEN TO TALKS ON UKRAINE CEASEFIRE DEAL WITH TRUMP: RTRS

- *PUTIN WON’T AGREE TO CEDING SIGNIFICANT TERRITORY: RTRS

- *UKRAINE FIRES UK STORM SHADOW MISSILES INTO RUSSIA: OFFICIAL

- President Biden authorizes giving antipersonnel land mines to Ukraine

- U.S. VETOES U.N. SECURITY COUNCIL RESOLUTION ON GAZA CEASEFIRE

- KREMLIN: WEST CONTINUES TO USE UKRAINE AS TOOL FOR STRATEGIC DEFEAT OF RUSSIA – RTRS

- Ukraine’s armed forces fire British cruise missiles at military targets inside Russia for the first time, per Bloomberg

- HEZBOLLAH CHIEF QASSEM: THE GROUP HAS RECEIVED THE US CEASEFIRE PROPOSAL, AND MADE COMMENTS THAT WERE SHARED WITH THE US ENVOY.

key headlines we care about:

- Jake Paul, Mike Tyson Fight Attract 108 Million Global Viewers, Streaming Record (Setting a new World Record for most disappointed people at one time….)

- Delta to begin serving Shake Shack on select flights (All Air Marshals will now have to be come cardiologists)

- Business spending on AI surged 500% this year to $13.8 billion, says Menlo Ventures – CNBC (–but still ZERO on benefits for your HUMAN employees…)

- Trump picks Dr. Oz to lead massive Medicare, Medicaid agency CMS (Many of these picks feel like we are in the Wizar of Oz…)

- Hacker Is Said to Have Obtained Damaging Testimony About Gaetz: NYT (They didn’t have to dig much…)

- THE US WILL SEND UKRAINE AT LEAST $275M IN NEW WEAPONS – AP. (So, 4 guns…Got it.)

WISHFUL WAISTBAND WEDNESDAY

Dads, noticing someone else has food left on their plate, after they crushed their entire meal

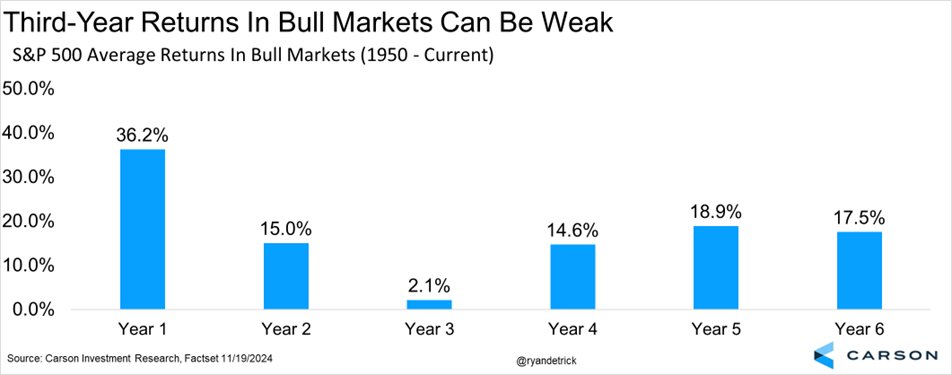

We are in the third year of this bull market, and it is worth noting these years can be on the weaker side of things.

Good news is if the bull continues (as we expect) years 4-6 are all quite strong.

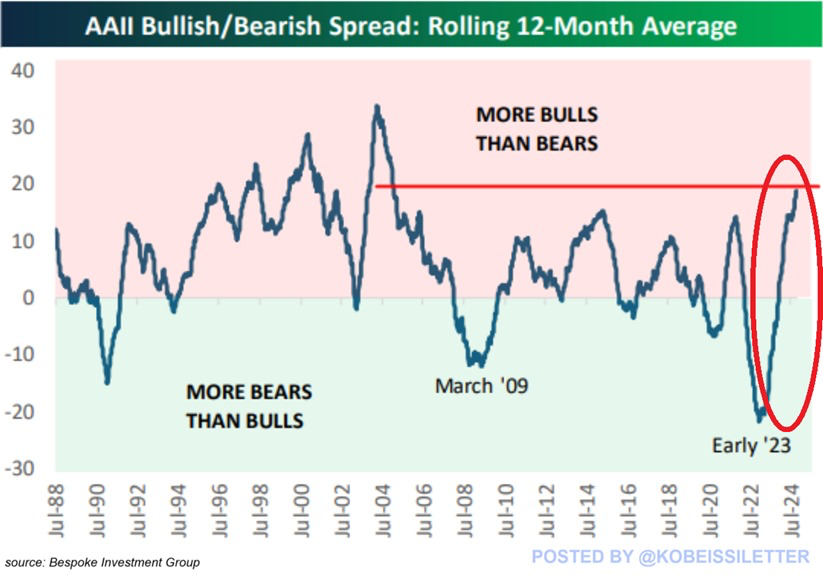

Retail investors are the most bullish in decades:

- The bull-bear spread 12-month average in the AAII survey reached ~20 points in November, the highest in 20 years.

