top headlines from today:

World & Market

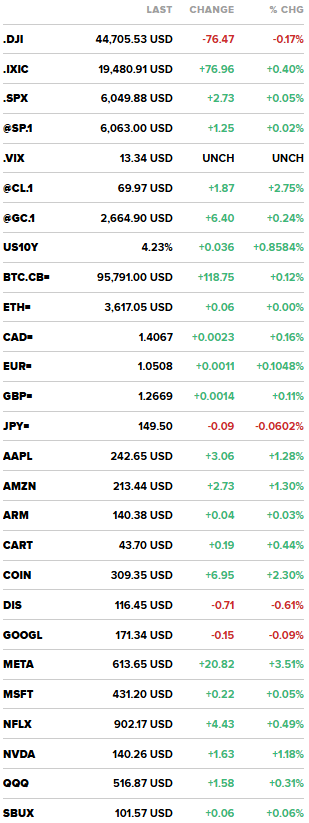

- S&P 500 ticks higher for another record close on Tuesday

- US markets closed: ⬆ S&P 500 – 6,049.88 (+0.05%) ⬇ DOW 30 – 44,705.41 (-0.17%) ⬆ NASDAQ – 19,480.91 (+0.40%) ⬇ Russell 2000 – 2,416.01 (-0.74%) ⬆CBOE Volatility – 13.40 (+0.45%)

- DOW JONES UNOFFICIALLY CLOSES DOWN 72.11 POINTS, OR 0.16%, AT 44,709.89

- S&P 500 UNOFFICIALLY CLOSES UP 2.98 POINTS, OR 0.05%, AT 6,050.13

- NASDAQ UNOFFICIALLY CLOSES UP 76.10 POINTS, OR 0.39%, AT 19,480.05

- GLOBAL DEBT HITS FRESH RECORD HIGH OF $323 TRLN IN Q3 – IIF

- US job openings picked up in October, suggesting demand for workers is stabilizing after steep declines in recent months.

- Mortgage Rates Lower on Average, But Timing Matters 30 Yr. Fixed: 6.85% (-0.06% ▼) | 15 Yr. Fixed: 6.05% (-0.07% ▼) |

- Bank of America economist just said it expects the S&P 500 to reach 6,666 by the end of 2025 driven by continued outperformance by the 🇺🇸 economy

- AT&T expects to no longer provide copper based services across a majority of its footprint by end of 2029

- Delaware rejects Elon Musk’s $56 billion pay package again.

- Number of older adults who lost $100,000 or more to fraud has tripled since 2020, FTC has said.

2024 Politics

- Donald Trump reportedly picks pro-crypto Paul Atkins for SEC chair, to replace Gary Gensler

- Trump reportedly told Justin Trudeau that if Trump’s tariffs destroyed Canada, and thecountry could not survive without “ripping off the U.S. to the tune of $100 billion a year,” then Canada should become the United States’ 51st state, with Trudeau serving as its governor, per FOX.

- Trump transition team reaches agreement with Department of Justice to conduct background checks — Statement

- META’S MARK ZUCKERBERG SEEKS ‘ACTIVE ROLE’ IN DONALD TRUMP’S TECH POLICIES.

- WHITE HOUSE: U.S. ASSESSING NEW CHNA EXPORT CONTROLS

- SCHUMER REELECTED DEMOCRATIC SENATE LEADER

- US TO TAKE STEPS TO MITIGATE CHINESE ‘COERCIVE ACTIONS’ -WHITE HOUSE

Conflict

- U.S. sends another $725 million in weapons to Ukraine.

- NATO CHIEF WARNS DONALD TRUMP OF ‘DIRE THREAT’ TO US IF UKRAINE PUSHED INTO BAD PEACE DEAL – FT

- ISRAEL’S NETANYAHU THANKS TRUMP FOR “STRONG STATEMENT” ON HOSTAGES

- South Korean president declares martial law to eradicate pro-North Korean forces, uphold constitutional order: Yonhap news agency

- U.S. AND SOUTH KOREAN MILITARIES ARE “IN CONTACT” FOLLOWING MARTIAL LAW DECLARATION, PENTAGON SAYS

- South Korean Military says Martial Law remains in place until the President says otherwise, despite the unanimous vote to block it.

- South Korean government says anyone violating martial law is subject to arrest without a warrant

Virus

- 5 years ago: A man in Wuhan, China starts feeling ill, becoming the first confirmed case of COVID-19

- California reports 2 more human cases of H5N1 bird flu, both linked to dairy farms

- 60% Americans don’t plan to get the most current COVID vaccine, $PFE, $MRNA, per the Pew Research Center.

key headlines we care about:

- MACRON SAYS HE WON’T RESIGN BEFORE HIS MANDATE ENDS IN 2027 (NO WAY, a French person being annoying and indignant?)

