top headlines from today:

World & Market

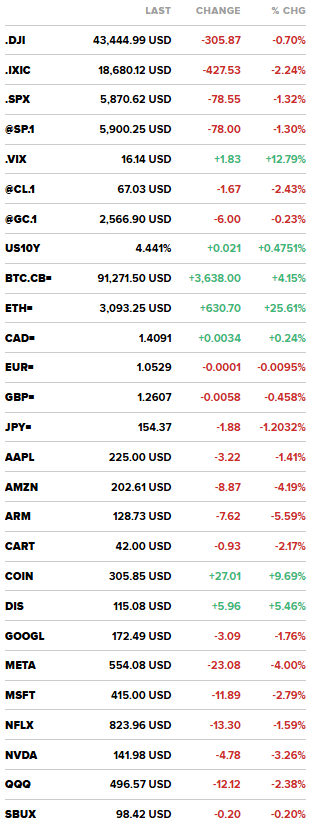

- Dow closes 300 points lower Friday as rate worries hinder postelection rally

- NASDAQ UNOFFICIALLY CLOSES DOWN 424.37 POINTS, OR 2.22 PERCENT, AT 18,683.28

- S&P 500 UNOFFICIALLY CLOSES DOWN 77.93 POINTS, OR 1.31 PERCENT, AT 5,871.24

- DOW JONES UNOFFICIALLY CLOSES DOWN 303.44 POINTS, OR 0.69%, AT 43,447.42

- Chicago Fed’s Goolsbee: The Basic Story Of The Economy Remains Falling Inflation, Labour Market Cooling To Full Employment – CNBC

- Elon’s xAI is raising $6B to buy 100,000 Nvidia chips for Memphis data center.

- US retail sales advanced in October, boosted by autos that masked more mixed performance elsewhere heading into the holiday season

- Stanley Druckenmiller’s family office led investment firms for the world’s rich in boosting allocations to US bank shares last quarter

2024 Politics

- Donald Trump picks Robert Kennedy Jr to run US health department

- TRUMP APPOINTS DEAN JOHN SAUER AS SOLICITOR GENERAL

- 84-year-old Nancy Pelosi (D-CA) has filed for reelection in 2026

- Trump Considers Larry Kudlow For Top Economic Jobs

- THUNE SUGGESTS DEFERRING TO PRESIDENT ON CABINET MEMBER CHOICES

- THUNE: MATT GAETZ DESERVES DUE PROCESS AS AN INDIVIDUAL

- President-elect Trump on Elon Musk: “He likes this place. I can’t get him out of here!…I’m asking him ‘what do you do best?’ and we were not able to figure it out.”

- Hedge Fund Manager Scott Bessent Expected To Meet With Trump Today In Florida – WAPO

Conflict

- HOUSTON TERROR ATTACK FOILED, FBI SAYS

- NORTH KOREA’S KIM SAYS THE COUNTRY HAS POTENTIAL TO PRODUCE VARIOUS TYPES OF DRONES – KCNA

- NORTH KOREA LEADER KIM ORDERS MASS PRODUCTION OF SUICIDE DRONES – YONHAP

key headlines we care about:

- Bernie Sanders has expressed a willingness to collaborate with the upcoming Trump administration to implement a 10% cap on credit card interest rates. (GREAT news for loan sharks who will pick up the slack…)

- FITCH AFFIRMS IRELAND AT AA WITH STABLE OUTLOOK. (Shocking to see “Ireland” and “AA” in the same sentence..)

- A teenager in California has passed the state’s bar exam at the age of 17, one year after her brother achieved the same goal. (For those who still can’t figure out why our kids are so stressed out….wake up…)

- 40% of companies advertise positions that don’t exist, per the Guardian. (Just wait until they stop posting real AND fake jobs…)

- DUTCH KING APPROVES RESIGNATION OF CUSTOMS MINISTER NORA ACHAHBAR (Does he get to keep the wooden shoes?

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

FRIED FINANCIAL FREEDOM FRIDAY

Before Kids vs. After Kids:

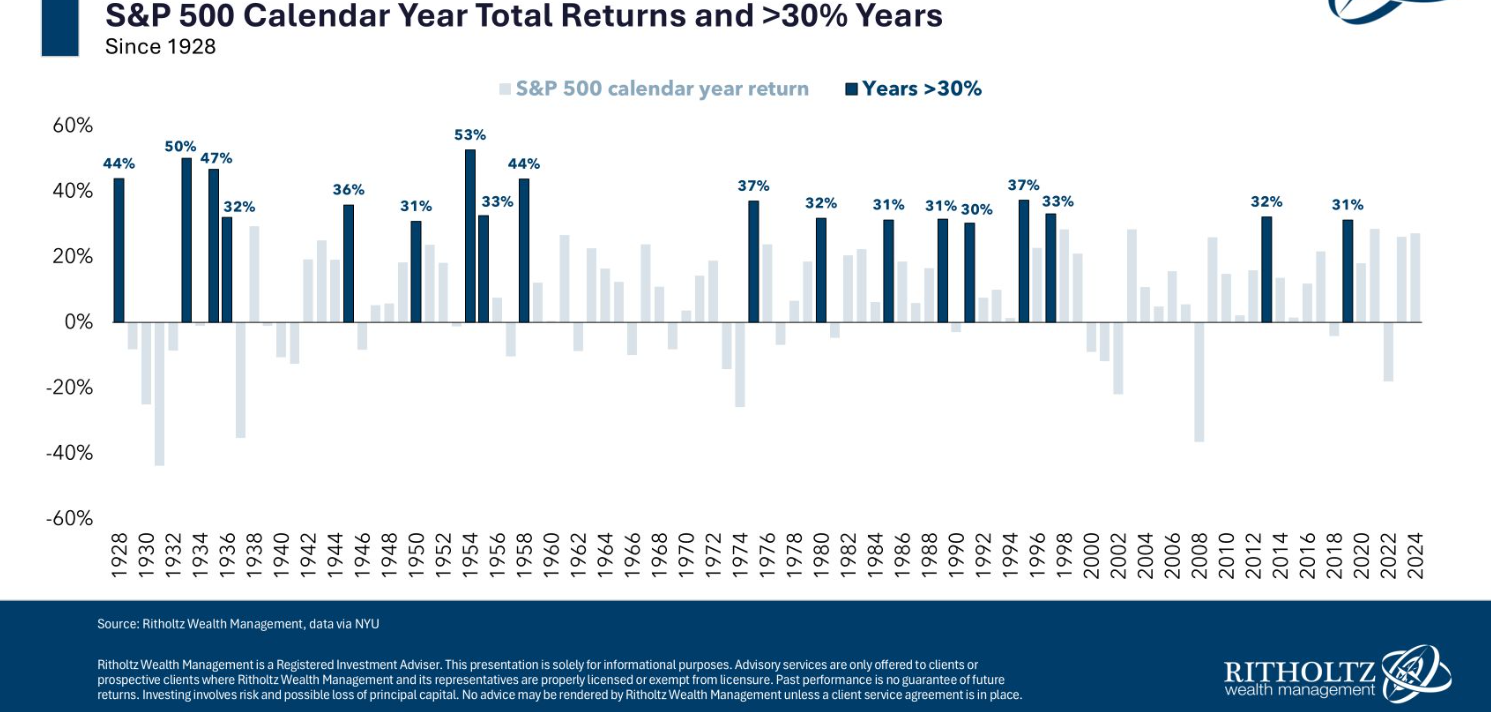

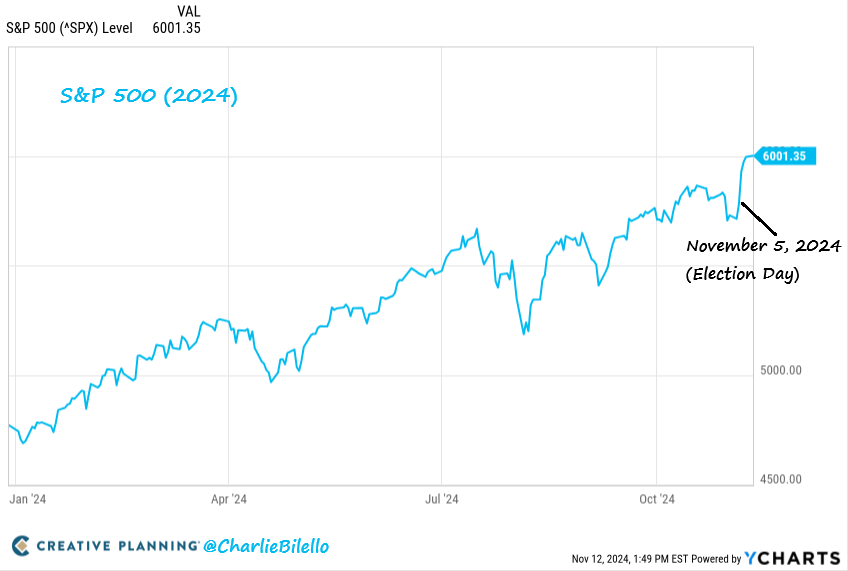

30% Yearly Gains in the S&P Aren’t All That Rare

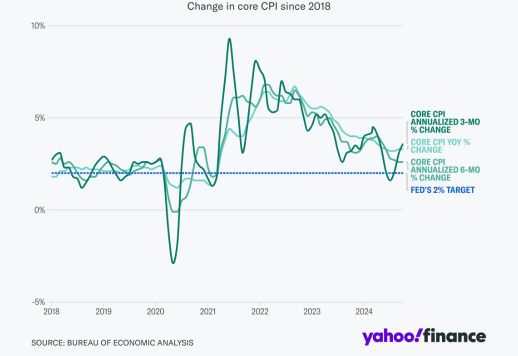

Inflation Heads for Fed’s 2% Target

