top headlines from today:

World & Market

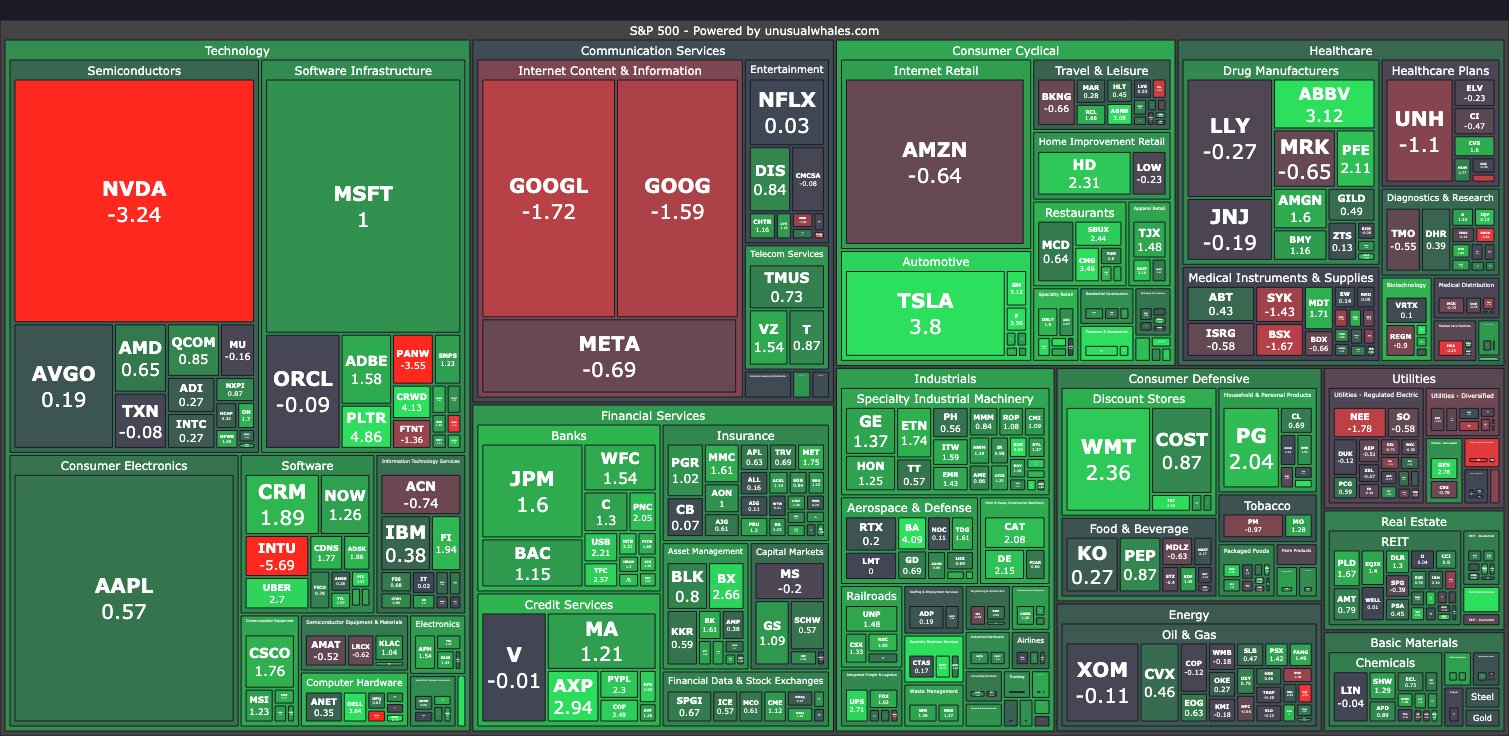

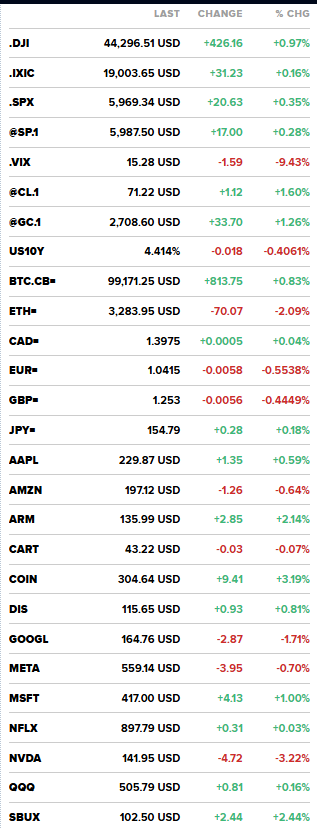

- Dow rises more than 400 points for record close, Wall Street posts weekly gain

- US markets closed:⬆ S&P 500 – 5,969.27 (+0.35%) ⬆ DOW 30 – 44,296.51 (+0.97%) ⬆ NASDAQ – 19,003.65 (+0.16%) ⬆ Russell 2000 – 2,402.18 (+1.61%) ⬇ CBOE Volatility – 15.54 (-7.88%)

- DOW JONES UNOFFICIALLY CLOSES UP 449.31 POINTS, OR 1.02%, AT 44,319.66

- NASDAQ UNOFFICIALLY CLOSES UP 34.60 POINTS, OR 0.18 PERCENT, AT 19,007.02

- S&P 500 UNOFFICIALLY CLOSES UP 22.76 POINTS, OR 0.38 PERCENT, AT 5,971.47

- FINANCIAL SECTOR LEVERAGE VULNERABILITIES REMAINED NOTABLE, WITH HEDGE FUND LEVERAGE AT OR NEAR HIGHEST SINCE 2013: FED REPORT

- U.S. 90-day auto loan delinquency rate at highest level since 2009 — WSJ

- US Services PMI Soars To 32-Month High, Manufacturing Output 23-Month Low

- 60% of homeowners go into debt for renovations they wish they hadn’t done, per FORTUNE.