- GLOBAL DEBT HITS FRESH RECORD HIGH OF $323 TRLN IN Q3 – IIF (“It’s not wrong if EVERYONE is doing it….”)

- “Resentment is sweeping through the American workforce,” per Axios. (Coming back from a long weekend will do that to you…)

- US SENATE MAJORITY LEADER SCHUMER: CONFIDENT GOVERNMENT FUNDING WILL BE DONE BY DEADLINE. (A “Confident Democrat” in 2024 is as rare as a “fun root canal”.)

- The University of Texas has announced that students whose families make less than $100,000 annually will receive free tuition and waived fees. (“Mom and Dad, I need you to quit your job for the next 4 years….”)

TEMPID TECHNOLOGY TUESDAY

When autocorrect hits you with “holy shot”

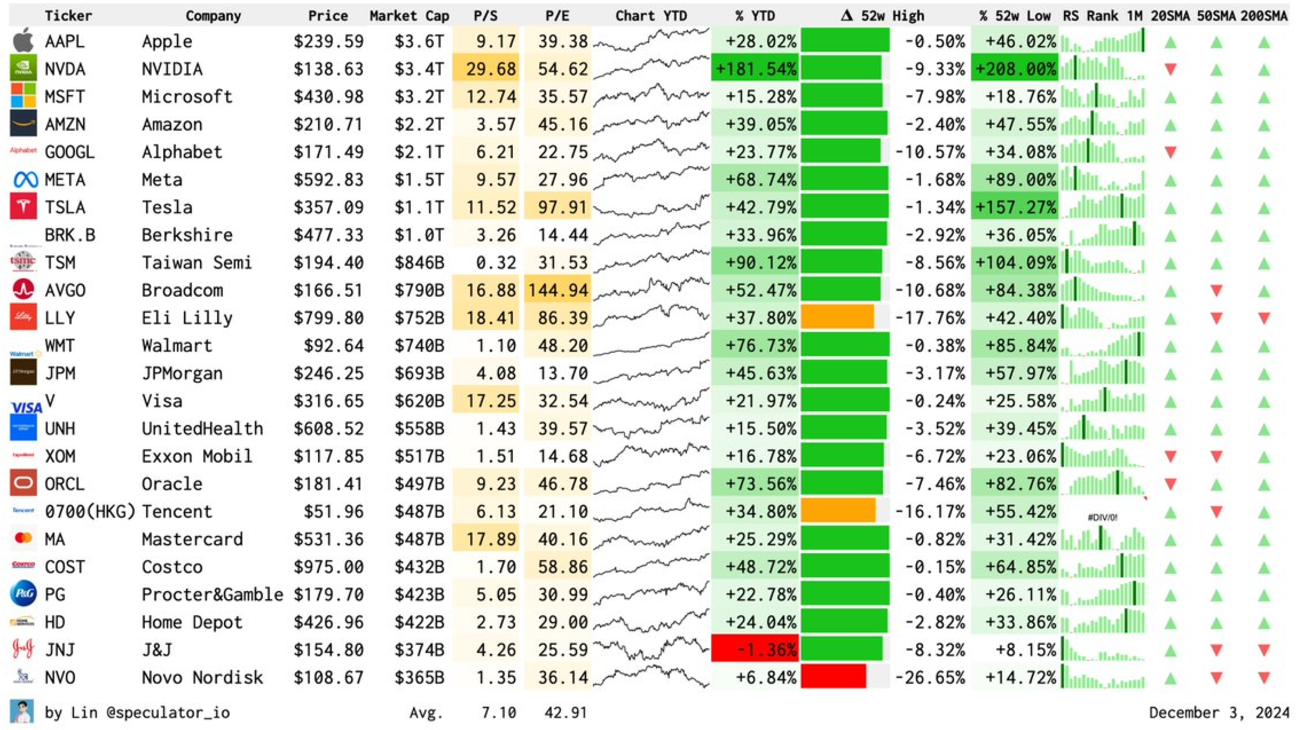

The World’s Biggest Companies

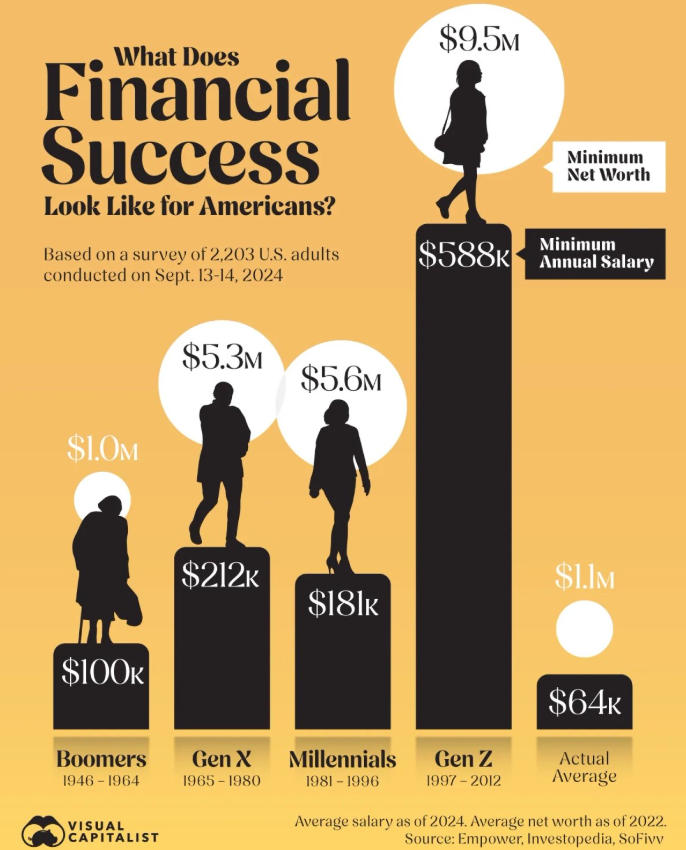

Minimum Salary and Net Worth needed for financial success by Generation

When the teacher asks a question and you’re trying to avoid eye contact…

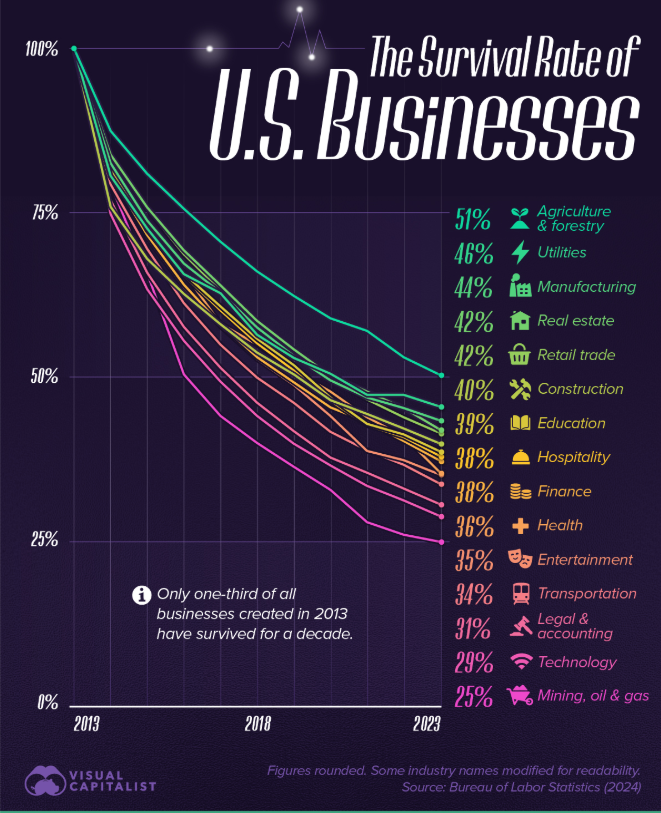

Charted: The Survival Rate of U.S. Businesses (2013-2023)

