top headlines from today:

World & Market

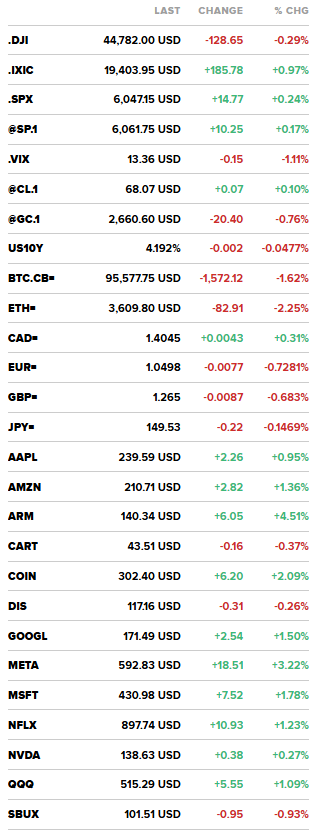

- S&P 500, Nasdaq close at records to kick off December trading

- US markets closed: ⬆ S&P 500 – 6,047.13 (+0.24%) ⬇ DOW 30 – 44,782.00 (-0.29%) ⬆ NASDAQ – 19,403.95 (+0.97%) ⬆ Russell 2000 – 2,441.59 (+0.28%) ⬇ CBOE Volatility – 13.46 (-0.37%)

- DOW JONES UNOFFICIALLY CLOSES DOWN 121.00 POINTS, OR 0.27%, AT 44,789.65

- S&P 500 UNOFFICIALLY CLOSES UP 14.50 POINTS, OR 0.24%, AT 6,046.88

- NASDAQ UNOFFICIALLY CLOSES UP 187.15 POINTS, OR 0.97%, AT 19,405.32

- Credit card debt has hit a record $1.17 trillion, per CNBC.

- *FED’S WALLER LEANING TOWARD DEC. RATE CUT, ABSENT DATA SURPRISE

- U.S. Factory Activity Contracts as Demand Remains Weak

- Announces Retirement Of CEO Pat Gelsinger – Names Zinsner & Johnston Holthaus Interim Co-CEOs

- INTEL CEO FORCED OUT AFTER BOARD GREW FRUSTRATED WITH PROGRES

- INTEL SUSPENDING DIVIDEND STARTING 4Q 2024 *INTEL ANNOUNCES $10B COST REDUCTION PLAN

- Inflation could surge to 5% during Trump’s Presidency, warns Nouriel “Dr. Doom” Roubini

- CHINA’S COMMERCE MINISTRY, ON U.S. CHIP EXPORT CONTROL MEASURES: CHINA FIRMLY OPPOSES IT

2024 Politics

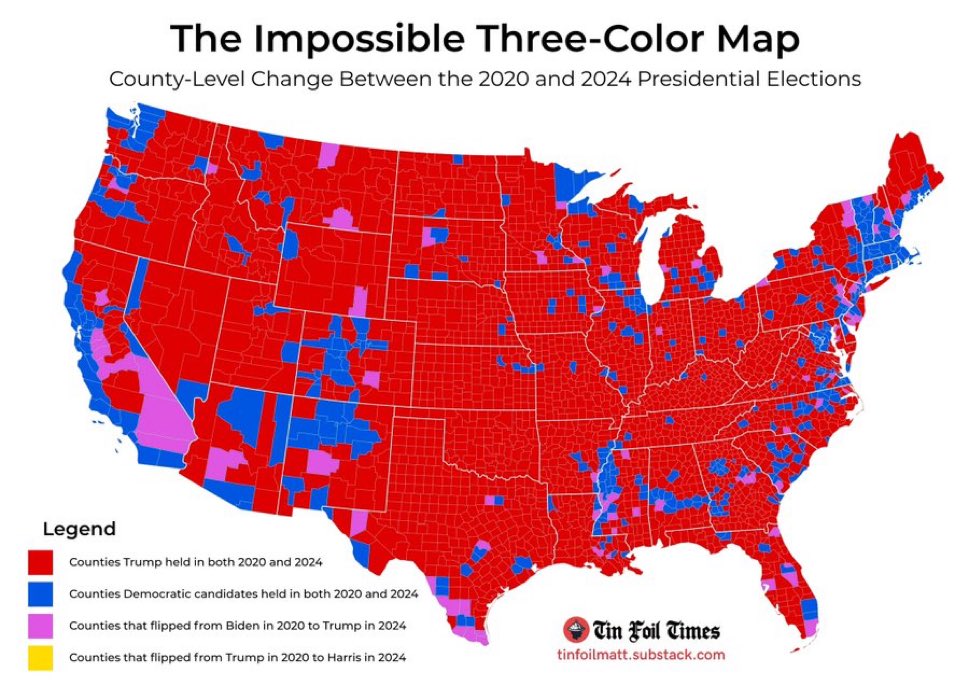

- Kamala Harris first candidate since 1932 to not flip a single county.