- The US S&P Composite PMI Flash actual figure for the latest period is 55.3, surpassing both the forecasted 54.3 and the previous 54.1. This indicates a strengthening performance in the country’s private sector.

- CBOE has announced they are offering the first SEC-regulated cash-settled options related to the price of spot Bitcoin ETFs, on Dec 2.

- A recent survey shows that 52% of Americans believe in a secret to achieving financial success, with the median annual income needed being $270,000. Only 37% currently feel successful, while 58% remain hopeful for the future.

2024 Politics

- Donald Trump has floated Kevin Warsh as his Treasury Secretary with the understanding that he could lead Fed when Powell’s term ends, per the WSJ

- TRUMP CONSIDERS BESSENT FOR NATIONAL ECONOMIC COUNCIL WITH POTENTIAL TREASURY SECRETARY NOMINATION LATER IN TERM: WSJ

- BOB CASEY CONCEDES PENNSYLVANIA SENATE RACE

- TRUMP APPOINTS PAM BONDI AS US ATTORNEY GENERAL

- Trump hush money sentencing delayed indefinitely

- US Congressman Matt Gaetz says he will expose corruption, treason, and betrayal connected to stock trading in Congress.

- US CHAMBER OF COMMERCE EXPECTS BIDEN TO IMPOSE NEW EXPORT CURBS ON CHINA AS SOON AS NEXT WEEK -EMAIL SEEN BY REUTERS

Conflict

- ELON MUSK SAYS DOGE WILL IMPROVE THE EFFICIENCY OF DEFENSE SPENDING

- MIDDLE EAST TENSIONS, POLICY UNCERTAINTY, U.S. RECESSION ALSO AMONG TOP-CITED POTENTIAL SHOCKS: FED SURVEY

key headlines we care about:

- NEW YORK STATE DECRIMINALIZES ADULTERY AFTER MORE THAN A CENTURY (Feels like Wall Street got a 60 year head start on this. Nice to see NYC focused in on what matters most…)

- CONTROLLED EXPLOSION AT U.S. EMBASSY IN LONDON AFTER SUSPICIOUS DEVICE FOUND (English “food” is destructive to most…)

- US Congressman Matt Gaetz says he will expose corruption, treason, and betrayal connected to stock trading in Congress. (First, Matt shouldn’t be “exposing” anything—and someone needs to do a well-being check on Nancy Pelosi and her “trading account”.)

- Elon Musk’s net worth just hit a new ALL TIME HIGH of $347,800,000,000.00 – Bloomberg (It’s tough time around the holidays for everyone…)

FLASHBACK FRIDAY

If you ever ate out of one of these, it’s probably time to schedule your colonoscopy & get your crowns checked