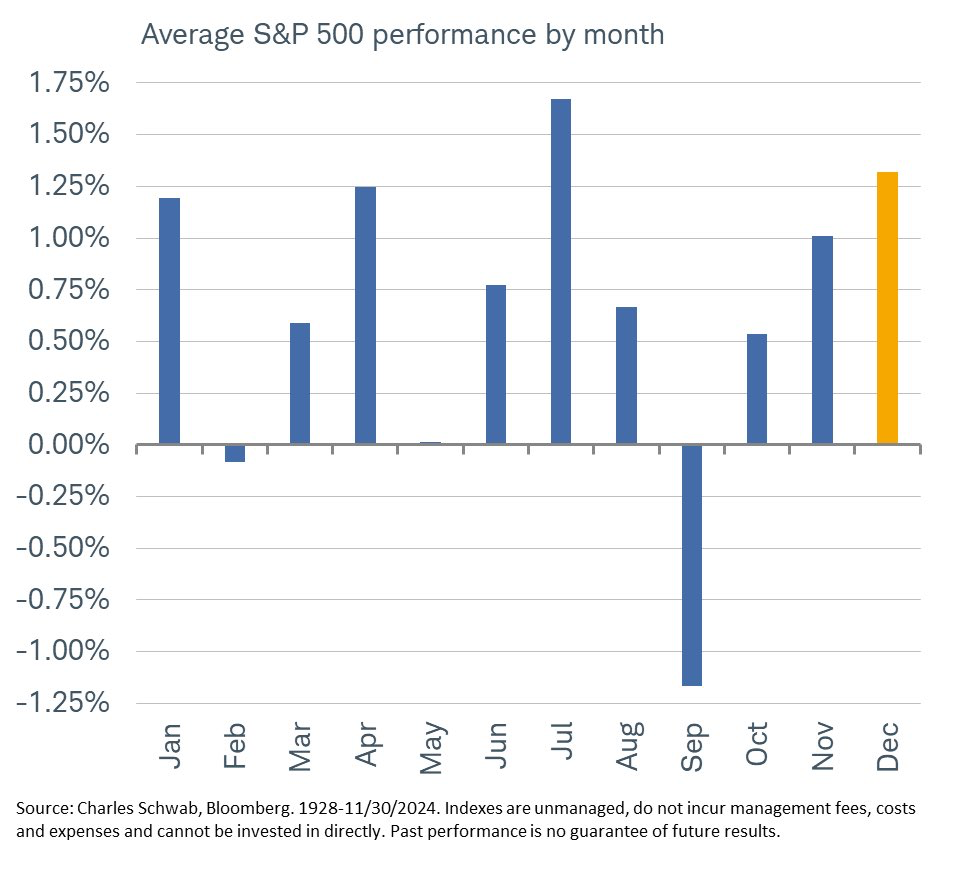

Since 1928, the S&P 500 has posted an average overall gain of 1.3% in December….gains have been positive 74% of the time, the best in monthly history

When you’ve only written the title for your essay-but you ALREADY feel drained

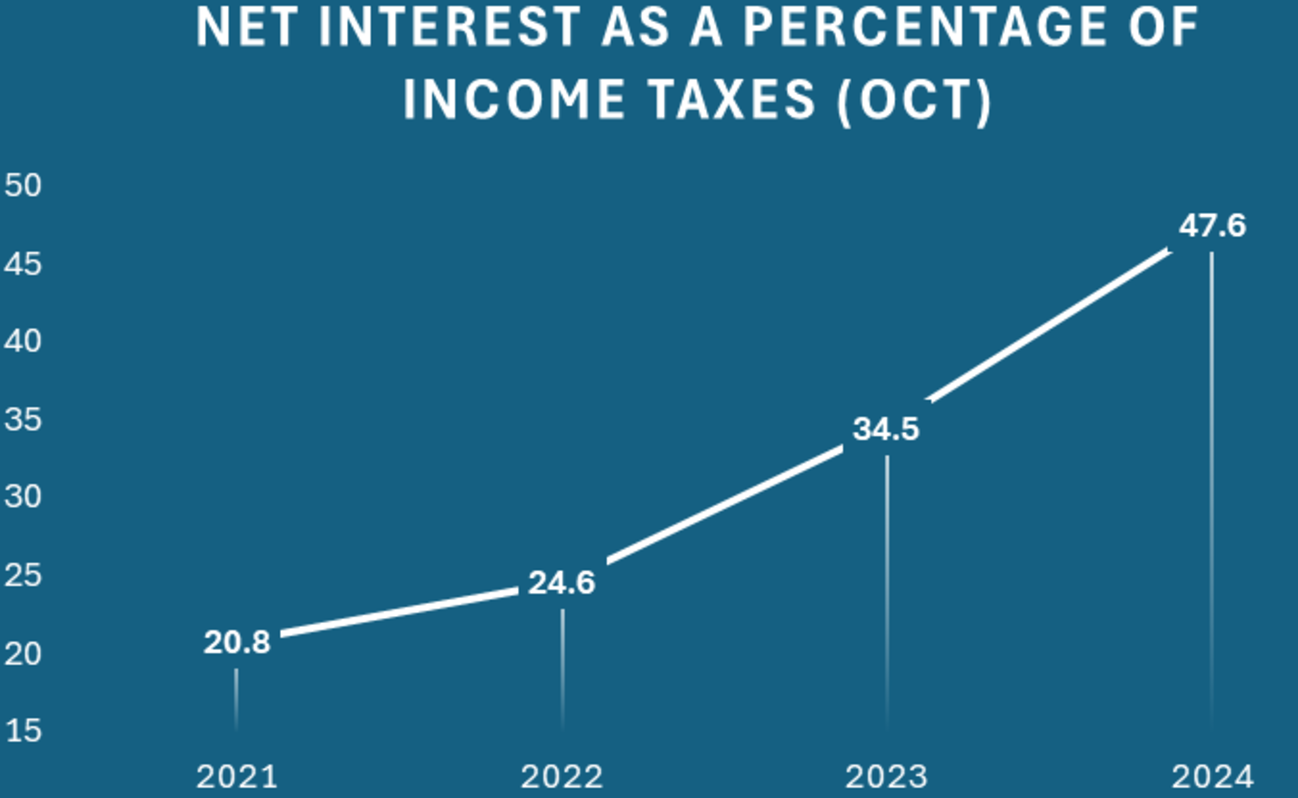

Global Politics Under the Biden regime – net interest on the federal debt has gone from consuming 20% to just under HALF of all income taxes for the first month of each fiscal year