- Jamie Dimon has been secretly communicating with Donald Trump on White House agenda for months: sources

- President Biden has decided to pardon his son Hunter, sources say – NBC

- *MEXICAN PRESIDENT SHEINBAUM: IF THERE ARE TARIFFS FROM U.S., MEXICO WILL RAISE THEM TOO

Conflict

- US TELLS ISRAEL IT’S CONCERNED LEBANON CEASEFIRE COULD UNRAVEL: AXIOS

- TRUMP: IF GAZA HOSTAGES NOT RELEASED PRIOR TO HIS JAN. 20 INAUGURATION, ‘THERE WILL BE ALL HELL TO PAY IN THE MIDDLE EAST’

- Syria’s anti-Assad rebels say they have captured the Citadel of Aleppo

- KIM JONG-UN, NORTH KOREA’S LEADER, HOLDS MEETING WITH RUSSIAN DEFENCE MINISTER, ACCORDING TO KCNA

- US State Department calls Assad a ‘brutal dictator with blood on his hands’

- Hamas says 33 hostages killed during war in Gaza – statement — Reuters

- Rebels have breached neighborhoods in Syria’s second-largest city of Aleppo and clashed with government military forces after detonating two car bombs, AP reports.

- MEXICO DOESN’T AGREE WITH A US MILITARY INCURSION: SHEINBAUM

- Hezbollah, For Now, Does Not Intend To Send Fighters To Northern Syria To Support Assad – RTRS Citing Three Source

key headlines we care about:

- US SCREENED RECORD 3.08 MILLION AIRLINE PASSENGERS SUNDAY – TSA (That’s a LOT of people asking you if they can bring their 84oz Diet Coke through security…)

- The luxury goods market have shrunk for first time since the 2008 financial crash, per CNBC. (No—the consumer has just gotten a lot bigger-so the items APPEAR smaller…)

- 1 in 5 Americans get their news from social media influencers, per CNBC. (Remember; If it DIDN’T appear on Social Media, it NEVER happened….)

- Art Cashin, New York Stock Exchange fixture for decades, dies at age 83 (Bar tabs in NYC are going to tank… RIP to one of the few remaining members of OLD WALL…)

MOSTLY MIDNIGHT MONDAY

People who enjoy winter: “Ah yes, 3pm.”

Santa Claus—Is that you?