- Since early 2023, this difference has skyrocketed by ~40 points.

- Over the last 36 years, the AAII survey has never seen such a rapid increase in bullish sentiment.

- This came after the market experienced one of its best rallies this century with the S&P 500 rallying 54% since the beginning of 2023.

- Bullish sentiment is through the roof

Unemployment rates can be deceptive b/c they’re determined by more than just the number of people unemployed, so it’s not always an indicator of labor market health; case in point – MD has one of the lowest unemployment rates in the country but fewer jobs today than pre-pandemic:

“I can’t afford eggs, man..”

Global Politics

Senate Democrats seek evidence from FBI sex-trafficking probe of Trump AG pick Matt Gaetz

Trump picks Dr. Oz to lead massive Medicare and Medicaid agency CMS

We all have a shelf life…

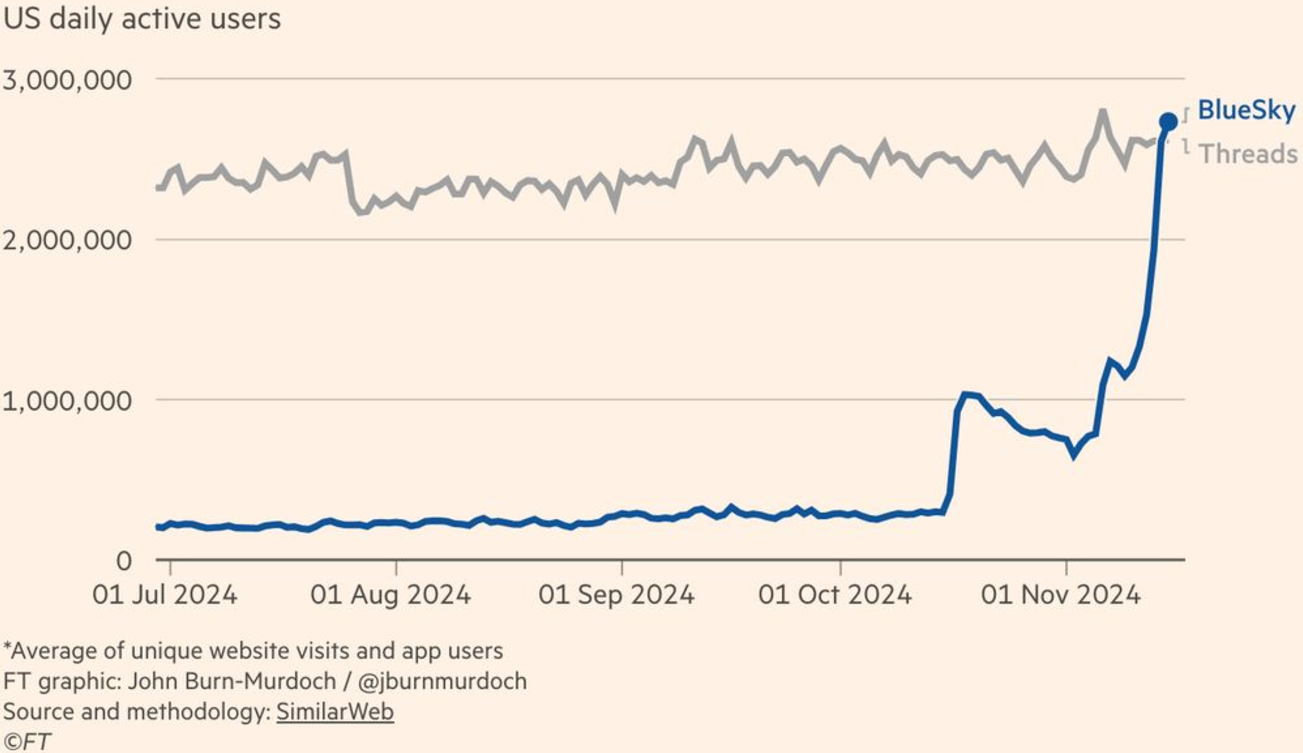

BlueSky User Numbers Have Now Overtaken Threads

Just a reminder that NO ONE fought the wind harder than Gen-X

FYI

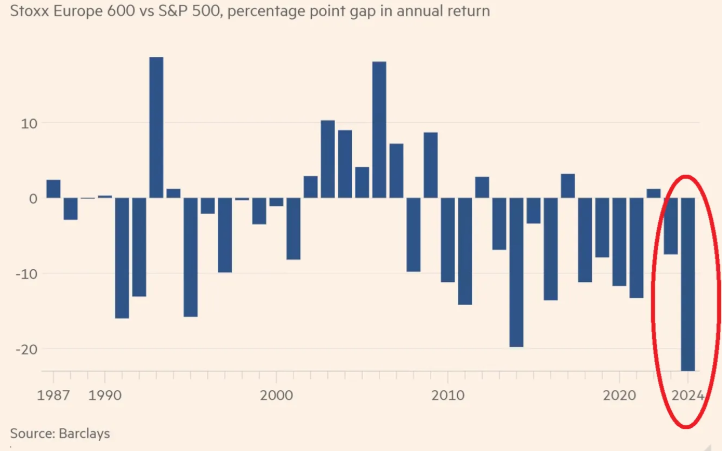

European Stocks Have Underperformed US in 8 of the Last 10 Years

There’s LOVE and then there’s GOING INTO TOWN TOGETHER LIKE THIS, love…

Click HERE for a market recap

on this day in history:

Today in History

1988 First module of the International Space Station launched

Called Zarya, the module is Russian-built and American owned. The International Space Station (ISS) is a manned artificial satellite was built and operated by 5 space agencies – the Canadian Space Agency, the European Space Agency, US’s NASA, Russia’s Roscosmos, and the Japanese Aerospace Exploration Agency. The brightest man-made object visible to the naked eye from Earth, ISS orbits the Earth at a speed of 17,500 miles per hour (28,000 kilometers per hour) at an average distance of 248 miles (400 kilometers) from Earth.

1985 Windows 1.0 released

Nearly two years after it was announced, Microsoft released its first graphical operating system. The OS made it easier for users to navigate on their computer screens. It came with Paint, Notepad, Calculator and a game called Reversi.

1959 Declaration of the Rights of the Child