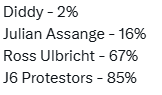

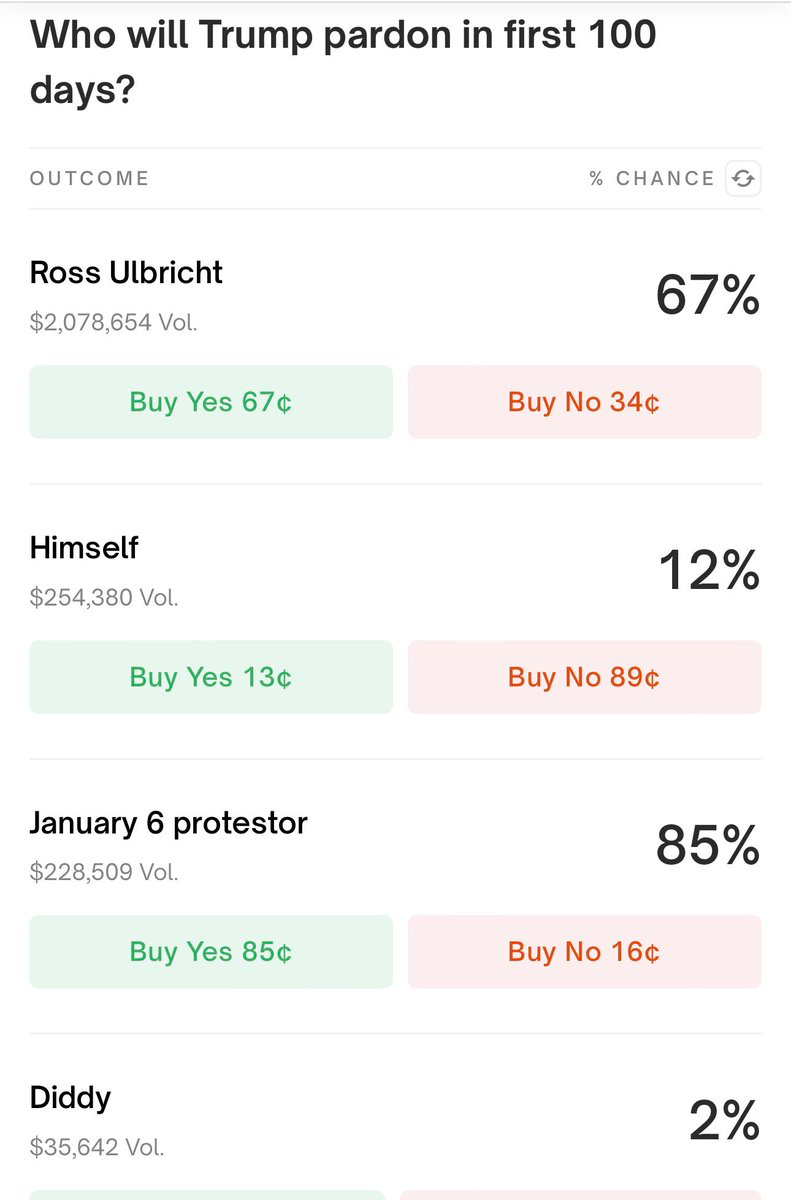

After Hunter Biden’s pardon, Unusual Whales partner Polymarket has new odds on who will be pardoned:

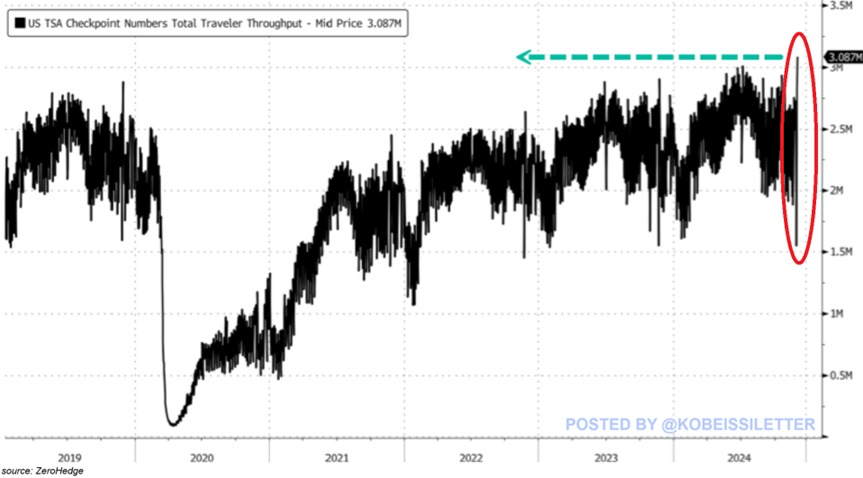

Total passenger volume at US airports jumped 33% year-over-year on Sunday, to a record 3.09 million

