With less than 10% of 2025 in the books, we’ve already seen a resurgence in market volatility, a spike in interest in hard assets (specifically Gold and Silver), and a hyper concentration in a handful of equity names like we have never seen before.

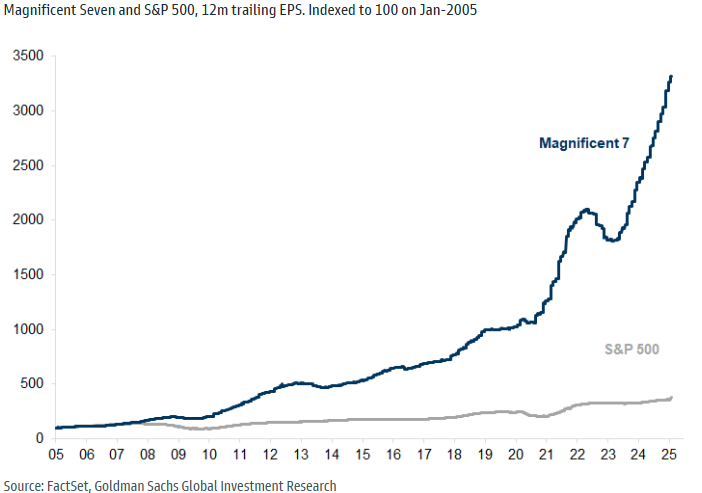

Per Goldman Sachs, “the dominance of the biggest companies in the US equity market is a function of their vastly superior earnings power over the last decade”, but at what cost?

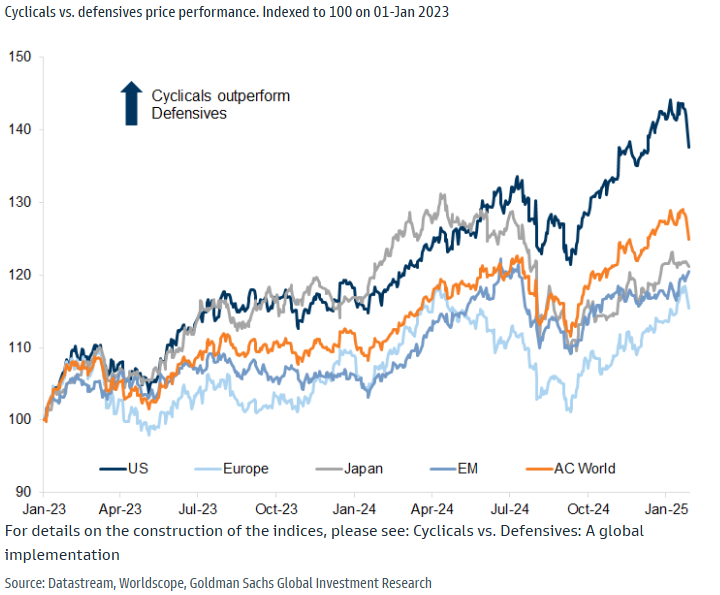

The “recent strength in equities in recent months has reflected higher growth expectations”. Where will this “growth” come from, and, again, at what cost?

If nothing else, the markets have taught us the importance of using technical analysis and getting a better understanding of trader sentiment. In his latest Weekly Market Report, AJ Monte, CMT, discusses the importance of reading the size of the candle on the chart to tell us just HOW motivated the sellers are.