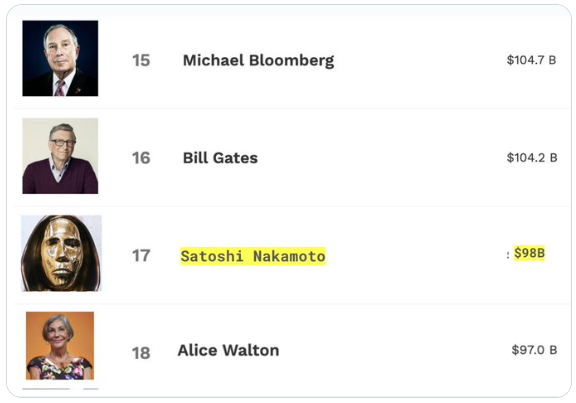

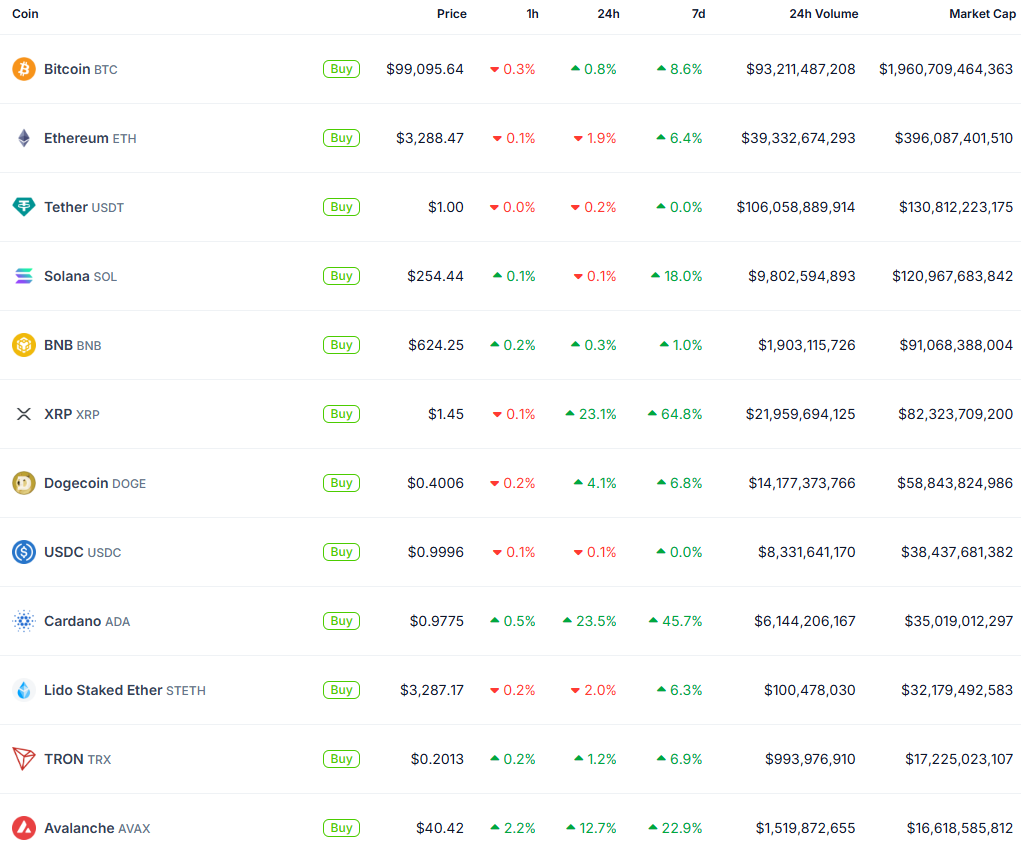

Bitcoin Creator Satoshi Nakamoto now has a net worth of $98 Billion (based on estimates of his BTC holdings). This gives him a higher net worth than Alice Walton, Blackstone Founder Stephen Schwarzman, Citadel Founder Ken Griffin, and places him only $6B behind Bill Gates

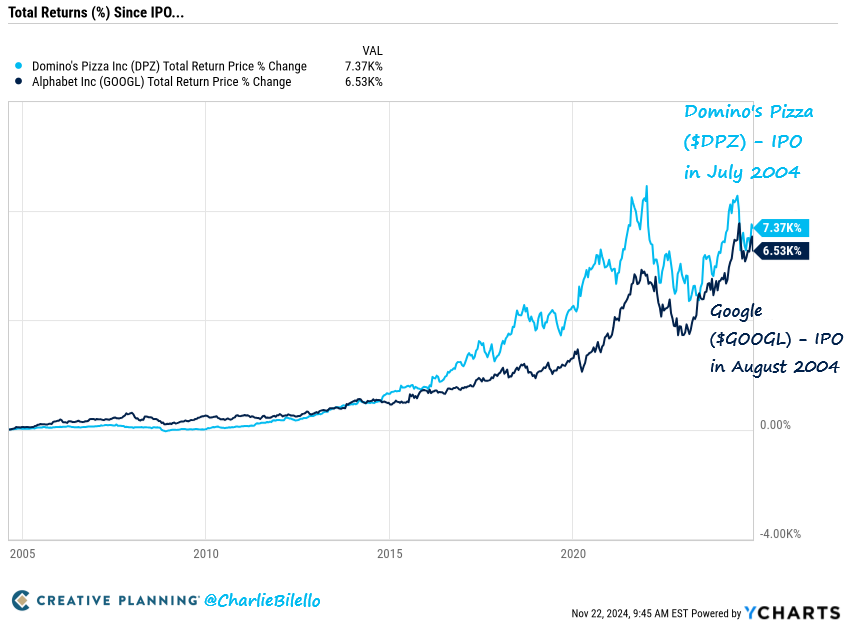

Two revolutionary companies went public twenty years ago. These are their returns since…

Google: +6,530% Domino’s Pizza: +7,370%

When there’s only 1 hour left at work and your only task is to cut some paper…

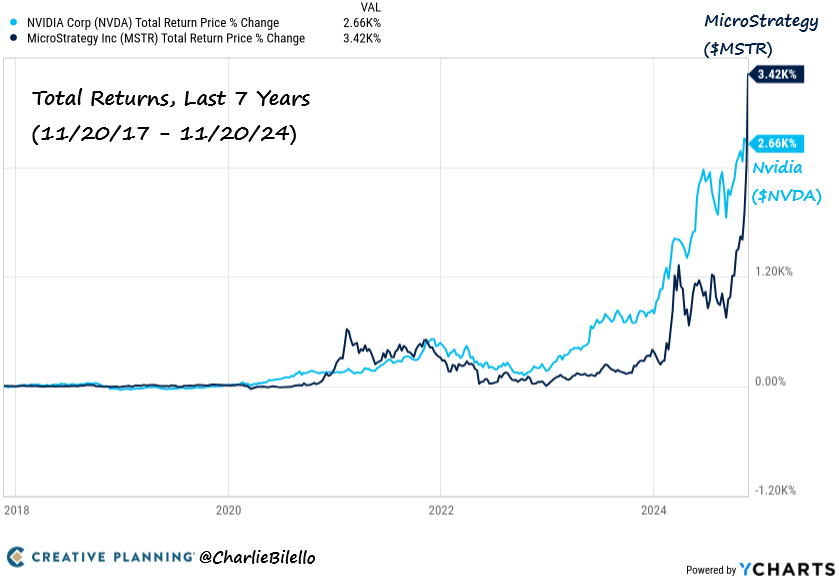

Nvidia is no longer the best performing stock in the Russell 1000 over the last 7 years. With a return of 3,420%, MicroStrategy has surged past Nvidia to take over the top spot.