When your friend MAKES you hold their baby

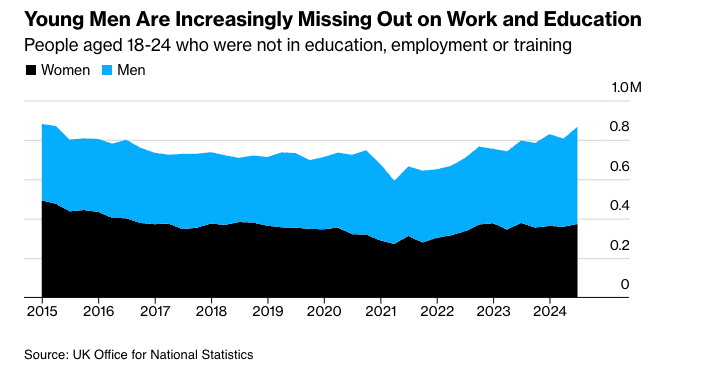

Almost 900,000 18-24 year-olds were classified as NEET — not in education, employment, or training — in the third quarter, the Office for National Statistics said. The 9% increase from a year earlier was entirely driven by men, almost a fifth of whom were NEET.

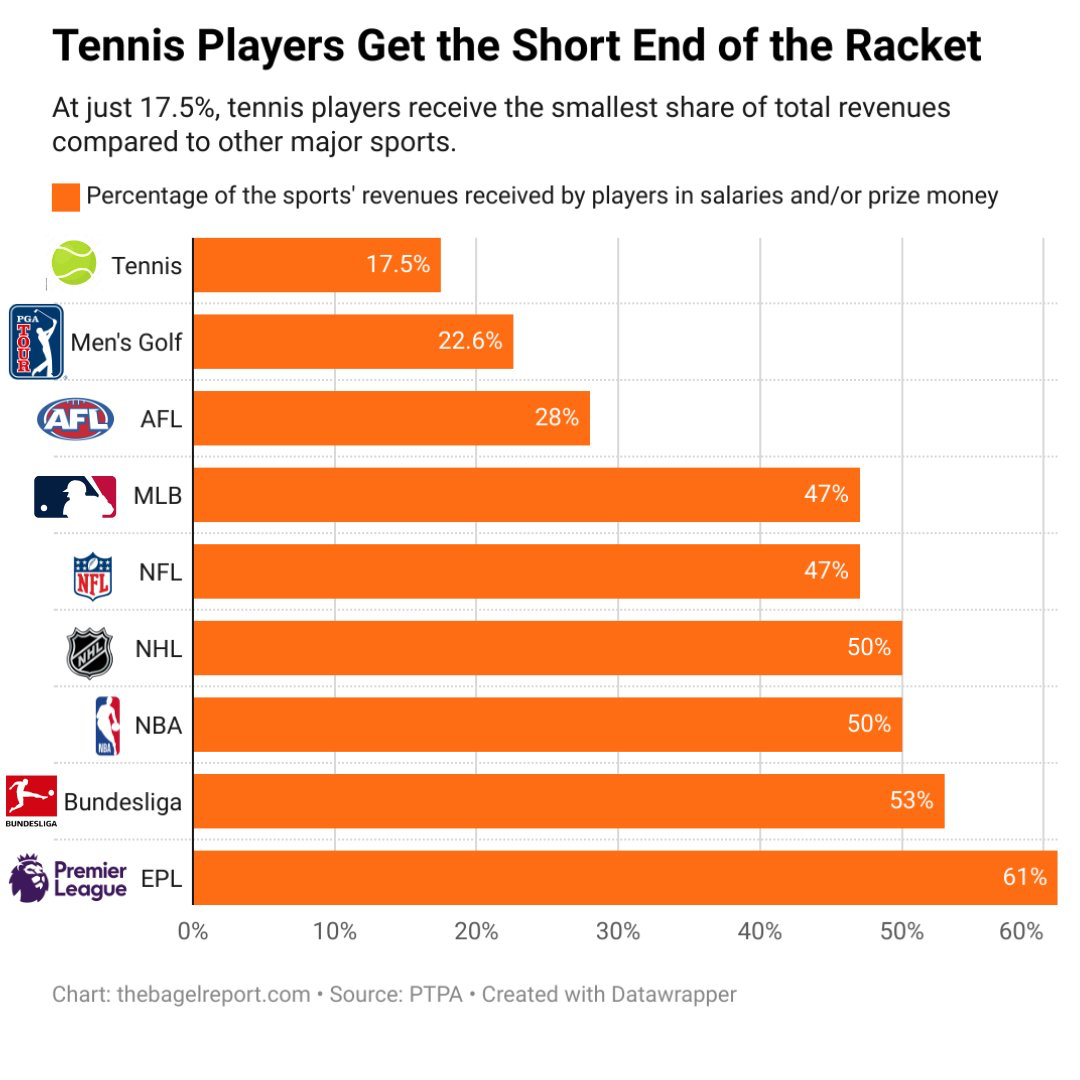

FYI At just 17.5%, tennis players receive the smallest share of total revenue of the sport, compared to all other major sports. (by frayedreality/reddit)

When you ask someone out on a date, and they ask you “Who else will be joining us?”