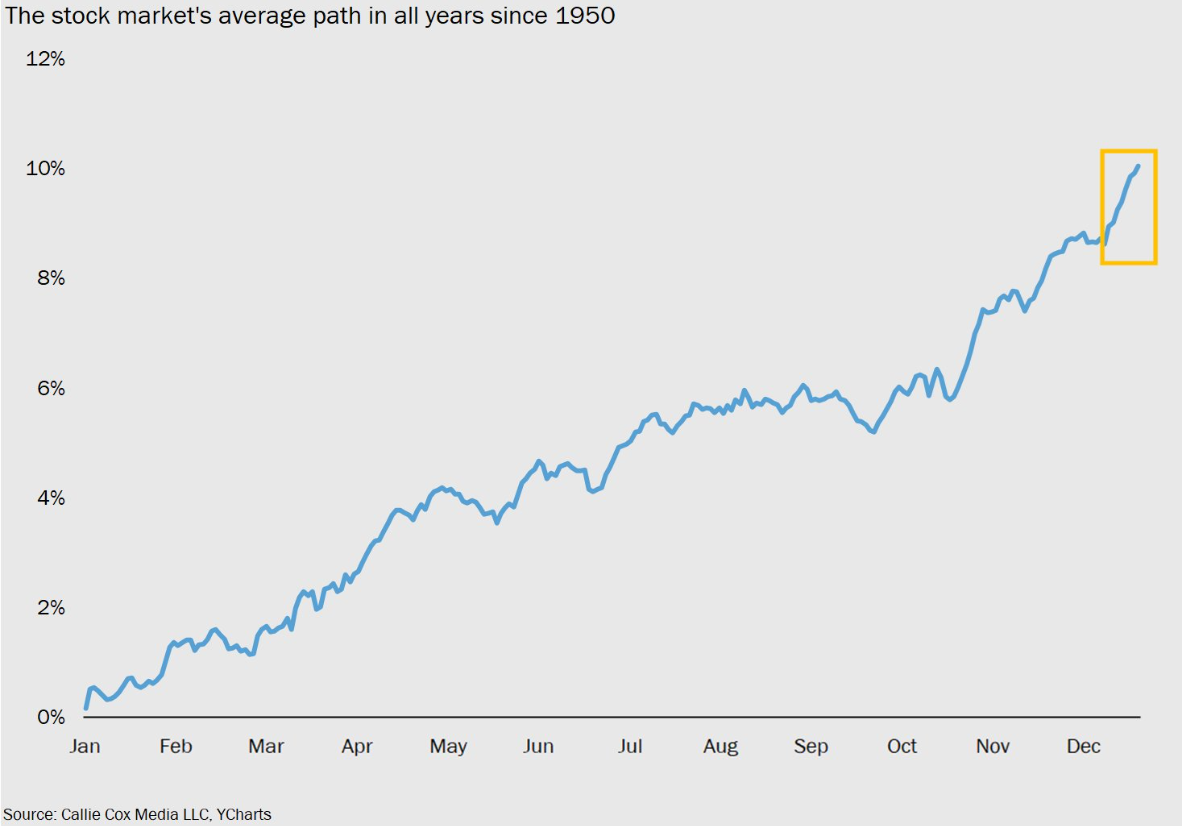

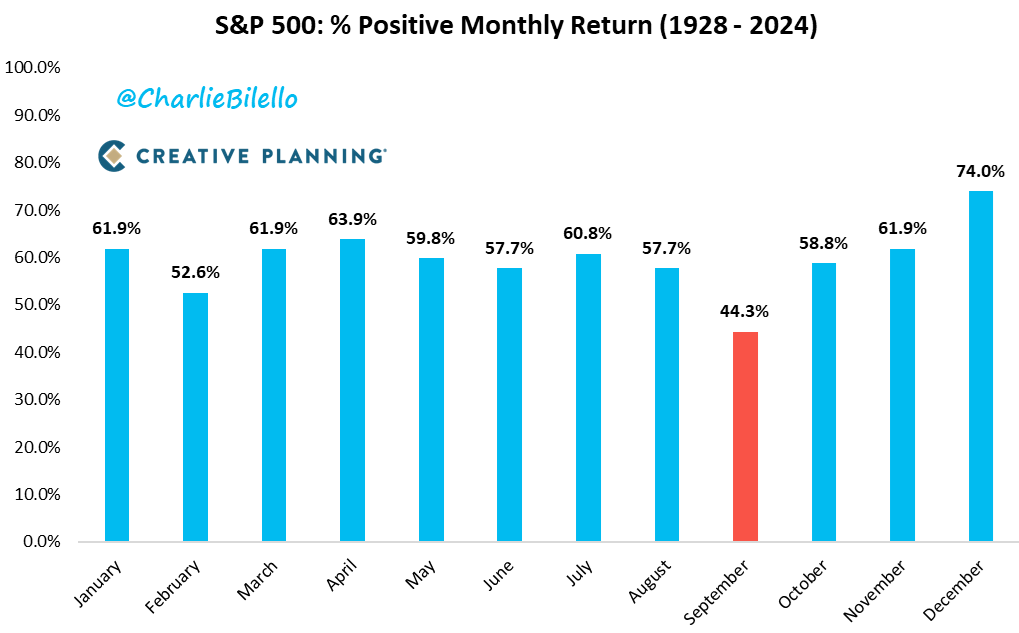

Since 1928, the S&P 500 has been positive in December 74% of the time, the highest of any month

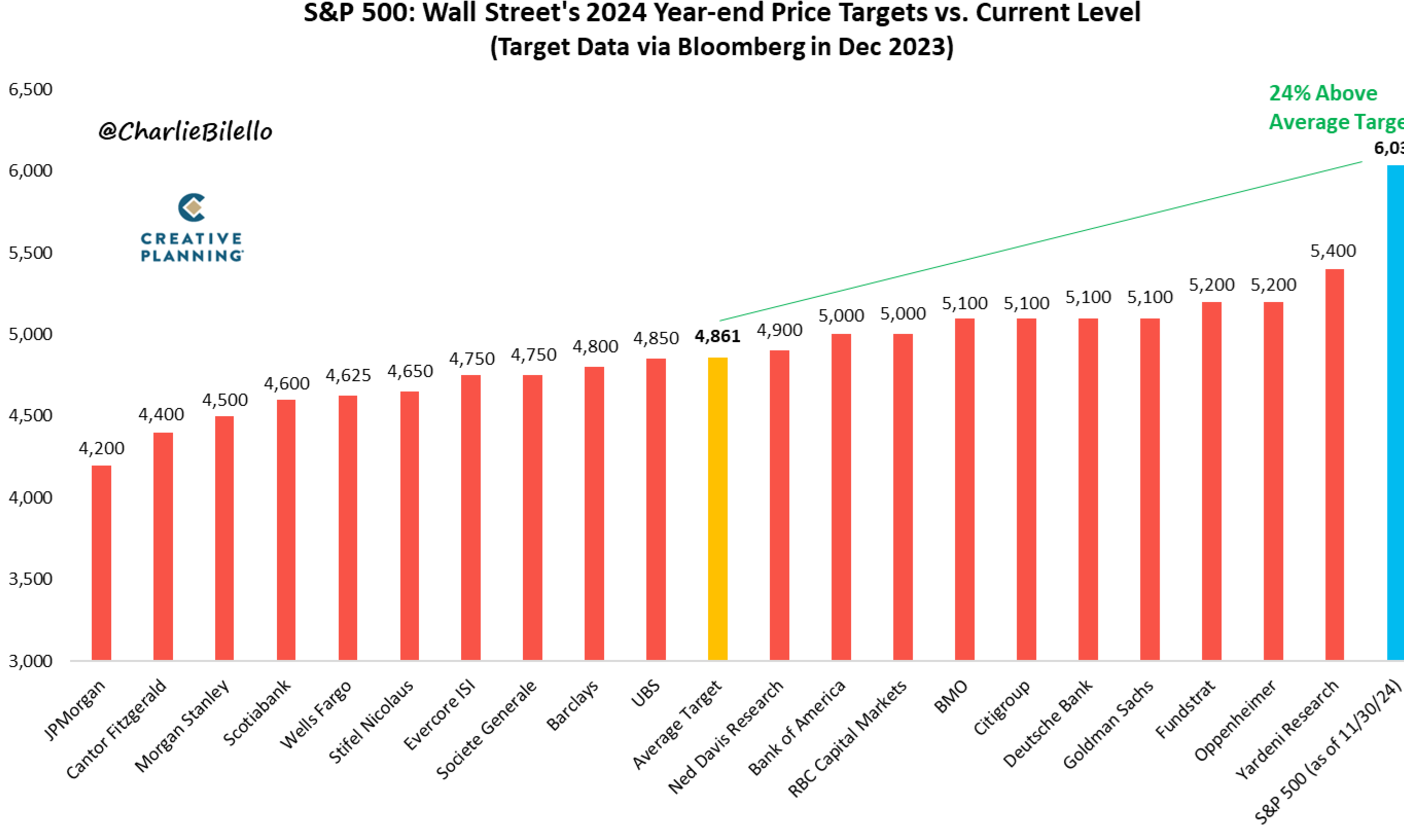

At 6,032, the S&P 500 is now over 600 points above the highest 2024 year-end price target from Wall Street strategists and 24% above the average target (4,861).