Global Politics

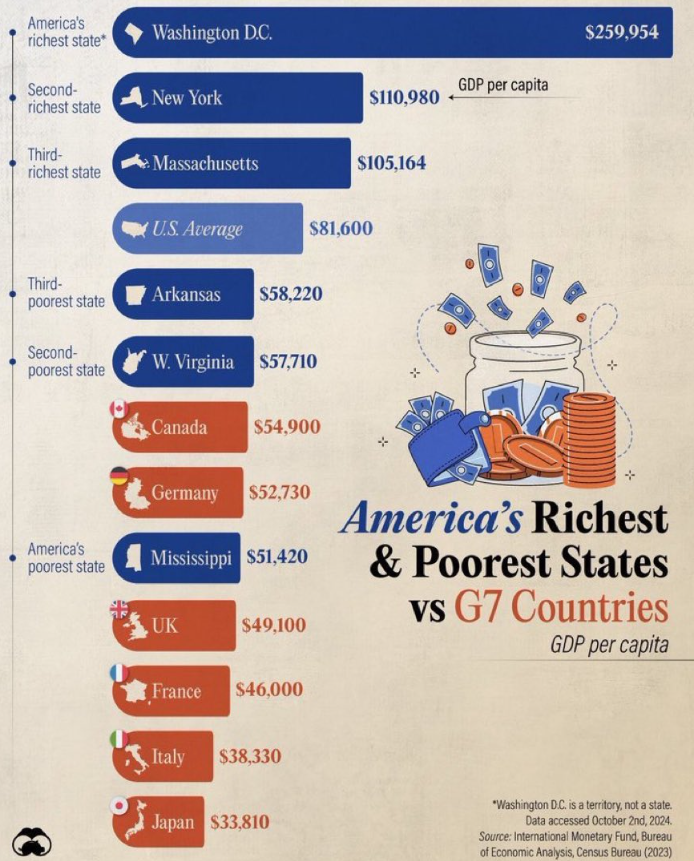

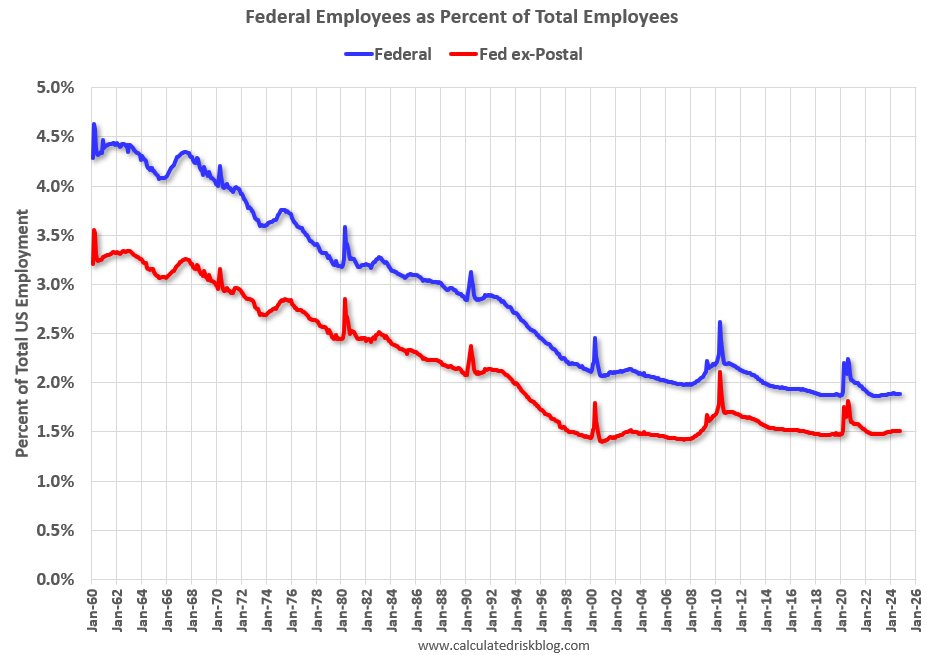

If Washington DC is our richest area per capita, that tells you how important D.O.G.E. is.

How many people work for the U.S. federal government?