Click HERE for a market recap

on this day in history:

Today in History

1984 Bhopal Gas Disaster

A gas leak from a Union Carbide India Limited pesticide plant in the city of Bhopal, India killed over 2000 people and affected thousands of others. It is said to be the world’s worst industrial disaster.

1979 Ayatollah Khomeini takes office

The Iranian religious leader was a leader of the 1979 Iranian Revolution.

1927 First Laurel & Hardy movie released

Putting Pants on Philip, a short silent film starring the comedy duo marked the beginning of a long partnership.

1910 First public demonstration of neon lights

Seen in most urban settings and cities today, the neon light was invented by French inventor and engineer, Georges Claude. They were first displayed at the Paris Motor Show.

1818 Illinois joins the Union

The midwestern state became the 21st state to be part of the United State. 3 U.S. presidents call it their home state.

birthdays & deaths:

Births On This Day, December 3rd

1985 Amanda Seyfried

American actress, singer

1981 David Villa

Spanish footballer

1895 Anna Freud

Austrian/English psychoanalyst

1857 Joseph Conrad

Polish/English author

1826 George B. McClellan

American general, politician, 24th Governor of New Jersey

Deaths On This Day, November 3rd

1939 Princess Louise, Duchess of Argyll

1928 Ezra Meeker

American businessman

1910 Mary Baker Eddy

American writer, founder of Christian Science

1894 Robert Louis Stevenson

Scottish author, poet

311 Diocletian

Roman Emperor

company news/earnings:

Analyst Actions

Upgrades – Dec 03, 2024

• $ALHC: Stephens Upgrades to Overweight from Equal Weight – PT $17 (from $13)

• $AU: RBC Capital Upgrades to Outperform from Sector Perform – PT $31

• $AXON: Morgan Stanley Upgrades to Overweight from Equalweight – PT $700 (from $500)

• $C: KBW Upgrades to Outperform from Market Perform

• $CENX: Wolfe Research Upgrades to Outperform from Peer perform

• $CNP: UBS Upgrades to Buy from Neutral – PT $37 (from $31)

• $CRDO: BofA Securities Upgrades to Buy from Underperform – PT $80 (from $27)

• $CVS: Deutsche Bank Upgrades to Buy from Hold – PT $66

• $DTE: UBS Upgrades to Buy from Neutral – PT $143 (from $129)

• $KR: Jefferies Upgrades to Buy from Hold – PT $73 (from $54)

• $PTCT: RBC Capital Upgrades to Outperform from Sector Perform – PT $63 (from $39)

• $STT: KBW Upgrades to Outperform from Market Perform

• $SYF: Wells Fargo Upgrades to Overweight from Equal Weight – PT $85 (from $60)

• $UPST: Redburn-Atlantic Upgrades to Buy from Neutral – PT $95

Downgrades – Dec 03, 2024

• $CUZ: BMO Capital Downgrades to Market Perform from Outperform – PT $32 (from $31)

• $CVCO: Wedbush Downgrades to Neutral from Outperform – PT $480

• $FDX: Bernstein Downgrades to Market Perform from Outperform – PT $316 (from $337)

• $KR: BMO Capital Downgrades to Market Perform from Outperform – PT $60

• $OLLI: Wells Fargo Downgrades to Equal Weight from Overweight – PT $95 (from $100)

Earnings

BOX Box reported earnings Q3 FY2025 results ended on October 31st 2024 – Revenue: $275.9M, +5% YoY – Net Income: $12.9M vs $10.7M YoY – Operating Income: $23.4M vs $11.4M YoY – Free Cash Flow: $57.4M, -2% YoY

MRVL Marvell Technology reported earnings Q3 FY2025 results ended on October 31st 2024 – Revenue: $1.52B, +7% YoY – Net Loss: $676.3M vs -$164.3M YoY – Operating Cash Flow: $536.3M, +7% YoY – GAAP Loss per Share: -$0.78 vs -$0.19 YoY

OKTA JUST REPORTED EARNINGS EPS of $0.67 beating expectations of $0.58 Revenue of $665M beating expectations of $650M

*SALESFORCE INC 3Q REV. $9.44B, EST. $9.35B *SALESFORCE INC SEES 4Q REV. $9.90B TO $10.10B, EST. $10.05B

$ZS Zscaler reported earnings First Quarter Fiscal 2025 ended October 31, 2024 – Revenue: $628.0M, +26% YoY – Net loss: $12.1M vs $33.5M loss YoY – Calculated billings: $516.7M, +13% YoY – Deferred revenue: $1.78B, +27% YoY

FYI

“Resentment is sweeping through the American workforce,” per Axios.