The United Nations General Assembly adopted the document that laid out the rights of children around the world. The day is also annually celebrated as Universal Children’s Day.

1945 Nuremberg trials begin

The trials were led by the International Military Tribunal and were held to prosecute high-ranking members of the Nazi party for war crimes committed during the Second World War. Of the 23 people tried, 14 were sentenced to death..

1923 Traffic signal patented

American Garret Morgan was awarded the patent for an automated traffic signal. Morgan’s invention was not the first of its kind, but unlike the other traffic signals which just had stop and go signals, his traffic light had a third signal that warned drivers about changes in the stop and go lights. This signal was the precursor for today’s yellow light.

birthdays & deaths:

Births On This Day, November 20th

1981 Sam Fuld

American baseball player

1942 Joe Biden

American politician, 46th President of the United States

1825 Robert F. Kennedy

American politician, 64th United States Attorney General

1912 Otto von Habsburg

Austrian/German son of Charles I of Austria

1750Tipu Sultan

Indian army officer, king

Deaths On This Day, November 20th

2006 Robert Altman

American director, screenwriter

1975 Francisco Franco

Spanish general, politician, Caudillo of Span

1925 Alenandra of Denmark

1910 Leo Tolstoy

Russian author

1737 Caroline of Ansbach

company news/earnings:

Analyst Actions

DELL PT raised to $150 from $140 at Evercore ISI – keeps Overweight rating

Earnings

GLBE Global-e Online Ltd. reported Q3 2024 earnings Results for quarter ended September 30th 2024 – Revenue: $176M, +32% YoY – GMV: $1.13B, +35% YoY – Net loss: $22.6M vs $33.1M in Q3 2023 – EPS: -$0.13 vs -$0.20 in Q3 2023

NIO NIO Inc. reported Q3 2024 earnings Results for quarter ended September 30th 2024 – Revenue: $2.66B, -2.1% YoY – Vehicle sales: $2.38B, -4.1% YoY – Net loss: $721M vs $650M in Q3 2023 – Loss per ADS: $0.36 vs $0.38 in Q3 2023

Palo Alto Networks beats by $0.08, reports revs in-line; guides Q2 EPS in-line, revs in-line; guides FY25 EPS in-line, revs in-line $PANW