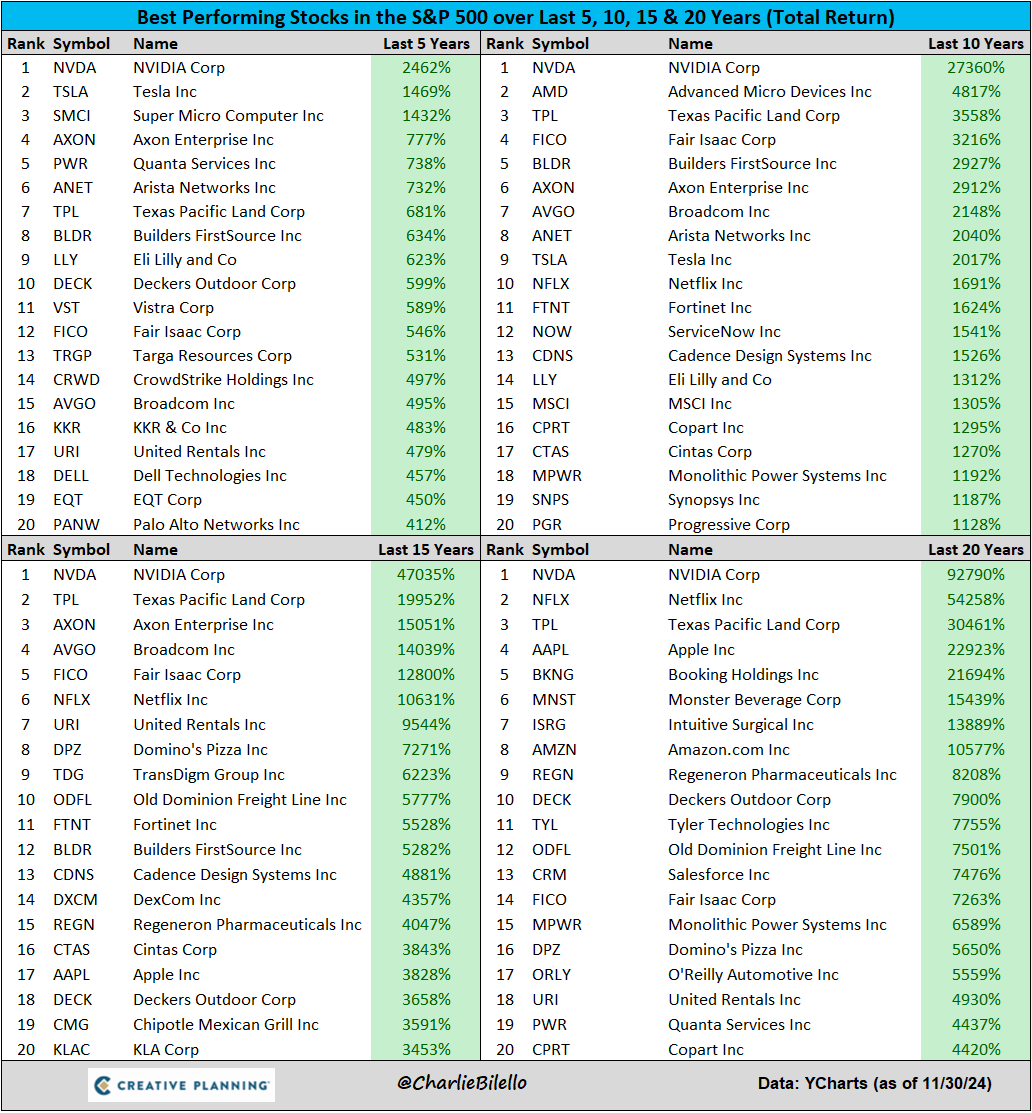

Nvidia is the best performing stock in the S&P 500 over the last 5, 10, 15, and 20 years

Me in 2003 trying to impress her with my CD collection…

Global Politics

Not since Hoover in 1932 has a candidate not flipped a single county.

