top headlines from today:

World & Market

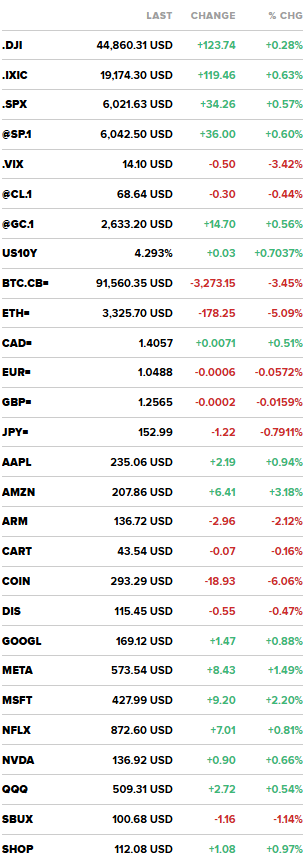

- Dow, S&P 500 end at record highs as investors shake off Trump’s tariff threat

- US markets closed: ⬆ S&P 500 – 6,021.60 (+0.57%) ⬆ DOW 30 – 44,860.31 (+0.28%) ⬆ NASDAQ – 19,174.30 (+0.63%) ⬇ Russell 2000 – 2,423.17 (-0.77%) ⬇ CBOE Volatility – 14.11 (-3.36%)

- DOW JONES UNOFFICIALLY CLOSES UP 120.42 POINTS, OR 0.27%, AT 44,856.99

- S&P 500 UNOFFICIALLY CLOSES UP 34.86 POINTS, OR 0.58%, AT 6,022.23

- NASDAQ UNOFFICIALLY CLOSES UP 122.29 POINTS, OR 0.64%, AT 19,177.13

- FOMC Minutes: Many Officials Noted ‘Uncertainties’ Around Neutral Interest Rate

- The top 1% of U.S. households now control 30% of the nation’s wealth, $44.6 trillion, per YF.

- TRUMP TO IMPOSE ADDITIONAL 10% TARIFF ON CHINA

- BOFA GLOBAL RESEARCH EXPECTS S&P 500 TO REACH 6666 BY END OF 2025

- Goldman Sachs, $GS, expects the S&P 500 to reach 6500 by year-end 2025

- Donald Trump has just said: as one of my many first executive orders, I will sign all necessary documents to charge Mexico and Canada a 25% tariff on all products coming into the US

- CHINESE OFFICIALS HAVE ASKED TSMC ABOUT THE U.S. INVESTIGATION AND A POTENTIAL TIGHTENING OF EXPORT CONTROLS- THE INFORMATION

- Kohl’s CEO Tom Kingsbury to step down in January, to be replaced by Michaels CEO Ashley Buchanan

2024 Politics

- Majority of Americans aged 18-29 view Trump favorably, according to a recent YouGov poll.

- Mexican president suggests Mexico could respond to any of Donald Trump’s tariffs with tariffs of its own on US products.

- MEXICAN PRESIDENT SHEINBAUM SAYS SENDING LETTER TO US PRESIDENT-ELECT TRUMP

- MEXICAN PRESIDENT SHEINBAUM SAYS MIGRANT CARAVANS ARE NO LONGER ARRIVING TO US-MEXICO BORDER

- SHEINBAUM: I’M OF THE VIEW THAT WE’LL REACH AGREEMENT WITH US

- SHEINBAUM: WE ARE SEEKING TO MEET US AS SOON AS POSSIBLE

- TRUDEAU SAYS WILL WORK ON U.S. RELATIONSHIP, SAYS EVERYONE MUST WORK TOGETHER; ‘THERE’S WORK TO DO AND WE KNOW HOW TO DO IT’

- *WHITNEY TILSON SAYS HE’S RUNNING FOR NEW YORK CITY MAYOR

Conflict

- *ISRAEL SECURITY CABINET APPROVED LEBANON CEASE-FIRE DEAL: CH12

- *BIDEN SAYS ISRAEL AND HEZBOLLAH AGREED TO CEASE-FIRE DEAL

- US NAVY’S 7TH FLEET AIRCRAFT TRANSITS TAIWAN STRAIT ON NOVEMBER 26TH

- AIRCRAFT FROM 7TH FLEET CROSS TAIWAN STRAIT

- TRUMP TEAM WEIGHS DIRECT TALKS WITH NORTH KOREA’S KIM – SOURCES.