SNOW Snowflake reported earnings Q3 FY2025 results ended October 31st, 2024 – Revenue: $942.1M, +28% YoY – Product Revenue: $900.3M, +29% YoY – Operating Loss: $365.5M vs $260.6M in Q3 FY2024 – Free Cash Flow: $78.2M vs $102.3M in Q3 FY2024

TGT Target Corporation reported earnings Q3 FY2024 results ended on November 2nd, 2024 – Revenue: $25.67B, +1.1% YoY – Net earnings: $854M, -12.1% YoY – EPS: $1.85 vs $2.10 in Q3 2023 – Traffic: +2.4% YoY

TJX The TJX Companies reported earnings Q3 FY2025 results ended on November 2nd, 2024 – Revenue: $14.1B, +6% YoY – Net income: $1.3B – EPS: $1.14, +11% YoY vs $1.03 – Comparable store sales: +3% YoY

WIX Wix .com Ltd. reported Q3 2024 earnings Results for quarter ended September 30th 2024 – Revenue: $444.7M, +13% YoY – Net income: $26.8M vs $7.0M in Q3 2023 – EPS: $0.49 vs $0.12 in Q3 2023 – Free cash flow: $127.8M vs $44.8M in Q3 2023

WSM Williams-Sonoma reported earnings Q3 FY2024 results ended October 27, 2024 – Revenue: $1.80B, -2.9% YoY – Net income: $248.9M, +4.9% YoY – EPS: $1.96, +7.1% YoY – Operating margin: 17.8%, +80bps YoY

ZIM ZIM Integrated Shipping Services reported Q3 2024 earnings Results for quarter ended September 30th 2024 – Revenue: $2.77B, +117% YoY – Net income: $1.13B vs -$2.27B in Q3 2023 – EPS: $9.34 vs -$18.90 in Q3 2023 – Volume: 970K TEUs, +12% YoY

FYI

A new report by Rio Tinto showed 39% of workers surveyed by the world’s second-biggest miner had experienced bullying within a 12-month period, up from 31% in 2021

*FORD PLANS TO CUT 4,000 JOBS IN EUROPE BY END OF 2027

Treasury yields rise as investors weigh geopolitical risks, economic data

US 20-Year Bond Sale:

– High Yield Rate: 4.680% (prev 4.590%)

– Bid-Cover Ratio: 2.34 (prev 2.59)

– Direct Accepted: 7.9% (prev 17.6%)

– Indirect Accepted: 69.5% (prev 67.9%)

– WI: 4.650%

“There are retail traders in the U.S. who want to trade at night. Many retail traders work during the day, they come home and want to trade beyond the 8 p.m. cutoff for trading,” Dmitri Galinov has said on CNBC.

GOLDMAN SACHS CEO DAVID SOLOMON SAYS THERE’S A BELIEF THAT THE NEW ADMINISTRATION WILL PARE BACK THE LEVEL OF REGULATION- CNBC INTERVIEW

Cayman Islands’ Premier, Hon. Juliana O’Connor-Connolly delivers opening remarks on behalf of all Overseas Territories at the opening of the Joint Ministerial Council meeting in her capacity as President of the United Kingdom Overseas Territories Association Political Council.

POLL: THE FED ARE TO CUT FED FUNDS RATE BY 25BPS IN DECEMBER TO 4.25%-4.50%, SAY 94 OF 106 ECONOMISTS.

POLL: THE FED ARE TO CUT FED FUNDS RATE TO 3.50%-3.75% BY END-2025 SHOWED BY THE POLL MEDIAN (3.00%-3.25% IN OCTOBER.)

IMF: BOK’S GRADUAL MONETARY NORMALIZATION IS APPROPRIATE

CHINA KEEPS LOAN PRIME RATES UNCHANGED FOR NOVEMBER

– 5-Year LPR: 3.60% (est 3.60%; prev 3.60%) – 1 Year LPR: 3.10% (est 3.10%; prev 3.10%)

The venture capital firm Bling Capital now has more than $750 million under management to invest in early startups

ARCHEGOS CAPITAL MANAGEMENT FOUNDER SUNG KOOK ‘BILL’ HWANG SENTENCED TO 18 YEARS IN PRISON FOR FRAUD, MARKET MANIPULATION

KERRISDALE CAPITAL: WE’RE SHORT $OKLO

Michael Saylor’s MicroStrategy to raise $2.6 billion, up from $1.75 billion, to purchase more Bitcoin

WELLS FARGO RAISES S&P 500 2025-END TARGET TO 6500-6700 FROM PRIOR FORECAST OF 6200-6400

WELLS FARGO RAISES 2025-END 10-YEAR TREASURY YIELD FORECAST TO 4.50%-5.00% FROM PRIOR FORECAST OF 4.00%-4.50%

FED’S COOK: THE ECONOMY IS IN A GOOD POSITION, THOUGH CORE INFLATION IS STILL SOMEWHAT ELEVATED.