The ELECTORAL vote was a pounding-but the POPULAR vote was much closer

The argument over upcoming tariffs continues

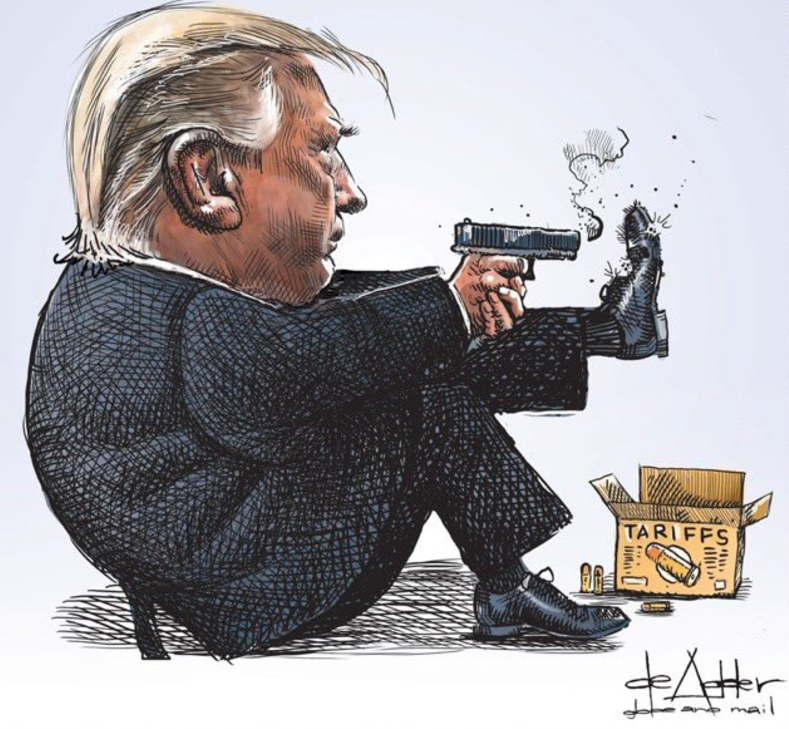

Gold underperformed after the election in 2016 and 2024. 8 years ago, weakness continued until mid-December, but gold is already up 5.6% from its Nov. 15 low

“I hate broccoli.” The Broccoli:

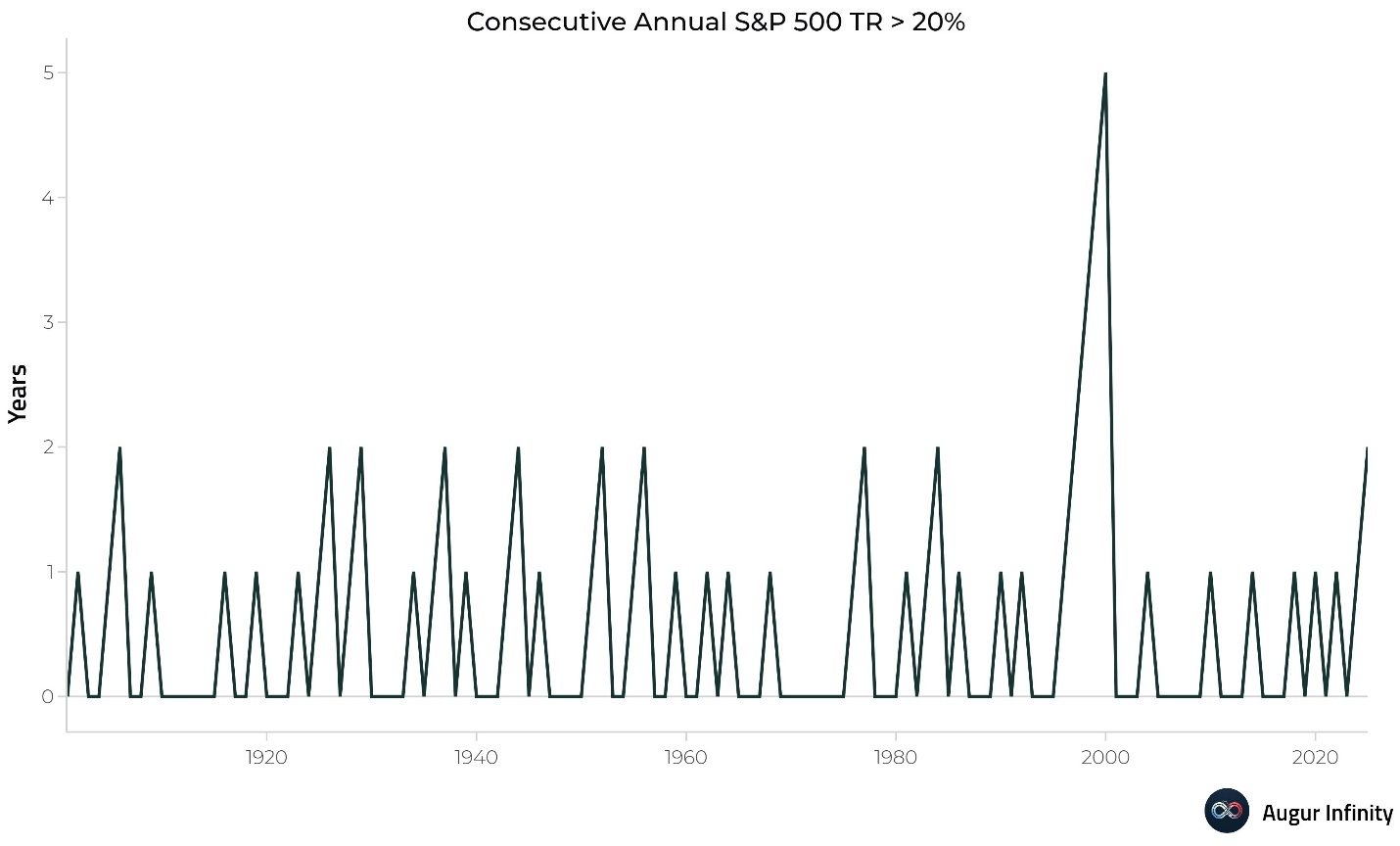

This is set to be the first year of back-to-back 20% S&P returns since 1996, when the index was on its way to a five-year streak.

FYI

We’re LEAVING and we are NEVER coming back!

Not a bad deal, but mine is FREE and WAY more bitter…

Click HERE for a market recap

on this day in history:

Today in History

2001 Enron Files for Bankruptcy

The Houston, Texas-based energy company filed for Chapter Eleven bankruptcy after reports of widespread accounting fraud became public. At that time, the company became the largest company in the history of the United States to declare bankruptcy.