- ISRAELI MILITARY: WE ARE ATTACKING HEZBOLLAH TARGETS IN THE BEIRUT AREA ON A LARGE SCALE.

- Russia is said to be thinking of putting missiles in Asia if the US keeps deploying weapons systems that anger China

- Russian air defenses destroyed 39 Ukrainian drones overnight

key headlines we care about:

- 415-47, UK LAWMAKERS VOTE TO GRADUALLY PHASEOUT, BAN SMOKING (Well, not there’s LITERALLY nothing fun to do in the UK…)

- IRS COMPLIANCE COSTS $546 BILLION PER YEAR (The Daily Signal) (Well, NOW you know where your tax dollars go…….)

- Hennessy suspends plan to bottle cognac in China, staff says Hennessy suspends plan to bottle cognac in China, staff says (SOMEONE got a phone call from Mara Lago)

- Update on Canada’s first human case of bird flu: The teenager remains in critical condition, nearly a month after falling ill. The source of the infection is still unknown. (A bird?)

TIRELESSLY TIRED TUESDAY

Trying to brace and prep for the holidays any way you can….and still struggling.

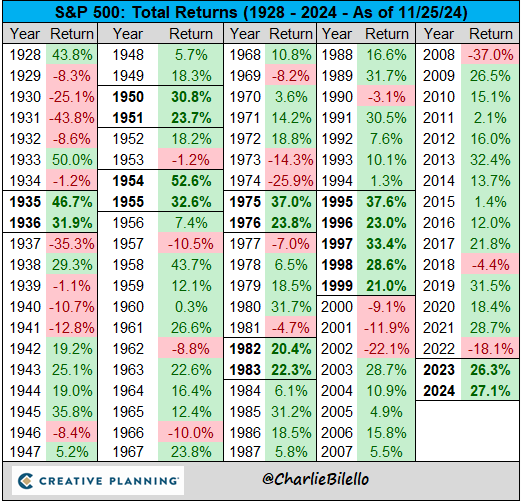

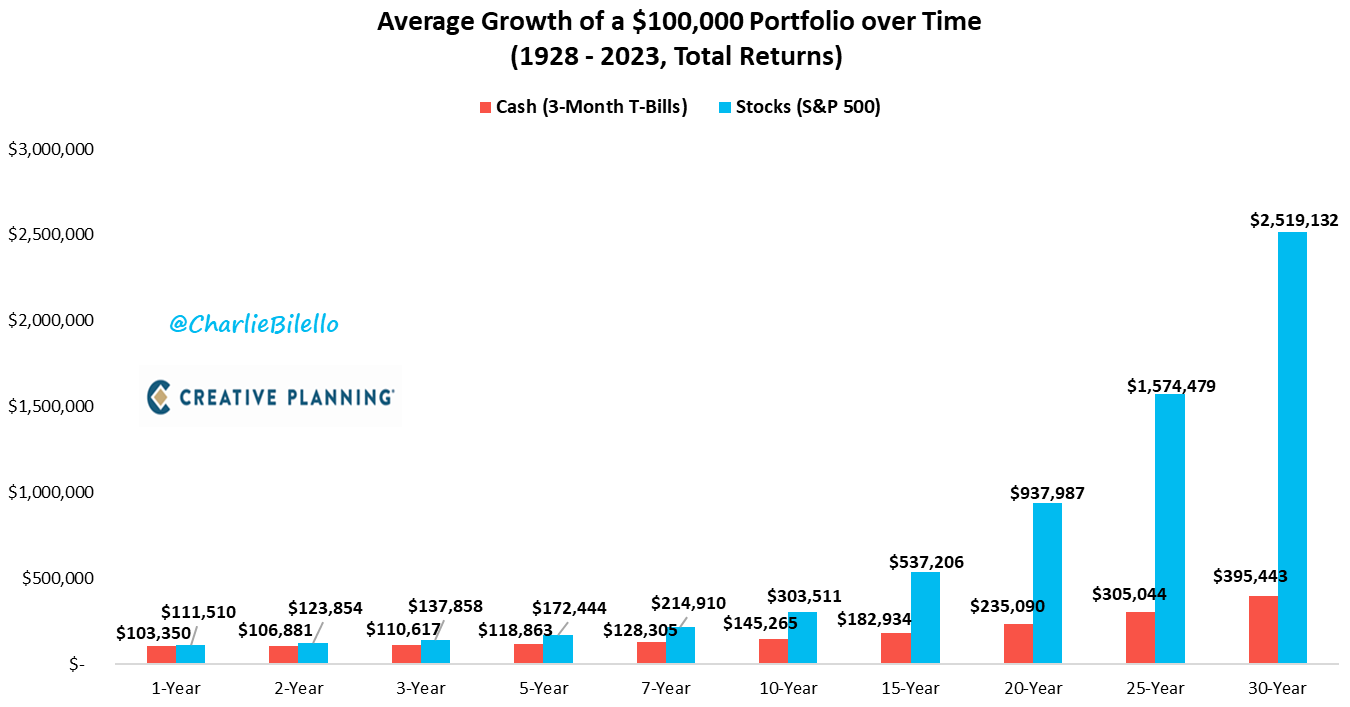

The S&P 500 is currently on pace for back-to-back years with a total return above 20%. The last time that happened: 1998-1999.

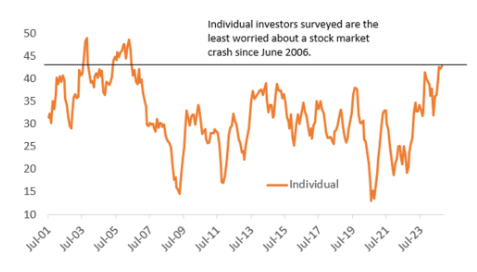

Retail Traders are the least worried about a stock market crash since 2006

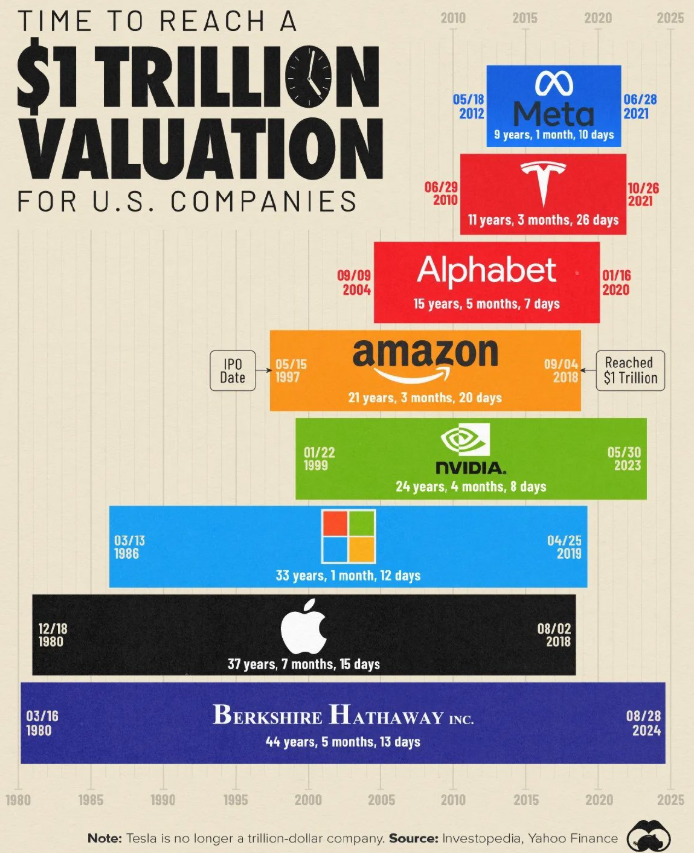

Warren Buffett Plays the Long Game

When you’ve already typed something twice & your phone autocorrects it again…

The average growth of $100k invested in US Stocks over 30 years is $2.5 million versus $395k for the same initial investment in Treasury Bills.