FED’S COOK: THE TOTALITY OF DATA SUGGESTS DISINFLATION IS STILL UNDERWAY WITH THE LABOR MARKET GRADUALLY COOLING.

GOLDMAN SACHS CEO SAYS IN 2025 WE WILL HAVE MORE ROBUST CAPITAL MARKETS

IMF WARNS OF TRADE SLOWDOWN AND GEOECONOMIC TENSIONS AS RISKS FOR KOREA

IMF PREDICTS SOUTH KOREAN ECONOMY TO GROW 2.2% IN 2024 AND 2% IN 2025

A former senior supervisor at the Federal Reserve Bank of Richmond pleaded guilty to insider trading

The man accused of killing Georgia nursing student Laken Riley has been found guilty of murder. He faces possible life in prison.

Susan Smith, a South Carolina woman who admitted to drowning her two children 30 years ago, was unanimously denied parole after she appeared before the board for the first time on Wednesday.

U.S MBA MORTGAGE APPLICATIONS (WOW) ACTUAL: 1.7% VS 0.5% PREVIOUS

U.S MBA 30-YEAR MORTGAGE RATE ACTUAL: 6.90% VS 6.86% PREVIOUS

U.S MBA PURCHASE INDEX ACTUAL: 136.0 VS 133.3 PREVIOUS

U.S MORTGAGE MARKET INDEX ACTUAL: 195.6 VS 192.4 PREVIOUS

U.S MORTGAGE REFINANCE INDEX ACTUAL: 514.9 VS 506.0 PREVIOUS

TOKYO CONDOMINIUM SALES INCREASE BY 23.4% YEAR ON YEAR

Comcast plans to spin off cable-TV channels including MSNBC and USA as it looks to reduce its exposure to a business that’s losing viewers and advertisers

DT Midstream has reached an agreement to buy three natural gas transmission pipelines from Oneok for $1.2 billion

Dollar resumes climb after three-day fall as investors eye Fed

Gold gains for third consecutive day on escalating Russia-Ukraine tensions

BRENT CRUDE FUTURES SETTLE AT $72.81/BBL, DOWN 50 CENTS, 0.68%.

NYMEX WTI CRUDE DECEMBER FUTURES SETTLE AT $68.87 A BARREL, DOWN 52 CENTS, 0.75%.

NYMEX DIESEL DECEMBER FUTURES SETTLE AT $2.2263 A GALLON.

NYMEX GASOLINE DECEMBER FUTURES SETTLE AT $2.0458 A GALLON.

NYMEX NATURAL GAS DECEMBER FUTURES SETTLE AT $3.1930/MMBTU.

GERMANY SETS GAS STORAGE LEVY AT €2.99/MWH FROM JANUARY 1ST.

JAPAN’S OCTOBER EXPORTS TO EU FALL 11.3% YEAR ON YEAR

ECB: EURO-ZONE WAGE GROWTH ACCELERATES TO 5.4% IN Q3

EUROZONE Q3 NEGOTIATED WAGE GROWTH 5.42% – ECB DATA

S&P 500 closes little changed as Nvidia’s big earnings report looms

US markets closed: ⬆ S&P 500 – 5,917.22 (+0.00%) ⬆ DOW 30 – 43,408.47 (+0.32%) ⬇ NASDAQ – 18,966.14 (-0.11%) ⬇ Russell 2000 – 2,319.14 (-0.24%) ⬆ CBOE Volatility – 17.37 (+6.24%)

DOW JONES UNOFFICIALLY CLOSES UP 109.14 POINTS, OR 0.25%, AT 43,378.08

S&P 500 UNOFFICIALLY CLOSES DOWN 3.02 POINTS, OR 0.05%, AT 5,913.96

NASDAQ UNOFFICIALLY CLOSES DOWN 26.48 POINTS, OR 0.14%, AT 18,960.99

European markets close slightly lower as traders assess simmering geopolitical tensions

Asia markets mostly lower as China keeps lending rates steady; investors assess Japan trade data