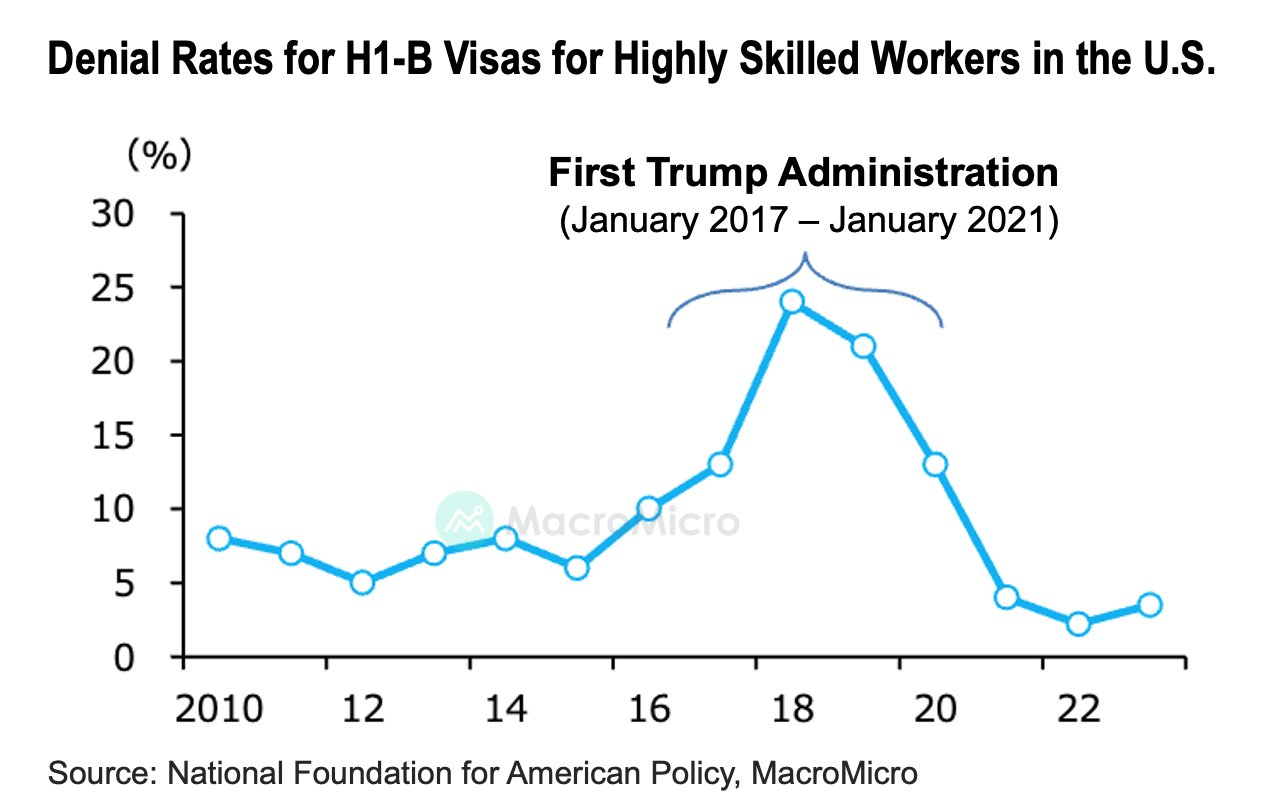

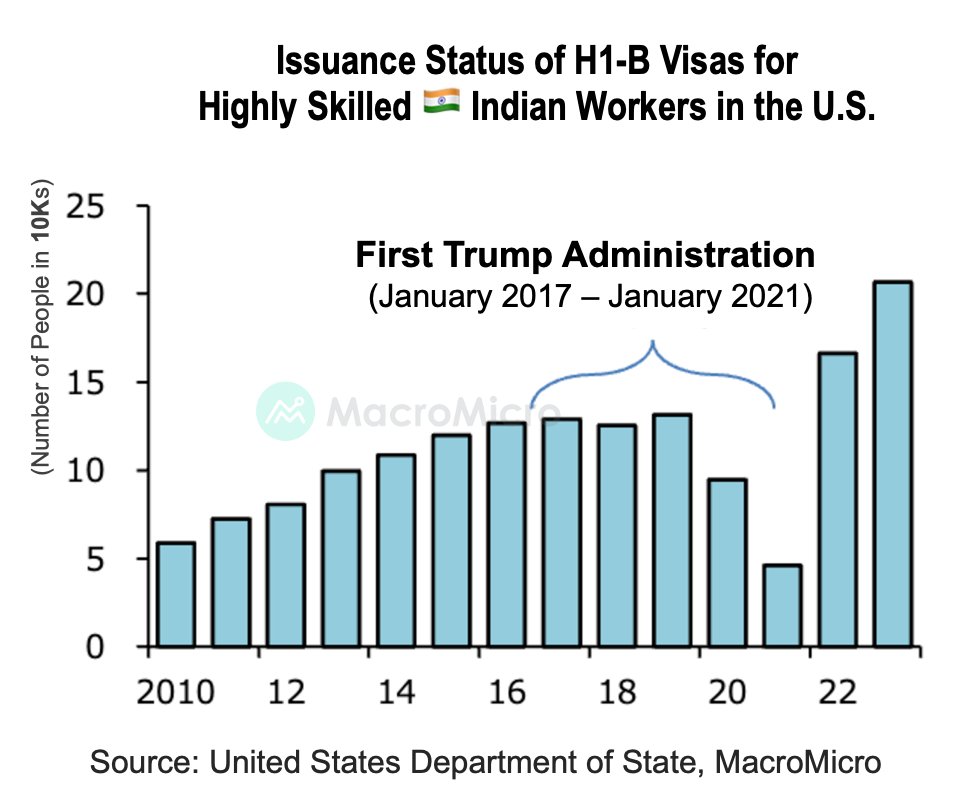

A second Trump presidency could reshape H1-B visa trends for skilled workers. His first term saw denial rates spike by 2018, with Indian professionals—80% of H1-B recipients—facing the biggest challenges.

Midwest Dads answering the phone..

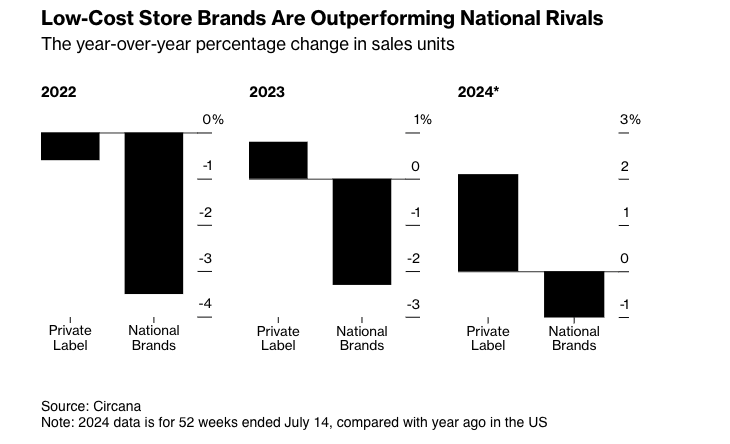

Low cost store brands are outperforming national rivals:

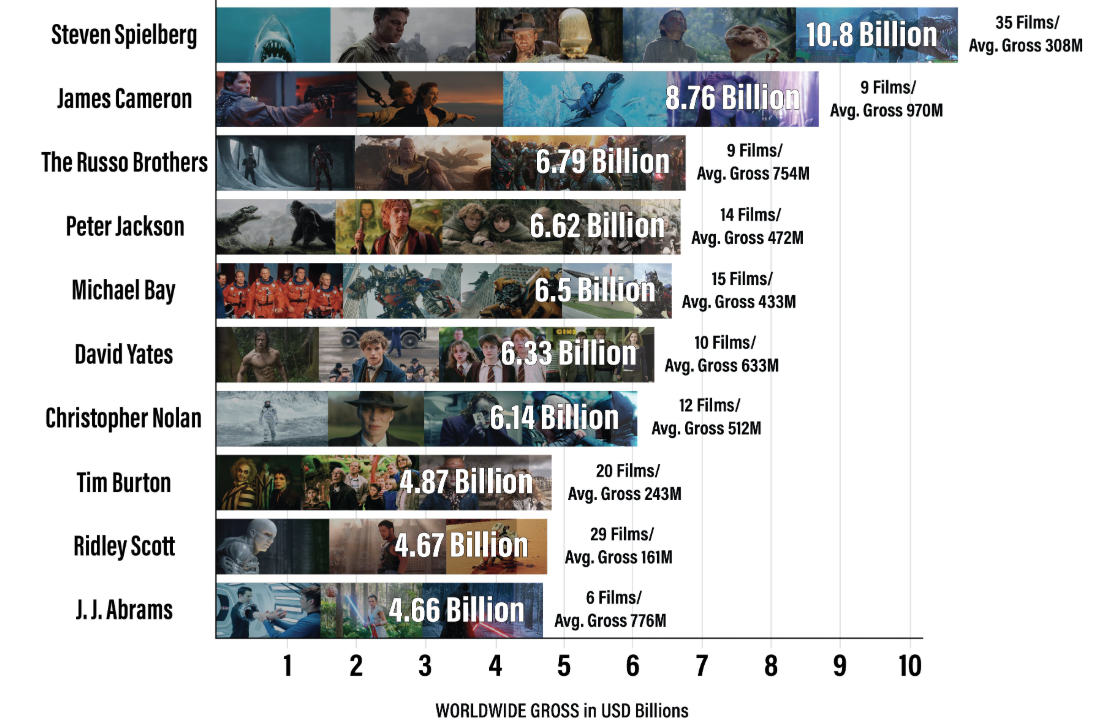

The 10 Highest Grossing Film Directors of All Time, as of Nov. 2024

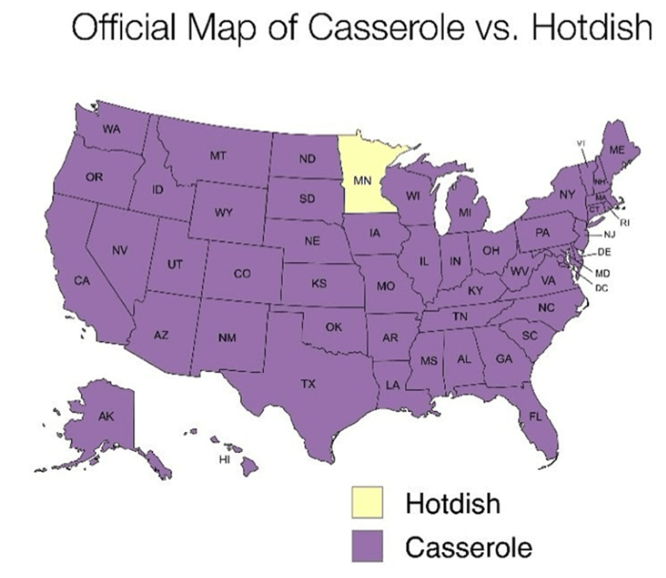

Minnesota tries SO hard to be different..

FYI

Projection of world’s biggest economies in 2075.

…BUT they have 31 grams of protein….

Click HERE for a market recap

on this day in history:

Today in History

2005 Angela Merkel takes office as German Chancellor

The physical chemist from former East Germany became the first female chancellor of the country.

2004 Orange Revolution begins in Ukraine

The revolution began after an election that was marred by widespread rumors of corruption and fraud. The protests resulted in electoral reforms in the country and November 22 was declared a Day of Freedom in 2005. The holiday was then moved to January 22 in 2011.

1995 Toy Story released

Produced by Pixar, the movie which follows the adventures of human-like toys, was the world’s first feature-length computer-animated movie. Considered to be one of the best animated films every released, Toy story won 3 Oscars including Best Original Screenplay, Best Original Score, and Best Original Song.

1986 Mike Tyson wins fight against Trevor Berbick

The victory won Tyson the World Boxing Council (WBC) heavyweight championship and made him world’s youngest heavyweight champion at the age of 20 years.s.