1988 Benazir Bhutto is sworn in as Prime Minister

Benazir Bhutto takes office as Pakistan’s Prime Minister, becoming the first woman PM of Pakistan.

1982 First artificial heart transplant

Barney Clark became the first person to receive a permanent artificial heart. The surgery occurred at the University of Utah Medical Center. Clark lived for 112 days after the transplant.

1939 LaGuardia Airport in New York City opens its doors

The airport was named after New York Mayor Fiorello La Guardia. American Airlines was the first carrier to regularly provide passenger service.

1804 Napoleon is crowned Emperor of France

Napoleon Bonaparte had risen through the ranks of the French army during the French revolution and became one of the most influential political figures of his era. His self-coronation as Napoleon I took place in Notre Dame in Paris, France.

birthdays & deaths:

Births On This Day, December 2nd

1981 Britany Spears

American singer-songwriter, dancer, actress

1978 Nelly Furtado

Canadian singer-songwriter, producer

1923 Marcia Callas

Greek soprano

1825 Pedro II of Brazil

1760 John Breckinridge

American politician, 5th United States Attorney General

Deaths On This Day, November 2nd

1993 Pablo Escobar

Colombian drug lord

1990 Aaron Copland

American composer

1985 Philip Larkin

English poet

1859 John Brown

American activist

1814 Marquis de Sade

French author, politician

company news/earnings:

Analyst Actions

UPGRADES

$ARCC Upgraded to Overweight at Wells Fargo; PT USD 23

$NET Upgraded to Overweight at Morgan Stanley; PT USD 130

$DAN Upgraded to Overweight at Barclays; PT USD 18

$EMBC Upgraded to Equal-Weight at Morgan Stanley; PT USD 20

$GAP Upgraded to Overweight at JPMorgan; PT USD 30

$ICLR Upgraded to Buy at Nephron Research; PT USD 280

$ISRG Upgraded to Overweight at Morgan Stanley

$IQV Upgraded to Buy at Nephron Research; PT USD 250

$KYMR Upgraded to Overweight at Wells Fargo; PT USD 57

$MNSO ADRs Upgraded to Buy at DBS Bank; PT USD 26.20

$NEP Upgraded to Overweight at Morgan Stanley

$NVCR Upgraded to Outperform at Evercore ISI

$OKTA Upgraded to Overweight at Morgan Stanley; PT USD 97

$PYCR Upgraded to Buy at TD Cowen

$RWAY Upgraded to Overweight at Wells Fargo

$SCCO Upgraded to Neutral at JPMorgan; PT USD 92.50

$SYK Upgraded to Overweight at Morgan Stanley; PT USD 44

$TNDM Upgraded to Overweight at Morgan Stanley

$VNET ADRs Upgraded to Buy at Goldman; PT USD 5

$XNCR Upgraded to Overweight at Piper Sandler; PT USD 30

$ZBRA Upgraded to Equal-Weight at Morgan Stanley; PT USD 400

$ZGN Upgraded to Neutral at BNPP Exane; PT USD 7.90

DOWWNGRADES

$ALNY Downgraded to Hold at Mirae Asset Securities; PT USD 236

$AMBA Downgraded to Sell at CFRA

$ANAB Downgraded to Neutral at BTIG

$APLT Downgraded to Sector Perform at RBC; PT USD 4

$ADSK Downgraded to Hold at HSBC; PT USD 290

$BXSL Downgraded to Equal-Weight at Wells Fargo

$CTGO Downgraded to Speculative Buy at Cantor; PT USD 25

$DOCU Downgraded to Sell at CFRA; PT USD 65

$FSK Downgraded to Equal-Weight at Wells Fargo; PT USD 21

$GKOS Downgraded to Underweight at Morgan Stanley

$HPQ Downgraded to Hold at HSBC; PT USD 38

$KSS Downgraded to Neutral at Guggenheim

$LC Downgraded to Neutral at JPMorgan; PT USD 17

$MKL Downgraded to Hold at TD Cowen; PT USD 1,836

$NOAH ADRs Downgraded to Equal-Weight at Morgan Stanley; PT USD 13

$OTLK US Downgraded to Neutral at Chardan Capital Markets

$PSTX Downgraded to Neutral at Piper Sandler; PT USD 10

$PGNY Downgraded to Neutral at JPMorgan; PT USD 17

$RMBL Downgraded to Neutral at B Riley; PT USD 7

$S Downgraded to Equal-Weight at Morgan Stanley

$SYM Downgraded to Hold at Craig-Hallum; PT USD 25

$TENB Downgraded to Equal-Weight at Morgan Stanley; PT USD 47

$TOST Downgraded to Neutral at Goldman; PT USD 45

$TRIN Downgraded to Underweight at Wells Fargo; PT USD 13

$UPST Downgraded to Underweight at JPMorgan; PT USD 57

INITIATIONS

$ANET Initiated at New Outperform at CICC; PT USD 450

$BV Initiated at New Buy at BTIG; PT USD 22

$CLF Reinstated Buy at Goldman; PT USD 16

$CMC Reinstated Buy at Goldman; PT USD 75

$CRBP Initiated at New Overweight at Piper Sandler

$ELAN Initiated at New Market Perform at Leerink; PT USD 14

$GTBP Initiated at New Buy at Roth Capital Partners; PT USD 11

$IDXX Initiated at New Outperform at Leerink; PT USD 500

$NUE Reinstated Buy at Goldman; PT USD 190

$PRCT Initiated at New Overweight at Morgan Stanley

$PGR Reinstated Buy at William O’Neil

$RDUS Reinstated Neutral at Goldman; PT USD 22

$RS Reinstated Neutral at Goldman; PT USD 341

$STLD Reinstated Neutral at Goldman; PT USD 155

$TDW Initiated at New Buy at DNB Markets; PT USD 70

$VLN Initiated at New Buy at ThinkEquity; PT USD 5

$VKTX Initiated at New Overweight at Piper Sandler

$VNOM Reinstated Buy at Goldman; PT USD 70

$VYGR Reinstated Buy at Citi; PT USD 12

$ZTS Initiated at New Outperform at Leerink; PT USD

Earnings

ALCO Alico Q4 Adj EPS $0.19 Sales $935.00K Up From $680.00K YoY

FYI

Meta Plans To Build A $10b Subsea Cable Spanning The World

US SETS PRELIMINARY ANTIDUMPING TARIFF RATE OF 125.37% ON SOLAR CELLS FROM CAMBODIA -COMMERCE STATEMENT

ELTON JOHN SAYS HE HAS LOST HIS EYESIGHT

Art Cashin, New York Stock Exchange fixture for decades, dies at age 83

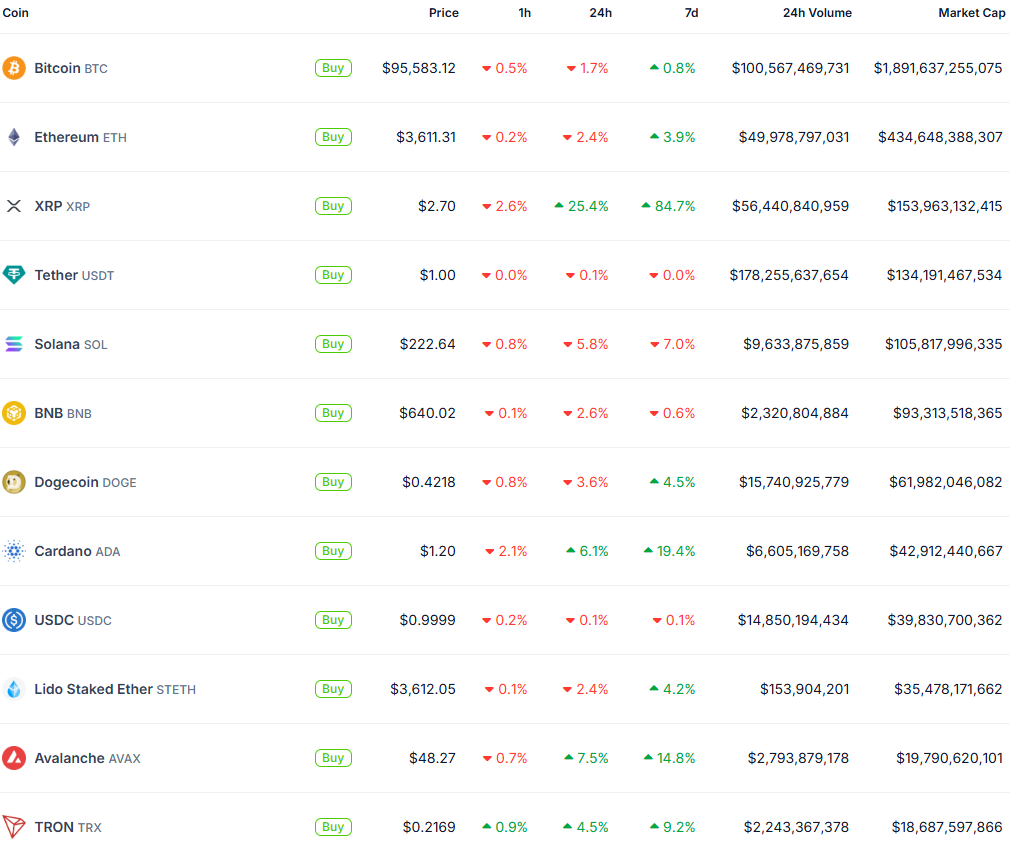

The potential creation of a US national stockpile of the cryptocurrency could trigger more governments to buy up Bitcoin. Such a concentrated ownership of the cryptocurrency comes with risks for everyone involved.

Coinbase now allows users to purchase cryptocurrency with Apple Pay.

*US ANTITRUST WATCHDOG LAUNCHES BROAD MICROSOFT INVESTIGATION

Ark Investment Management’s Cathie Wood said she welcomes an expected era of looser regulation once Donald Trump is inaugurated as president, notably on technology, cryptocurrencies, and digital assets

U.S. COMMERCE DEPARTMENT ANNOUNCES NEW CRACKDOWN AGAINST CHINESE CHIP MANUFACTURERS

Tipping was abolished in Switzerland in 1974 after a dispute over taxes on tips. Service is now included in prices, with higher wages replacing tips.

The Fed’s last big monetary policy rethink didn’t work out too well. Former New York Fed President Bill Dudley has some advice for the next one

FED’S BOSTIC: WE WILL HAVE TO WAIT AND SEE HOW TARIFF OR OTHER POLICIES OF NEW ADMINISTRATION SHAPE THE ECONOMY; AS CONDITIONS CHANGE MONETARY POLICY WILL ADAPT.