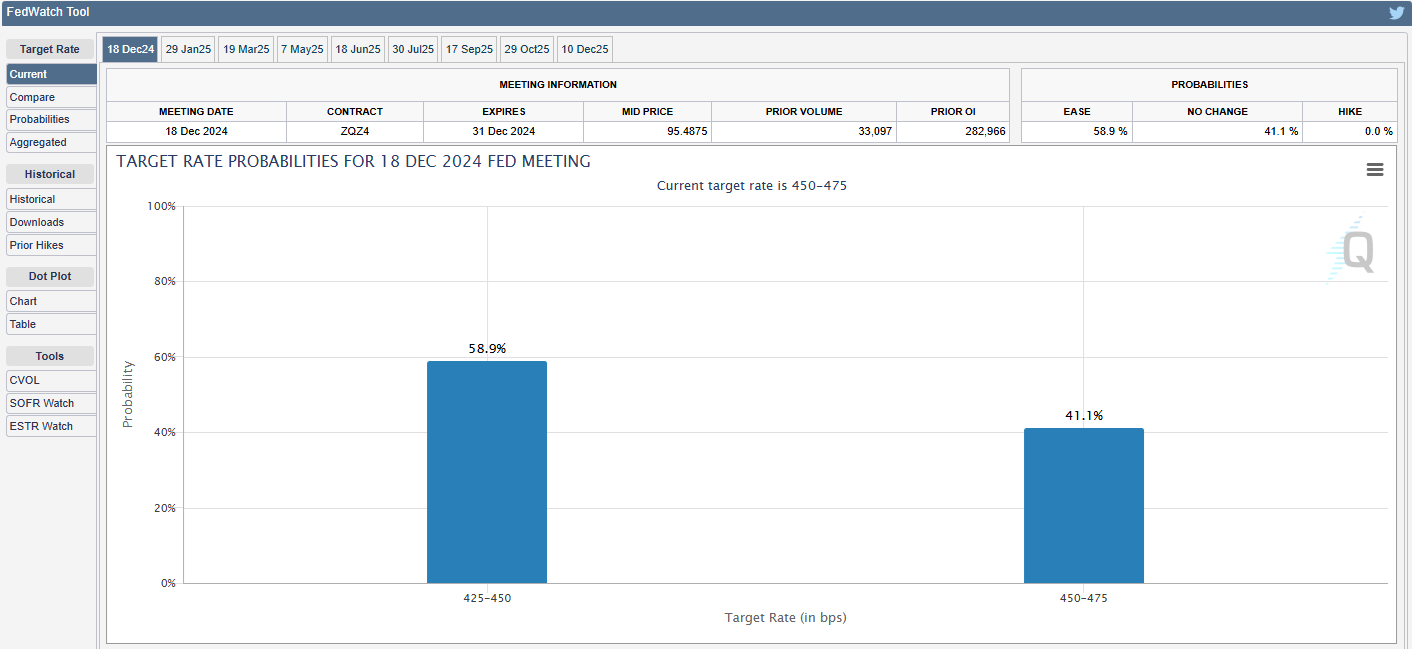

The chances of a December Rate Cut have plunged to 59%, down from 82% yesterday

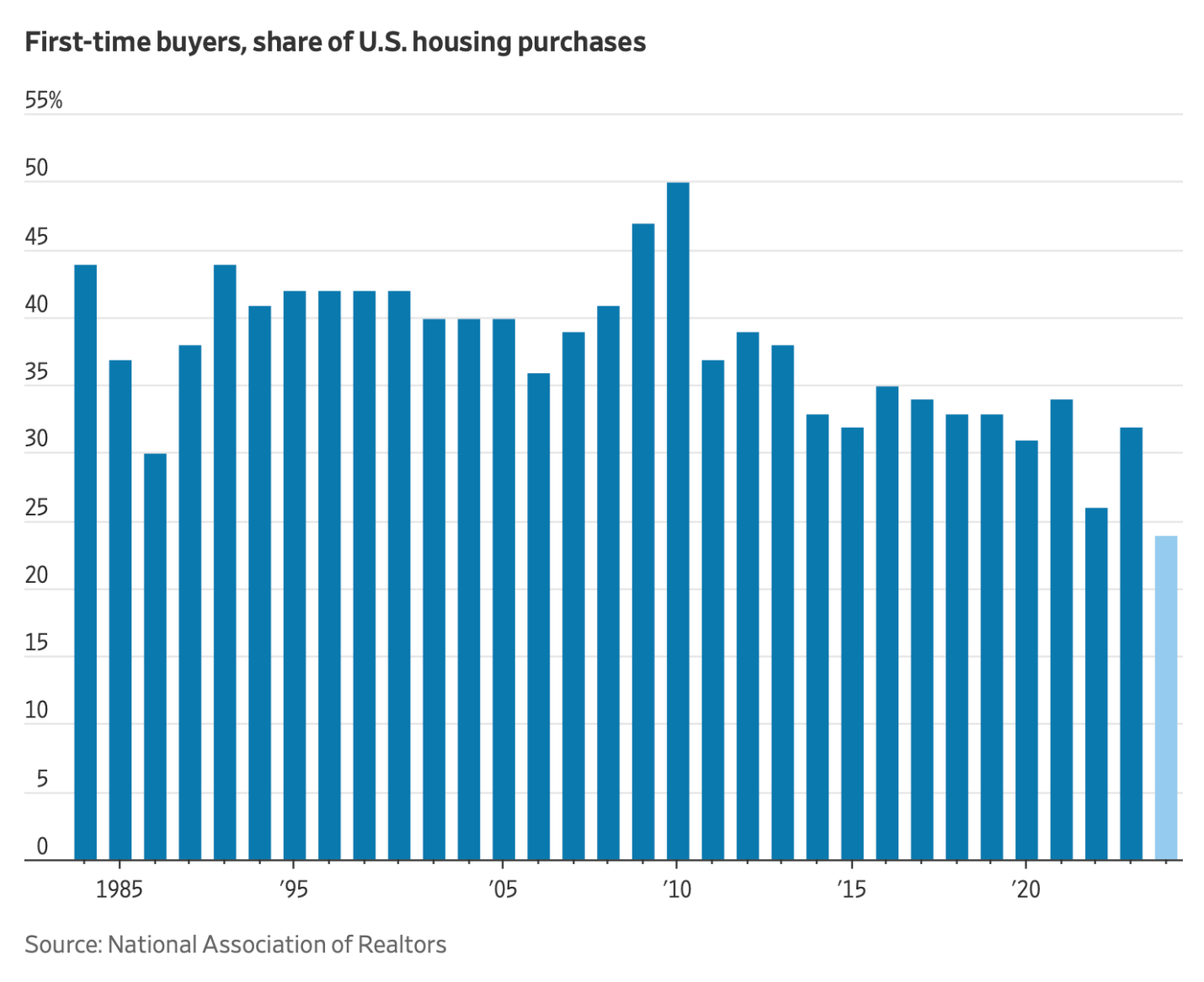

‘Homeownership is a luxury that many young families can no longer afford.’

Enjoy the weekend and turn off the “news”

Global Politics

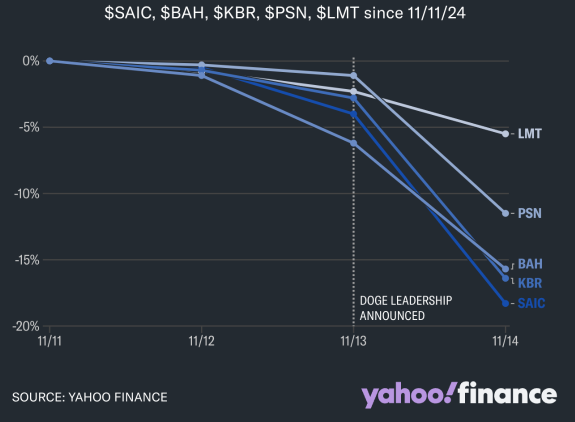

“DOGE” Formation Sinks Government Contractor Stocks

Me:

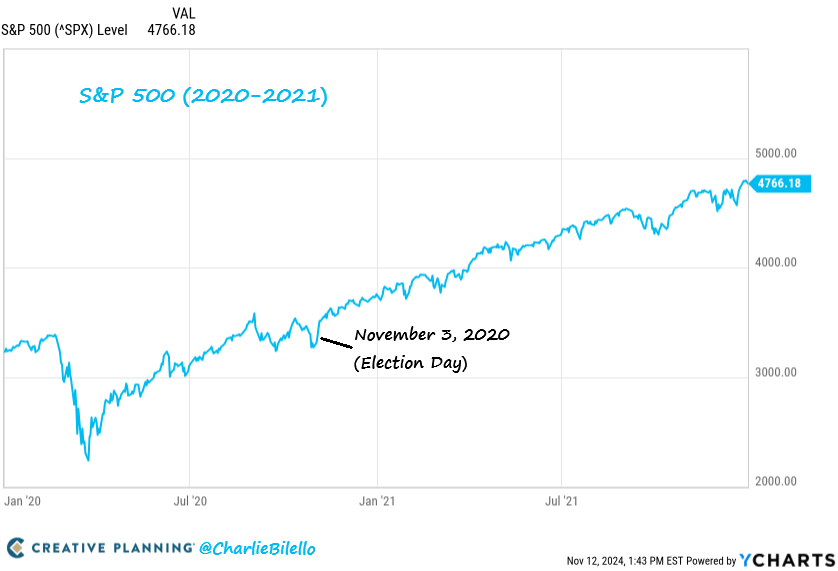

In 2020, the stock market surged higher after the election…

Any time you hear your spouse shout your full, governmental name from the other room…

And in 2024, the stock market has surged higher after the election…

FYI

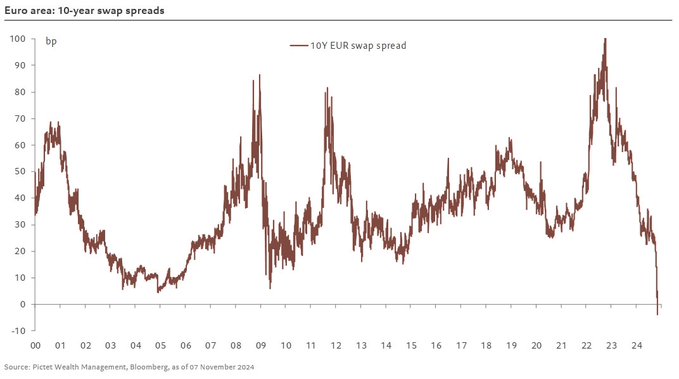

10-year swap spreads turn negative for the first time ever. Historic move driven by a combination of technical factors, the shift from QE to QT (with consequences on the net supply of bonds and money markets, collateral, etc.) and concerns over fiscal/sovereigns.

Going to see a movie based on your favorite book

Click HERE for a market recap

on this day in history:

Today in History

2006 Al Jazeera English launched

The English language 24-hour news channel is owned and run by Al Jazeera Media Network based in Doha, Qatar.

1988 State of Palestine created

The Palestinian Liberation Organization (PLO) declared the creation of the state while in exile in Algiers, Algeria. The declaration designated eastern Jerusalem as the state’s capital. Today, almost 70% of all UN members state recognize it as an independent country.

1956 Elvis Presley makes his movie debut

Love Me Tender, a black-and-white musical starred the American singer, who is also sometimes called the King of Rock and Roll. The movie was named after Presley’s hit single by the same name.

1949 Assassins of MK Gandhi Executed in India

Nathuram Godse, Narayan Apte and 6 other co-conspirators of the assassination of Mahatma Gandhi were hanged at the Ambala jail. On January 30, 1948, Godse who was unhappy about Gandhi’s accommodation of India’s Muslims shot Gandhi while he was out for his evening prayers.

1920 League of Nations meets for the first time

The general assembly of the international organization got together for the first time after being founded in January 1920. The League was created as a response to World War I and was entrusted by member states to maintain peace in the world.

birthdays & deaths:

Births On This Day, November 15th

1942 Daniel Barenboim

Argentine/Israeli conductor, pianist

1891 Erwin Rommel

German field marshal

1887 Georgia O’Keeffe

American painter

1886 René Guénon

French/Egyptian author

1708 William Pitt, 1st Earl of Chatham

English politician, Prime Minister of the United Kingdom

Deaths On This Day, November 18th

1983 John Le Mesurier

English actor

1978 Margaret Mead

American anthropologist

1917 Émile Durkheim

French sociologist

1908 Empress Dowager Cixi

Of China

1630 Johannes Kepler

German astronomer

company news/earnings:

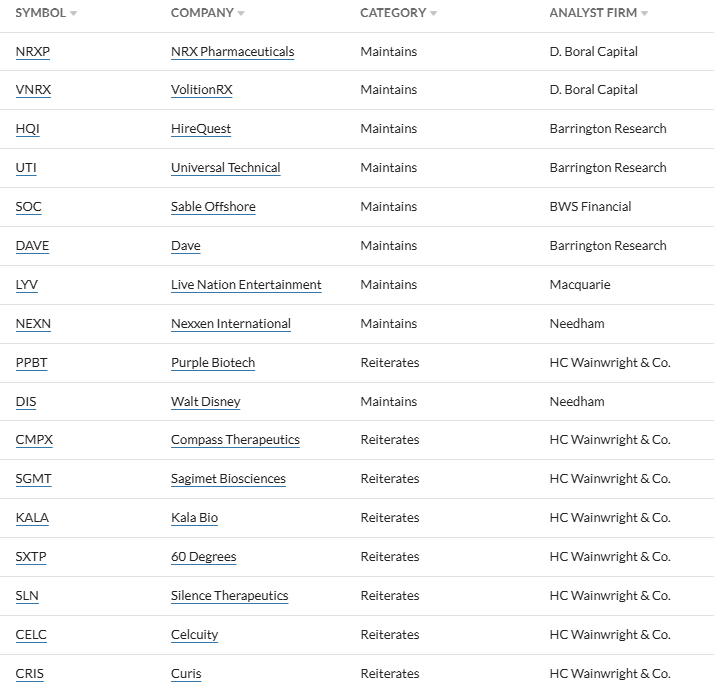

Analyst Actions

Earnings

$AMAT Applied Materials reported earnings Q4 FY2024 results ended October 27, 2024 – Revenue: $7.05B, +5% YoY – Net income: $1.73B, -14% YoY – GAAP EPS: $2.09 vs $2.38 in Q4 2023 – Non-GAAP EPS: $2.32 vs $2.12 in Q4 2023

$ASTS AST SpaceMobile reported earnings Q3 FY2024 results ended September 30th 2024 – Revenue: $1.1M (first reported revenue) – Net Loss: $303.1M vs $50.7M in Q3 2023 – Net Loss per Share: -$1.10 vs -$0.23 in Q3 2023 – Cash Position: $518.9M

$OKLO Oklo Inc. reported earnings Q3 FY2024 results ended September 30th 2024 – Total Operating Expenses: $12.3M, +163% YoY – Net Loss: $10.0M vs $8.7M in Q3 2023 – EPS: -$0.08 vs -$0.13 in Q3 2023 – Cash Position: $288.5M ($91.8M cash, $196.7M marketable securities)

$QBTS D-Wave Quantum reported earnings Q3 FY2024 results ended September 30th 2024 – Revenue: $1.9M, -27% YoY – QCaaS Revenue: $1.6M, +41% YoY – Professional Services Revenue: $0.3M, -80% YoY – Net Loss: $22.7M vs $16.1M in Q3 2023 – EPS: -$0.11 vs -$0.12 in Q3 2023

FYI

Canada’s indigenous communities are seeking deals with China that could give Beijing access to the country’s natural resources, per Reuters

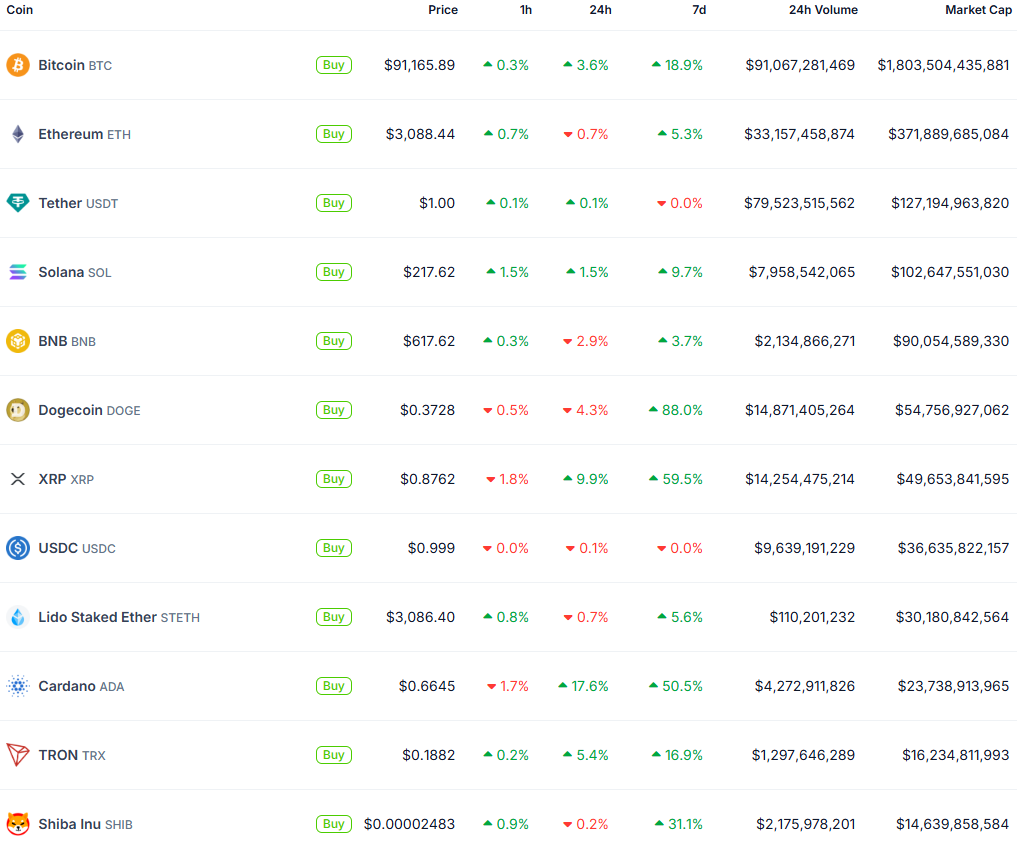

Manhattan US Attorney’s Office to reduce its pursuit of crypto cases, prosecutor says.