1963 John F. Kennedy assassinated

The 35th President of the United States was shot by Lee Harvey Oswald, while traveling in a motorcade in Dallas, Texas. He was the 4th American president to be assassinated while in office. The other 3 were Abraham Lincoln, James Abram Garfield, and William McKinley.

birthdays & deaths:

Births On This Day, November 22nd

1986 Oscar Pistorius

South African sprinter

1984 Scarlett Johansson

American actress, singer

1967 Boris Becker

German tennis player

1890 Charles de Gaulle

French general, politician, President of France

1819 George Eliot

English author

Deaths On This Day, November 22nd

1963 Aldous Huxley

English author

1963 John F. Kennedy

American lieutenant, politician, 35th President of the United States

1963 C. S. Lewis

Irish author, poet

1900 Arthur Sullivan

English composer

1718 Blackbeard

English pirate

company news/earnings:

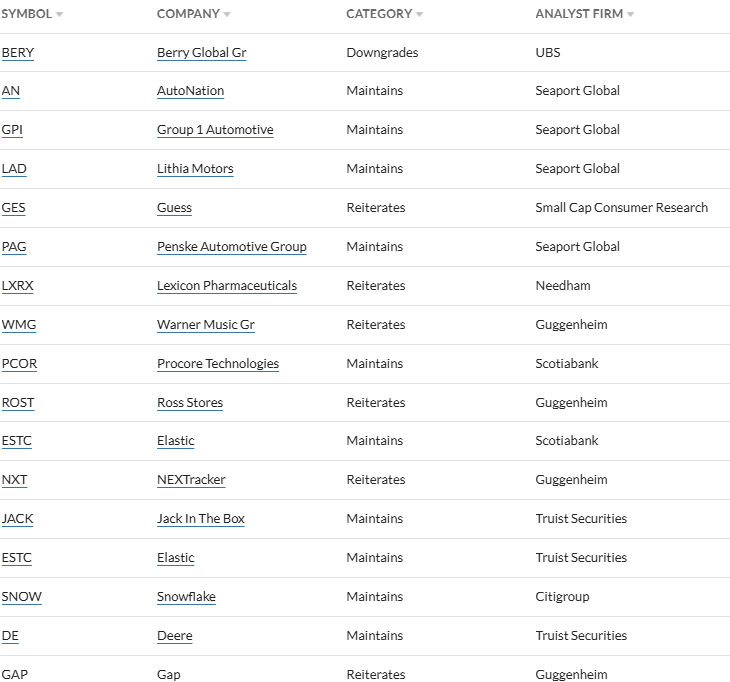

Analyst Actions

Citi today raised its price target on Snowflake $SNOW to $225 up from $183 while maintaining its Buy rating

Earnings

ESTC Elastic reported earnings Q2 FY2025 results ended October 31st, 2024 – Revenue: $365M, +18% YoY (17% in constant currency) – GAAP Net Loss: $25.5M ($0.25 per share) – Non-GAAP Net Income: $62.9M ($0.59 per share) – Elastic Cloud Revenue: $169M, +25% YoY

GAP Gap Inc. reported earnings Q3 FY2024 results ended November 2nd 2024 – Revenue: $3.83B, +2% YoY – Net income: $274M, +26% YoY vs $218M – Operating margin: 9.3%, +270bps YoY – Comparable sales: +1% YoY

FYI

The average 401(k) balance for Americans aged 65 and older is $272,588 but the median is just $88,488, per YF.

10-year Treasury yield slips as investors weigh state of U.S. economy

The US S&P Composite PMI Flash actual figure for the latest period is 55.3, surpassing both the forecasted 54.3 and the previous 54.1. This indicates a strengthening performance in the country’s private sector.

CBOE has announced they are offering the first SEC-regulated cash-settled options related to the price of spot Bitcoin ETFs, on Dec 2.

Bitwise CEO says, “Solana is an incredible emerging asset and story.

APPLE ON REGULATORY REPORT: POTENTIAL INTERVENTIONS WOULD HINDER ITS ABILITY TO “MAKE THE KIND OF TECHNOLOGY THAT SETS APPLE APART”

US SEC obtained record financial remedies in fiscal 2024, agency says

GERMAN FINANCE MINISTER: BANKING REGULATIONS SHOULD BE MORE TARGETED AND LESS BUREAUCRATIC, WITH A FOCUS ON COMPETITIVENESS.

HSBC STOPS PROCESSING ALL PAYMENTS FROM RUSSIA OR BELARUS FOR PERSONAL BANKING CUSTOMERS

SEC Commissioner Jaime Lizárraga to resign.

*ROBINHOOD’S DAN GALLAGHER WON’T TAKE SEC CHAIR ROLE: CNBC

U.S. RESTRICTS IMPORTS FROM MORE COMPANIES OVER UYGHUR FORCED LABOR -FEDERAL REGISTER

The JMC Plenary concluded yesterday following two days of high-level discussions. The Cayman Islands played a key role as Premier Hon. Juliana O’Connor-Connolly co-chaired in her capacity as President of the UK Overseas Territories Association

US COMMERCIAL PAPER OUTSTANDING RISES $35.8 BILLION IN NOVEMBER 20 WEEK: FED

LIQUIDITY CONDITIONS IN TREASURY CASH MARKET APPEAR CHALLENGED AND COULD AMPLIFY SHOCKS: FED REPORT

ECB’S VILLEROY: WE SHOULD REACH 2% GOAL EARLIER THAN EXPECTED IN 2025.

ECB’S VILLEROY: EUROPEAN ECONOMY IS ACHIEVING A SOFT LANDING || ECB’S VILLEROY: WE ARE NOT BEHIND THE CURVE TODAY

ECB’S VILLEROY: THE EUROPEAN ECONOMY IS ACHIEVING A SOFT LANDING.