56 COUNTERPARTIES TAKE $135.858B AT FED REVERSE REPO OPERATION.

FED BANK PROVIDES $18.5B IN TERM FUNDING LOANS IN WEEK ENDED NOV. 27, FOLLOWING $21.4B

FED LENDS $2.50B AT DISCOUNT WINDOW IN WEEK ENDING NOV 27, DOWN FROM $2.75B.

*ECB’S STOURNARAS: LOOKS LIKE RATES WILL BE CUT AGAIN IN DEC.

*ECB GOVERNING COUNCIL MEMBER KAZAKS SPEAKS TO DELFI TV

*KAZAKS: LIKELY TO DISCUSS BIGGER DEC. CUT BUT UNCERTAINTY HIGH

MicroStrategy acquired 15,400 Bitcoins for about USD 1.5bln in cash

JPMORGAN’S GLOBAL CHAIR OF INVESTMENT BANKING, JENNIFER NASON, IS SET TO RETIRE FROM THE BANK AFTER NEARLY FOUR DECADES AT WALL STREET’S LARGEST LENDER – SOURCES

“Tech jobs are in a recession,” per BI.

Inflation could surge to 5% during Trump’s Presidency, warns Nouriel “Dr. Doom” Roubini

US GDP NOWCAST (Q4) ACTUAL: 1.81% VS 1.91% PREVIOUS

JPMorgan Now Expecting 50bps ECB Rate Cut In December; Previously Saw Cut In January 2025

S&P AFFIRMS FRANCE’S AA-/A-1+ RATINGS WITH STABLE OUTLOOK

S&P CONFIRMS UZBEKISTAN AT BB-/B WITH STABLE OUTLOOK

TEAMSTERS: FILED CHARGES AGAINST AMAZON AFTER ALLEGED VERBAL ASSAULT AGAINST AN AMAZON DRIVER IN NEW YORK FACILITY – WEBSITE

President Biden has decided to pardon his son Hunter, sources say – NBC

U.S. JUDGE SAYS HUNTER BIDEN’S GUN CHARGES WILL BE TERMINATED ONCE HIS PARDON IS DOCKETED – COURT FILING

U.S CONSTRUCTION SPENDING (MOM) (OCT) ACTUAL: 0.4% VS 0.1% PREVIOUS; EST 0.2%

Mortgage balances have increased by $75 billion from the previous quarter and reached $12.59 trillion at the end of September.

HELOC balances increased by $7 billion, representing the tenth consecutive quarterly increase since Q1 2022, and stood at $387 billion

Buyout firm Advent is contemplating setting up an investment vehicle targeting mid-sized transactions as it looks to bolster its core private equity business

Lack of M&A is squeezing Britain’s media old guard -Reuters

Euro tumbles as French government crisis grows

Sterling rises versus euro towards its 2-1/2-year high

Gold drops as dollar strength sours four-session rally; Fed in focus

U.S. CRUDE OIL FUTURES SETTLE AT $68.10/BBL, UP 10 CENTS, 0.15%

NYMEX WTI CRUDE JANUARY FUTURES SETTLE AT $68.10 A BARREL, UP 10 CENTS, 0.15%.

NYMEX NATURAL GAS JANUARY FUTURES SETTLE AT $3.2130/MMBTU.

NYMEX DIESEL JANUARY FUTURES SETTLE AT $2.1777 A GALLON.

NYMEX GASOLINE JANUARY FUTURES SETTLE AT $1.9172 A GALLON.

CANADA MANUFACTURING PMI (NOV) ACTUAL: 52.0 VS 51.1 PREVIOUS; EST 50.8

DUTCH RETAIL SALES YOY ACTUAL 2% (FORECAST -, PREVIOUS -0.2%) DUTCH RETAIL SALES YOY ACTUAL 2% (FORECAST -, PREVIOUS -0.2%)

KIM: NORTH KOREA TO BOLSTER TIES WITH RUSSIA, STATES KCNA

KIM JONG-UN, NORTH KOREA’S LEADER, HOLDS MEETING WITH RUSSIAN DEFENCE MINISTER, ACCORDING TO KCNA

U.S MANUFACTURING PMI (NOV) ACTUAL: 49.7 VS 48.5 PREVIOUS; EST 48.8

U.S ISM MANUFACTURING PMI (NOV) ACTUAL: 48.4 VS 46.5 PREVIOUS; EST 47.6

U.S ISM MANUFACTURING PRICES (NOV) ACTUAL: 50.3 VS 54.8 PREVIOUS; EST 56.0

U.S ISM MANUFACTURING NEW ORDERS INDEX (NOV) ACTUAL: 50.4 VS 47.1 RPEVIOUS

S&P 500, Nasdaq close at records to kick off December trading

US markets closed: ⬆ S&P 500 – 6,047.13 (+0.24%) ⬇ DOW 30 – 44,782.00 (-0.29%) ⬆NASDAQ – 19,403.95 (+0.97%) ⬆ Russell 2000 – 2,441.59 (+0.28%) ⬇ CBOE Volatility – 13.46 (-0.37%)

DOW JONES UNOFFICIALLY CLOSES DOWN 121.00 POINTS, OR 0.27%, AT 44,789.65

S&P 500 UNOFFICIALLY CLOSES UP 14.50 POINTS, OR 0.24%, AT 6,046.88

NASDAQ UNOFFICIALLY CLOSES UP 187.15 POINTS, OR 0.97%, AT 19,405.32

Europe stocks close higher; Delivery Hero down 11%; Stellantis falls 6% after CEO resigns

Asia-Pacific markets mostly rise as investors await key economic readings