Citigroup facing US probe over ties to sanctioned Russian billionaire, Barron’s reports

US PRIVATE FUNDS GROUP ASKS TRUMP TO REVIEW ‘HARMFUL RULES,’ PRESERVE ‘PRO-GROWTH’ TAXES, PROMOTE ALTERNATIVE ASSETS – LETTER

FED’S GOOLSBEE: I DO NOT THINK RATES WILL GO BACK TO WHERE THEY WERE BEFORE THE PANDEMIC.

FED’S GOOLSBEE: I STILL FEEL GOOD ABOUT A 12 TO 18-MONTH PATH TO THE NEUTRAL INTEREST RATE.

FED’S GOOLSBEE: THE CURRENT FED POLICY IS STILL IN RESTRICTIVE POSTURE.

FED’S GOOLSBEE: NOT A LOT HAS CHANGED ON THAT IN LAST COUPLE WEEKS.

FED’S GOOLSBEE: IF WE STARTED TO SEE REVERSAL ON INFLATION PROGRESS, WE WOULD HAVE TO FIGURE OUT IF IT IS A BUMP.

BERKSHIRE HATHAWAY REPORTS SHARE STAKE OF 1.3M SHARES IN DOMINO’S PIZZA INC – SEC FILING

ELLIOTT INVESTMENT MANAGEMENT DISSOLVES SHARE STAKE IN MARATHON PETROLEUM – SEC FILING

TIGER GLOBAL MANAGEMENT LLC RAISES SHARE STAKE IN BROADCOM INC TO 1.8 MILLION SHARES

VIKING GLOBAL INVESTORS LP REPORTS SHARE STAKE OF 4.5 MLN SHARES IN METLIFE INC

VIKING GLOBAL INVESTORS LP REPORTS SHARE STAKE OF 967.2 THOUSAND SHARES IN BOSTON SCIENTIFIC CORP

VIKING GLOBAL INVESTORS LP DISSOLVES SHARE STAKE IN SANOFI

VIKING GLOBAL INVESTORS LP RAISES SHARE STAKE IN SHERWIN-WILLIAMS CO TO 1.3 MLN SHARES

VIKING GLOBAL INVESTORS LP RAISES SHARE STAKE IN NVIDIA CORPORATION BY 63.6% TO 2.3 MLN SHARES

VIKING GLOBAL INVESTORS LP REPORTS SHARE STAKE OF 20 MLN SHARES IN BANK OF AMERICA CORP

VIKING GLOBAL INVESTORS LP CUTS SHARE STAKE IN MCDONALD’S CORP BY 40.3% TO 1.1 MLN SHARES

VIKING GLOBAL INVESTORS LP REPORTS SHARE STAKE OF 1.3 MLN SHARES OF CLASS A CAPITAL STOCK IN ALPHABET INC

ELLIOTT INVESTMENT MANAGEMENT: CHANGE IN HOLDINGS ARE AS AT QTR-ENDED SEPT 30 VS QTR-ENDED JUNE 30

ELLIOTT INVESTMENT MANAGEMENT RAISES SHARE STAKE IN WESTERN DIGITAL BY 89.9% TO 2.25 MLN SHARES – SEC FILING

Stanley Druckenmiller’s family office led investment firms for the world’s rich in boosting allocations to US bank shares last quarter

Chicago Fed’s Goolsbee: The Basic Story Of The Economy Remains Falling Inflation, Labour Market Cooling To Full Employment – CNBC

Lawyers at the Department of Justice are threatening to quit if Matt Gaetz is confirmed as Attorney General.

FBI raids apartment of election betting site Polymarket’s CEO and seizes cellphone, source says

The execution of Robert Roberson — whose “shaken baby syndrome” murder conviction in the death of his 2-year-old daughter has come under scrutiny — is allowed to resume, according to a Texas Supreme Court decision.

“Median rents have gone up 23.4% where median incomes have gone up by 5%” since 2019, said Peter Hepburn, associate director of the Eviction Lab at Princeton University.