Global Politics BIDEN SAYS ISRAEL AND HEZBOLLAH AGREED TO CEASE-FIRE DEAL

Trump Team Signs Transition Agreement With Biden Administration

When you’re on your lunch break and SERIOUSLY consider not going back.

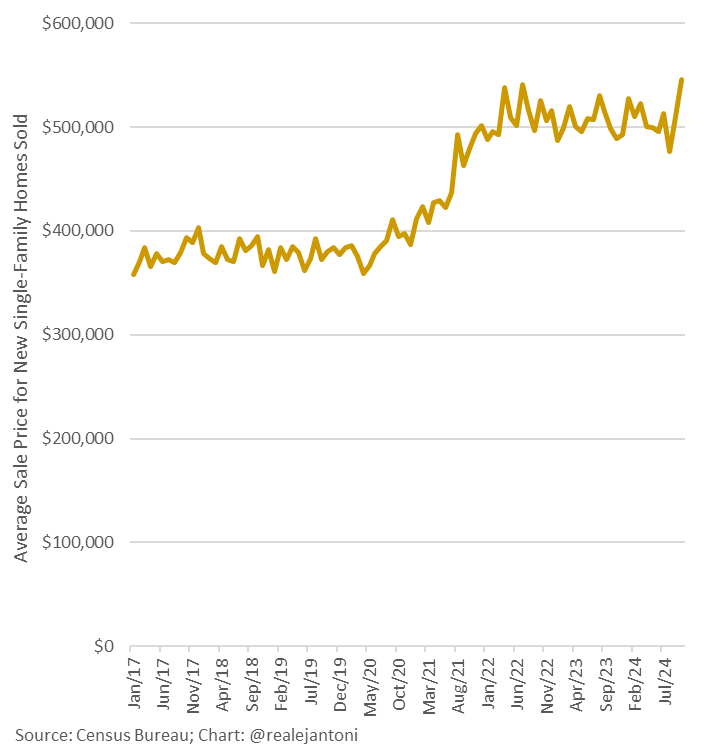

Average new home price exploded in Oct to new record of $545,800; The increase is partly due to many homebuilders only making a profit on large or luxury homes while starter homes can’t be profitably priced today. So, less of the latter are being sold, driving up the average:

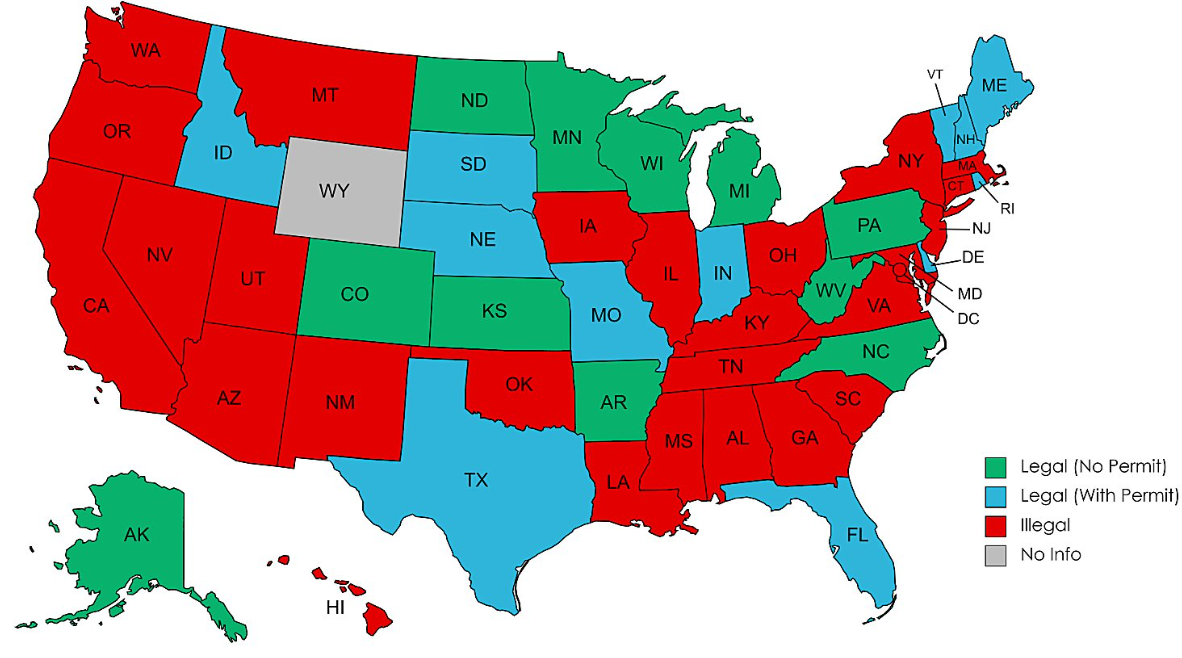

FYI The legality of owning an alligator

When you run out of sources for an essay…

Click HERE for a market recap

on this day in history:

Today in History

2003 Concorde retired from service

Concorde retired from service after 27 years of flight

1983 Brink’s Mat gold heist

The £ 26 million robbery took place in a Brink Mat warehouse at Heathrow Airport in London. The stolen gold, diamonds and cash has never been recovered.

1966 World’s first tidal power station opens in France

The Rance Tidal Power Station on the Rance River in Brittany, France was inaugurated by French president Charles de Gaulle. Today, it is one of the largest tidal power stations in the world.

1965 France launches Astérix

The launch of the satellite from Hammaguir, Algeria made France the 6th country in the world after the US, the USSR, the UK, Canada, and Italy to have an artificial satellite in orbit. The satellite is named after the Asterix the popular comic character created by French writer René Goscinny.

1942 Casablanca premiers

The classic movie starring Ingrid Bergman and Humphrey Bogart won 3 Oscars – Best Picture, Director, and Adapted Screenplay. The film, which is set during the Second World War, follows the life of Rick Blaine, a former freedom fighter and a club owner in Casablanca, Morocco, who has to choose between his love for a woman, Ilsa Lund, and saving her husband from the Nazis.

birthdays & deaths:

Births On This Day, November 26th

1972 Arjun Rampal

Indian actor

1939 Tina Turner

American singer, dancer, actress

1922 Charles M. Schulz

American cartoonist

1876 Ibn Saud

Saudi Arabian king

1827 Ellen G. White

American author, co-founder of the Seventh-Day Adventist Church

Deaths On This Day, November 26th

1952 Sven Hedin

Swedish geographer, explorer

1943 Edward O’Hare

American pilot, Medal of Honor recipient

1883 Sojourner Truth

American activist

1855 Adam Mickiewicz

Polish poet

1504 Isabella I of Castile

company news/earnings:

Analyst Actions

UPGRADES

$ALGT Upgraded to Neutral at UBS

$AIT Upgraded to Buy at BofA; PT USD 315

$BAC Upgraded to Buy at CFRA

$CPRI Upgraded to Buy at Guggenheim

$CHTR Upgraded to Neutral at BNPP Exane; PT USD 360

$CVX Upgraded to Buy at Citi; PT USD 185

$EMN Upgraded to Overweight at Wells Fargo; PT USD 125

$FIBK Upgraded to Buy at DA Davidson; PT USD 42

$ONB Upgraded to Strong Buy at Raymond James

$SAIC Upgraded to Overweight at Wells Fargo

$UAL Upgraded to Buy at UBS; PT USD 139

$ZM Upgraded to Outperform at Evercore ISI; PT USD 115

DOWNGRADES

$AAL Downgraded to Neutral at UBS; PT USD 16

$BC Downgraded to Neutral at B Riley; PT USD 88

$SAVA Downgraded to Neutral at HC Wainwright

$EG Downgraded to Hold at Jefferies; PT USD 429

$GMS Downgraded to Neutral at DA Davidson; PT USD 97

$GS Downgraded to Hold at HSB

$HUBB Downgraded to Hold at Deutsche Bank

$MS Downgraded to Hold at HSBC

$PSTX Downgraded to Neutral at BTIG

$PSTX Downgraded to Neutral at Cantor

$LUV Downgraded to Sell at UBS; PT USD 27

$SUM Downgraded to Peerperform at Wolfe

$SUM Downgraded to Neutral at Longbow

$SUM Downgraded to Neutral at Citi; PT USD 52.50

$SUM Downgraded to Hold at Loop Capital; PT USD 52.50

$TGT Downgraded to Neutral at Daiwa; PT USD 130

INITIATIONS

$TEAM Reinstated Buy at William O’Neil

$AUR Initiated at New Peerperform at Wolfe

$RNA Initiated at New Outperform at RBC; PT USD 67

$CRGX Initiated at New Outperform at William Blair

$CCL Initiated at New Market Perform at Bernstein; PT USD 26

$DYN Initiated at New Outperform at RBC; PT USD 45

$INGM Initiated at New Hold at Melius; PT USD 26

$KRNT Initiated at New Overweight at Cantor; PT USD 39

$PNR Initiated at New Outperform at Wolfe; PT USD 125

$PINS Initiated at New Buy at TD Cowen; PT USD 38

$RMBS Initiated at New Outperform at Baird

$RDW Initiated at New Buy at HC Wainwright; PT USD 18

$RCL Initiated at New Outperform at Bernstein; PT USD 290

$SON Initiated at New Buy at Truist Secs; PT USD 63

Earnings

ADI Analog Devices reported earnings Q4 FY2024 results ended November 2nd, 2024 – Revenue: $2.44B, -10% YoY – Net income: $478.1M, -4% YoY – Operating margin: 23.3% vs 23.4% YoY – Free cash flow: $885.4M, 36% of revenue

ADSK Autodesk Inc. reported earnings Fiscal 2025 Q3 results ended October 31st, 2024 – Revenue reached $1.57B, up 11% YoY – Net income was $275M, up from $241M YoY – GAAP diluted EPS $1.27, up from $1.12 YoY – Total billings increased 28% YoY to $1.54B

ANF Abercrombie & Fitch reported earnings Q3 FY2024 results ended November 2nd, 2024 – Revenue: $1.21B, +14% YoY – Net income: $132.0M, +37% YoY – Comparable sales: +16% YoY – Operating margin: 14.8% vs 13.1% YoY

BBY Best Buy reported earnings Q3 FY2025 results ended November 2nd, 2024 – Revenue: $9.45B, -3.2% YoY – Net income: $273M, +3.8% YoY – Comparable sales declined 2.9% YoY – Operating margin: 3.7% vs 3.6% YoY

CROWDSTRIKE $CRWD JUST REPORTED EARNINGS EPS of $0.93 beating expectations of $0.81 Revenue of $1.01B beating expectations of $983M

DELL | Dell Tech Q3 25 Earnings: – Adj Eps $2.15 (est $2.05) – Adj oper Income $2.20B (est $2.16B) – Infrastructure Solution Group Rev $11.37B (est $11.34B) – Net Rev $24.37B (est $24.59B)

DKS DICK’S Sporting Goods reported earnings Q3 FY2024 results ended on November 2nd, 2024 – Revenue: $3.06B, +0.5% YoY – Net income: $228M, +13% YoY – Comparable sales growth: 4.2% vs 1.9% in Q3 2023 – Earnings per share: $2.75, +15% YoY

KSS Kohl’s reported Q3 FY2024 earnings Q3 FY2024 results ended November 2nd, 2024 – Revenue: $3.51B, -8.8% YoY – Net income: $22M, -62.7% YoY vs $59M – EPS: $0.20 vs $0.53 in Q3 2023 – Operating income: $98M vs $157M in Q3 2023

SJM J.M. Smucker reported earnings Q2 FY2025 results ended October 31st, 2024 – Revenue: $2.27B, +17% YoY – Net loss: $24.5M, vs profit of $194.9M YoY – Adjusted EPS: $2.76, +7% YoY – Free cash flow: $317.2M vs $28.2M YoY

WDAY Workday Inc. reported earnings Fiscal 2025 Q3 results ended October 31st, 2024 – Total revenue reached $2.16B, up 15.8% YoY – Net income grew to $193M, up from $114M YoY – Diluted EPS was $0.72, up from $0.43 YoY – Operating cash flow was $406M, down from $451M YoY

FYI

BBY Best Buy CEO says around 60% of the cost of their sales comes from China

Databricks closes in on multibillion funding round at $55 billion valuation to help employees cash out

10-year Treasury yield rises after Fed minutes say to expect gradual rate cuts

ETFs listed in the U.S. hit a record-breaking $900 billion in inflows and about 600 ETF launches this year, per CNBC.