U.S. INVESTOR BILL ACKMAN ACQUIRES $2.6-BILLION STAKE IN BROOKFIELD CORP- GLOBE AND MAIL $BN

FINANCIAL SECTOR LEVERAGE VULNERABILITIES REMAINED NOTABLE, WITH HEDGE FUND LEVERAGE AT OR NEAR HIGHEST SINCE 2013: FED REPORT

US probes JPMorgan’s links with Iranian oil trader’s hedge fund, Bloomberg News reports

PERSISTENT INFLATION DROPS TO NO. 5 ON RISKS LIST FROM NO. 1 IN PRIOR SURVEY, NOW TIED WITH GLOBAL TRADE RISKS: FED SURVEY

UK CONSUMER CONFIDENCE IMPROVES TO -18, BEATING ESTIMATES OF -22.

S&P: U.S. INDICTMENT OF 3 BOARD REPRESENTATIVES OF UNRATED ADANI GROUP ENTITY COULD AFFECT INVESTOR CONFIDENCE IN OTHER ADANI GROUP ENTITIES

Trump hush money sentencing delayed indefinitely

Redfin Survey Reveals 22% Of U.S. Renters Spend Entire Income On Rent, With 19% Working Jobs They Dislike And 13% Tapping Retirement Funds To Cover Housing Costs Amid Stagnant Wages And High Post-Pandemic Rental Prices

*US 30-YEAR MORTGAGE RATES RISE TO 6.84%, HIGHEST SINCE JULY

CANADA NEW HOUSING PRICE INDEX (MOM) (OCT) ACTUAL: -0.4% VS 0.0% PREVIOUS; EST 0.1%

POLL: UK HOME PRICES ARE TO RISE 3.1% IN 2025 AND 4.0% IN 2026 (3.0%; 4.0% IN THE SEPTEMBER POLL)

POLL: LONDON HOME PRICES ARE TO RISE 3.0% IN 2025 AND 4.0% IN 2026 (3.2%, 3.5% IN THE SEPTEMBER POLL)

Affinity is in talks to acquire Malaysian seafood supplier Golden Fresh, according to people familiar with the matter.

*AMAZON TO INVEST ADDITIONAL $4 BILLION IN ANTHROPIC

UNILEVER TO SLIM DOWN BUT NOT SPIN OFF FOOD BUSINESS, SAYS CHIEF- FT

Dollar climbs, euro weakens to two-year low after PMI data

Euro Falls to Lowest Since 2022 as Bets on ECB Rate Cuts Surge – BBG

Gold rallies on safe-haven demand, set for best week in nearly 2 years

U.S. CRUDE OIL FUTURES SETTLE AT $71.24/BBL, UP $1.14, 1.63 PCT

BRENT CRUDE FUTURES SETTLE AT $75.17/BBL, UP 94 CENTS, 1.27 PCT

NYMEX WTTI CRUDE JANUARY FUTURES SETTLE AT $71.24 A BARREL, UP $1.14, 1.63%.

NYMEX NATURTAL GAS DECEMBER FUTURES SETTLE AT $3.1290/MMBTU.

NYMEX GASOLINE DECEMBER FUTURES SETTLE AT $2.0614 A GALLON.

NYMEX DIESEL DECEMBER FUTURES SETTLE AT $2.2749 A GALLON.

CANADA RETAIL SALES (MOM) (SEP) ACTUAL: 0.4% VS 0.4% PREVIOUS; EST 0.4%

CANADA CORE RETAIL SALES (MOM) (SEP) ACTUAL: 0.9% VS -0.7% PREVIOUS; EST 0.4%

U.S MANUFACTURING PMI (NOV) ACTUAL: 48.8 VS 48.5 PREVIOUS; EST 48.9

U.S SERVICES PMI (NOV) ACTUAL: 57.0 VS 55.0 PREVIOUS; EST 55.0

U.S S&P GLOBAL COMPOSITE PMI (NOV) ACTUAL: 55.3 VS 54.1 PREVIOUS; EST 54.3

U.S MICHIGAN CONSUMER SENTIMENT (NOV) ACTUAL: 71.8 VS 73.0 PREVIOUS; EST 73.9

U.S MICHIGAN 1-YEAR INFLATION EXPECTATIONS (NOV) ACTUAL: 2.6% VS 2.6% PREVIOUS; EST 2.7%

U.S MICHIGAN 5-YEAR INFLATION EXPECTATIONS (NOV) ACTUAL: 3.2% VS 3.1% PREVIOUS; EST 3.1%

Dow ends up 1.1% to score best session since day after U.S. election

US markets closed: ⬆ S&P 500 – 5,948.70 (+0.53%) ⬆ DOW 30 – 43,870.35 (+1.06%) ⬆NASDAQ – 18,972.42 (+0.03%) ⬆ Russell 2000 – 2,366.98 (+1.78%) ⬇ CBOE Volatility – 16.94 (-1.28%)

DOW JONES UNOFFICIALLY CLOSES UP 468.12 POINTS, OR 1.08%, AT 43,876.59

S&P 500 UNOFFICIALLY CLOSES UP 31.49 POINTS, OR 0.53%, AT 5,948.60

NASDAQ UNOFFICIALLY CLOSES UP 9.72 POINTS, OR 0.05%, AT 18,975.86

European stocks close higher; JD Sports slumps 16% on profit warning

Asia markets fall as investors assess Nvidia results; Adani Group companies plunge