Singapore home sales rose to the highest level in nearly a year, after developers released more inventory in suburban districts

CHINESE NEW HOUSE PRICES YOY ACTUAL -5.9% (FORECAST -, PREVIOUS -5.8%)

BLACKSTONE, WARBURG WEIGHING $12 BILLION SALE OF INTRAFI

Private-equity owners of Diligent explore $7-billion sale of software maker, sources say -Reuters

Dollar set for strong weekly rise as markets anticipate fewer rate cuts

Gold set for biggest weekly fall in 3 years as Fed rate-cut bets ease

U.S. CRUDE OIL FUTURES SETTLE AT $67.02/BBL, DOWN $1.68, 2.45 PCT

BRENT CRUDE FUTURES SETTLE AT $71.04/BBL, DOWN $1.52, 2.09 PCT

NYMEX GASOLINE DECEMBER FUTURES SETTLE AT $1.9493 A GALLON.

NYMEX DIESEL DECEMBER FUTURES SETTLE AT $2.1709 A GALLON.

NYMEX NATURAL GAS DECEMBER FUTURES SETTLE AT $2.8230/MMBTU.

CANADA MANUFACTURING SALES (MOM) (OCT) ACTUAL: -0.5% VS -1.3% PREVIOUS; EST -0.7%

CANADA WHOLESALE SALES (MOM) (SEP) ACTUAL: 0.8% VS -0.6% PREVIOUS; EST 1.0%

CHINA INDUSTRIAL PRODUCTION (Y/Y) OCT: 5.3% (EST 5.6%; PREV 5.4%) – INDUSTRIAL PRODUCTION YTD (Y/Y): 5.8% (EST 5.7%; PREV 5.8%)

CHINA RETAIL SALES (Y/Y) OCT: 4.8% (EST 3.8%; PREV 3.2%) – RETAIL SALES YTD (Y/Y): 3.5% (EST 3.4%; PREV 3.3%)

JAPANESE CAPACITY UTILIZATION MOM ACTUAL 4.4% (FORECAST -, PREVIOUS -5.3%)

JAPAN 3Q GDP GROWS 0.9% ON ANNUALIZED BASIS; EST. 0.7%

Malaysia posts slower economic growth at 5.3% in Q3.

NEW ZEALAND (OCT) BUSINESSNZ MANUFACTURING PMI ACTUAL: 45.8 VS 46.9 PREVIOUS

U.S RETAIL SALES (MOM) (OCT) ACTUAL: 0.4% VS 0.4% PREVIOUS; EST 0.3%

U.S CORE RETAIL SALES (MOM) (OCT) ACTUAL: 0.1% VS 0.5% PREVIOUS; EST 0.3%

US INDUSTRIAL PRODUCTION YOY ACTUAL -0.29% (FORECAST -, PREVIOUS -0.64%)

U.S EXPORT PRICE INDEX (MOM) (OCT) ACTUAL: 0.8% VS -0.7% PREVIOUS; EST -0.1%

– Export Price Index (Y/Y): 0.8% (est -1.7%; prev -2.1%; prevR -1.9%)

U.S IMPORT PRICE INDEX (MOM) (OCT) ACTUAL: 0.3% VS -0.4% PREVIOUS; EST -0.1%

– Import Price Index (Y/Y): 0.2% (est 0.1%; prev 0.2%)

U.S NY EMPIRE STATE MANUFACTURING INDEX (NOV) ACTUAL: 31.20 VS -11.90 PREVIOUS; EST -0.30

*HIGHEST SINCE DECEMBER 2021

U.S INDUSTRIAL PRODUCTION (MOM) (OCT) ACTUAL: -0.3% VS -0.3% PREVIOUS; EST -0.3%

U.S CAPACITY UTILIZATION RATE (OCT) ACTUAL: 77.1% VS 77.5% PREVIOUS; EST 77.1%

U.S MANUFACTURING PRODUCTION (MOM) (OCT) ACTUAL: -0.5% VS -0.4% PREVIOUS; EST -0.5%

US Business Inventories (M/M) Sep: 0.1% (est 0.2%; prev 0.3%)

Dow closes 300 points lower Friday as rate worries hinder postelection rally

NASDAQ UNOFFICIALLY CLOSES DOWN 424.37 POINTS, OR 2.22 PERCENT, AT 18,683.28

S&P 500 UNOFFICIALLY CLOSES DOWN 77.93 POINTS, OR 1.31 PERCENT, AT 5,871.24

DOW JONES UNOFFICIALLY CLOSES DOWN 303.44 POINTS, OR 0.69%, AT 43,447.42

European markets close lower, recording fourth consecutive weekly decline; Bavarian Nordic sinks 17%

Asia markets mixed as investors assess China economic data and Japan GDP after Wall Street falls