Kraken is shutting down its NFT marketplace almost two years after the platform was launched, saying it’s shifting more resources into new products and services

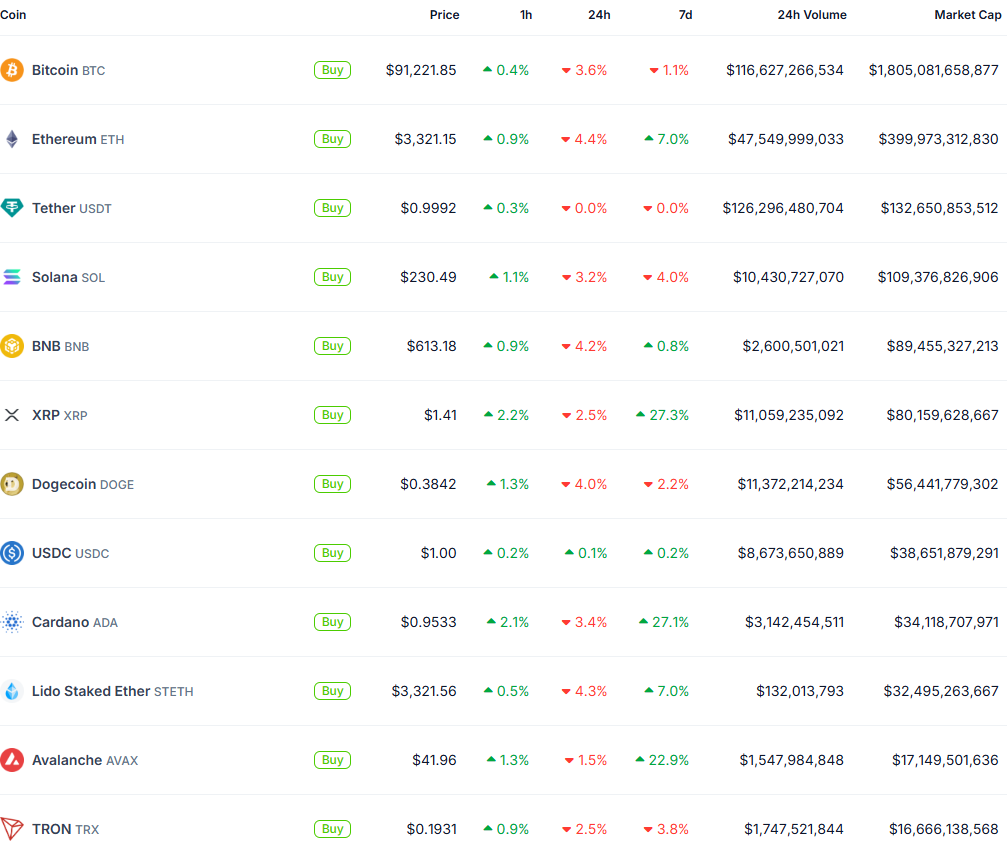

*RUMBLE TO ALLOCATE PORTION OF EXCESS CASH RESERVES TO BITCOIN

UK’s Financial Watchdog to Finalize Crypto Sector Rules in 2026

President-elect Trump administration considers CFTC to lead digital asset regulation.

Gavin Newsom is rebooting EV incentives in California, but excluding Tesla, $TSLA, per Bloomberg

IRS COMPLIANCE COSTS $546 BILLION PER YEAR (The Daily Signal)

Norway is tackling income inequality with a Massive Wealth Tax on Billionaires like Elon Musk

FOMC Minutes: Many Officials Noted ‘Uncertainties’ Around Neutral Interest Rate

*FED MINUTES SHOW BROAD SUPPORT FOR `GRADUALLY’ LOWERING RATES

*FED: SOME SAW PAUSE OR FASTER CUTS AS OPTIONS DEPENDING ON DATA

*FED MULLS 5-BPS REVERSE-REPO RATE CUT AS TECHNICAL ADJUSTMENT

FED’S KASHKARI SUGGESTS NEUTRAL RATE COULD BE HIGHER, FED POLICY LESS RESTRICTIVE

CONSIDERATION FOR DECEMBER RATE CUT:

FED’S KASHKARI: MONITORING CHINA’S DOMESTIC ECONOMIC CHALLENGES CLOSELY

FED’S KASHKARI SEES INFLATION GENTLY TRENDING DOWN

BOFA GLOBAL RESEARCH EXPECTS S&P 500 TO REACH 6666 BY END OF 2025

Goldman Sachs, $GS, expects the S&P 500 to reach 6500 by year-end 2025

Digicel, the international mobile operator, told creditors it is cooperating with a US Justice Department probe in a private earnings call

U.S NEW HOME SALES (OCT) ACTUAL: 610K VS 738K PREVIOUS; EST 724K

U.S NEW HOME SALES (MOM) (OCT) ACTUAL: -17.3% VS 4.1% PREVIOUS

*U.S. SEPTEMBER S&P CASE SHILLER 20-CITY HOUSE PRICE INDEX RISES 4.6% Y/Y; EST. 4.7%; PREV. 5.2% *LOWEST SINCE SEPTEMBER 2023

Trump’s tariff threats signal the start of a wild ride in currency markets

Gold steady as safe-haven demand faces mixed geopolitical signals

Iron ore prices have rallied this week as Chinese steel mills churn out more metal than usual at the beginning of the low season

NYMEX WTI CRUDE JANUARY FUTURES SETTLE AT $68.77 A BARREL, DOWN 17 CENTS, 0.25%.

NYMEX DIESEL DECEMBER FUTURES SETTLE AT $2.2404 A GALLON.

NYMEX NATURAL GAS DECEMBER FUTURES SETTLE AT $3.4310/MMBTU.

CANADA OCTOBER WHOLESALE TRADE MOST LIKELY ROSE 0.5% FROM THE PREVIOUS MONTH

MAGNITUDE 5.7 EARTHQUAKE STRIKES NEAR WEST COAST OF HONSHU, JAPAN REGION – EMSC

U.S CB CONSUMER CONFIDENCE (NOV) ACTUAL: 111.7 VS 108.7 PREVIOUS; EST 111.8

Philadelphia Fed Non-Manufacturing Activity Nov:-5.9 (prev 6.0)

U.S RICHMOND MANUFACTURING INDEX (NOV) ACTUAL: -14 VS -14 PREVIOUS; EST -10

U.S RICHMOND MANUFACTURING SHIPMENTS (NOV) ACTUAL: -12 VS -8 PREVIOUS

U.S RICHMOND SERVICES INDEX (NOV) ACTUAL: 9 VS 3 PREVIOUS

US REDBOOK YOY ACTUAL 4.9% (FORECAST -, PREVIOUS 5.1%)

U.S DALLAS FED SERVICES REVENUES (NOV) ACTUAL: 10.9 VS 9.2 PREVIOUS

U.S TEXAS SERVICES SECTOR OUTLOOK (NOV) ACTUAL: 9.8 VS 2.0 PREVIOUS

Dow, S&P 500 end at record highs as investors shake off Trump’s tariff threat

US markets closed: ⬆ S&P 500 – 6,021.60 (+0.57%) ⬆ DOW 30 – 44,860.31 (+0.28%) ⬆NASDAQ – 19,174.30 (+0.63%) ⬇ Russell 2000 – 2,423.17 (-0.77%) ⬇ CBOE Volatility – 14.11 (-3.36%)

DOW JONES UNOFFICIALLY CLOSES UP 120.42 POINTS, OR 0.27%, AT 44,856.99

S&P 500 UNOFFICIALLY CLOSES UP 34.86 POINTS, OR 0.58%, AT 6,022.23

NASDAQ UNOFFICIALLY CLOSES UP 122.29 POINTS, OR 0.64%, AT 19,177.13

Europe markets close lower; autos stocks fall 1.7% as investors digest Trump tariff threats

Asia-Pacific markets trade mixed after U.S. stocks hit new highs overnight