Former Celsius CEO Alex Mashinsky to plead guilty in fraud case.

Donald Trump reportedly picks pro-crypto Paul Atkins for SEC chair, to replace Gary Gensler

MICROSOFT’S AI SOFTWARE SALES, OPENAI DEAL TARGETED BY FTC PROBE – THE INFORMATION

American companies are growing more upbeat about their prospects in anticipation of more pro-business policies and less regulatory burden following Trump’s election win -Bloomberg

UBS stands trial in Paris accused of harassing a pair of whistleblowers who lifted the lid on thebank’s efforts to help wealthy French dodge taxes

A 2023 debt ceiling and budget-cuts deal resulted in $1.4 billion rescinded from the agency and a separate agreement to take $20 billion from the IRS over the next two years and divert those funds to other nondefense programs.

FED’S DALY: TIMING OF RATE CUT IS UP FOR DEBATE, BUT NEED TO KEEP MOVING POLICY RATE DOWN

DALY: DECEMBER RATE CUT IS ABSOLUTELY NOT OFF THE TABLE

US banks made progress in making sure the paper losses that piled up during last year’s industry turmoil never become real ones, per Bloomberg.

Valley National offloaded nearly $1 billion of property loans to Brookfield

BOJ TO PROVIDE USD FUNDS AGAINST POOLED COLLATERAL STARTING FROM DECEMBER 5TH

BLACKROCK’S FINK SAYS TOGETHER WITH HPS WE’RE AIMING TO OFFER THE BEST OF PUBLIC, PRIVATE MARKETS IN A UNIFIED FASHION

FED’S DALY: EVEN IF WE DO ANOTHER RATE CUT, POLICY WILL REMAIN RESTRICTIVE

Delaware rejects Elon Musk’s $56 billion pay package again.

Hunter Biden’s federal gun case in Delaware has been terminated by the judge overseeing the case. The move comes two days after Pres. Biden issued a blanket pardon for his son.

Mortgage Rates Lower on Average, But Timing Matters

30 Yr. Fixed: 6.85% (-0.06% ▼) | 15 Yr. Fixed: 6.05% (-0.07% ▼) |

*TRUMP: WILL BLOCK NIPPON STEEL-US STEEL DEAL WHEN PRESIDENT

*TRUMP: TOTALLY AGAINST US STEEL BEING BOUGHT BY NIPPON STEEL

*TRUMP COMMENTS ON US STEEL IN TRUTH SOCIAL POST

Vertex Companies, LLC has acquired LitCon Group to strengthen its financial analysis services for attorneys. The expansion was announced on December 3, 2024.

BlackRock Strikes $12 Billion Deal for HPS, Doubling Down on Wall Street’s Hottest Market – WSJ

South Korean won falls, but is off lows amid political chaos in country

CHINA’S YUAN FALLS TO 1-YEAR LOW OF 7.2890 AGAINST THE DOLLAR

Gold ticks higher after labor report, more U.S. data eyed

NYMEX WTI CRUDE JANUARY FUTURES SETTLE AT $69.94 A BARREL.

NYMEX NAT GAS JANUARY FUTURES SETTLE AT $3.0420/MMBTU.

NYMEX GASOLINE JANUARY FUTURES SETTLE AT $1.9624 A GALLON.

NYMEX DIESEL JANUARY FUTURES SETTLE AT $2.2177 A GALLON.

MACRON SAYS HE WON’T RESIGN BEFORE HIS MANDATE ENDS IN 2027

U.S. JOLTS JOB OPENINGS 7.744 MLN IN OCT (CONSENSUS 7.475 MLN) (SEPT 7.372 MLN) – LABOR DEPT

S&P 500 ticks higher for another record close on Tuesday

US markets closed: ⬆ S&P 500 – 6,049.88 (+0.05%) ⬇ DOW 30 – 44,705.41 (-0.17%) ⬆NASDAQ – 19,480.91 (+0.40%) ⬇ Russell 2000 – 2,416.01 (-0.74%) ⬆ CBOE Volatility – 13.40 (+0.45%)

DOW JONES UNOFFICIALLY CLOSES DOWN 72.11 POINTS, OR 0.16%, AT 44,709.89

S&P 500 UNOFFICIALLY CLOSES UP 2.98 POINTS, OR 0.05%, AT 6,050.13

NASDAQ UNOFFICIALLY CLOSES UP 76.10 POINTS, OR 0.39%, AT 19,480.05

European markets close higher as investors closely watch political upheaval in France

Asia-Pacific markets trade higher after key Wall Street benchmarks hit record highs