In 1993, Professor Bob Whaley created the Volatility Index, which forever changed the way options were traded in the open market. Up until that time, floor traders relied on the Black-Scholes model to calculate the fair value of the options they traded. While the Black-Scholes model helped market makers adjust their bid/ask spreads, it provided no value for floor traders with regard to it being able to forecast the direction of the underlying market.

In the early 1980’s I was fortunate enough to be one of the first market makers to trade Gold Options when they were first introduced in New York. Due to the inefficiencies of the market, floor traders had a field day trading because of the super wide bid/ask spreads. It was hard to lose money when the markets were trading within a stable price range, however, losses would quickly mount during times when breaking news caused big volatility spikes.

To this day, the majority of retail orders that come into the market are on the buy side. As a result, market makers, who are obligated to take the opposite side of those trades, usually find themselves net short option premium. Being short volatility exposes traders to the risk of a gamma squeeze. Should a gamma squeeze take place, traders would have to be quick to hedge themselves with the underlying futures contract and move their ask price as far away from fair value as possible.

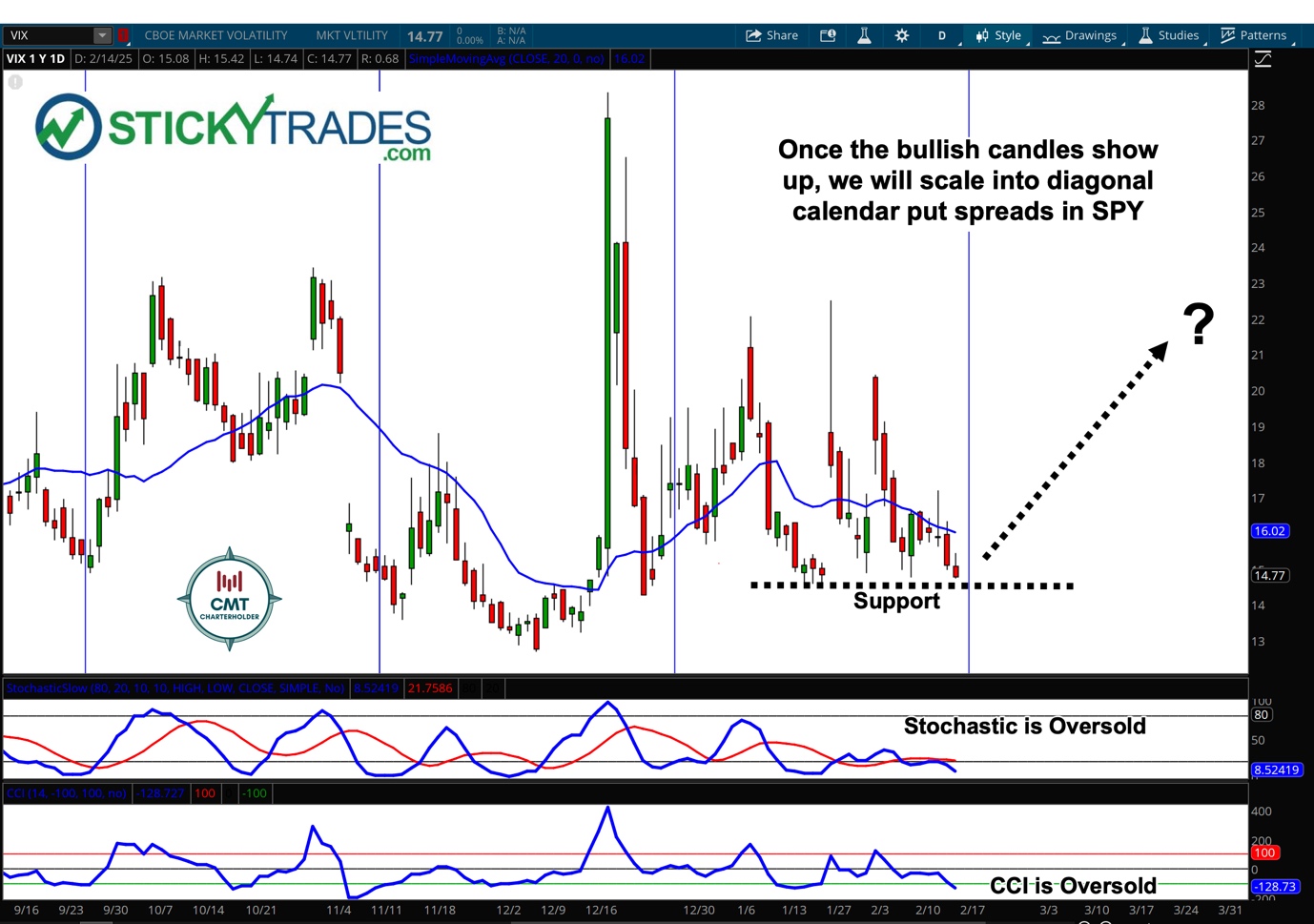

Over the years I’ve come to rely on the technical charts to forecast volatility spikes.

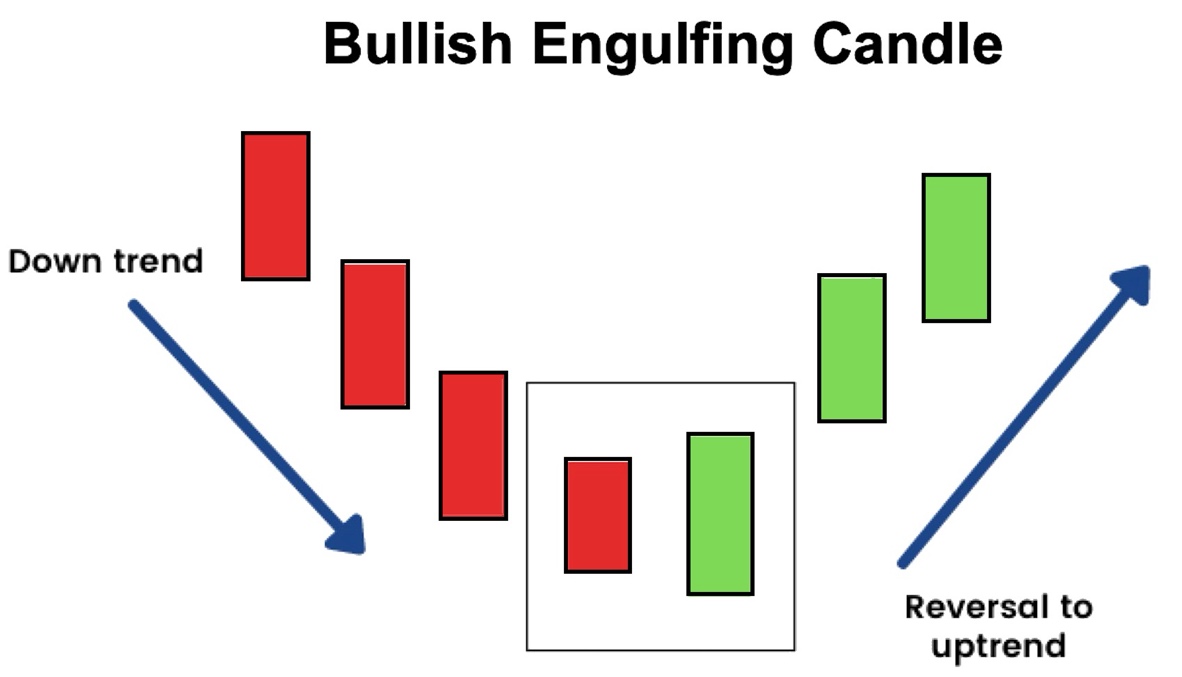

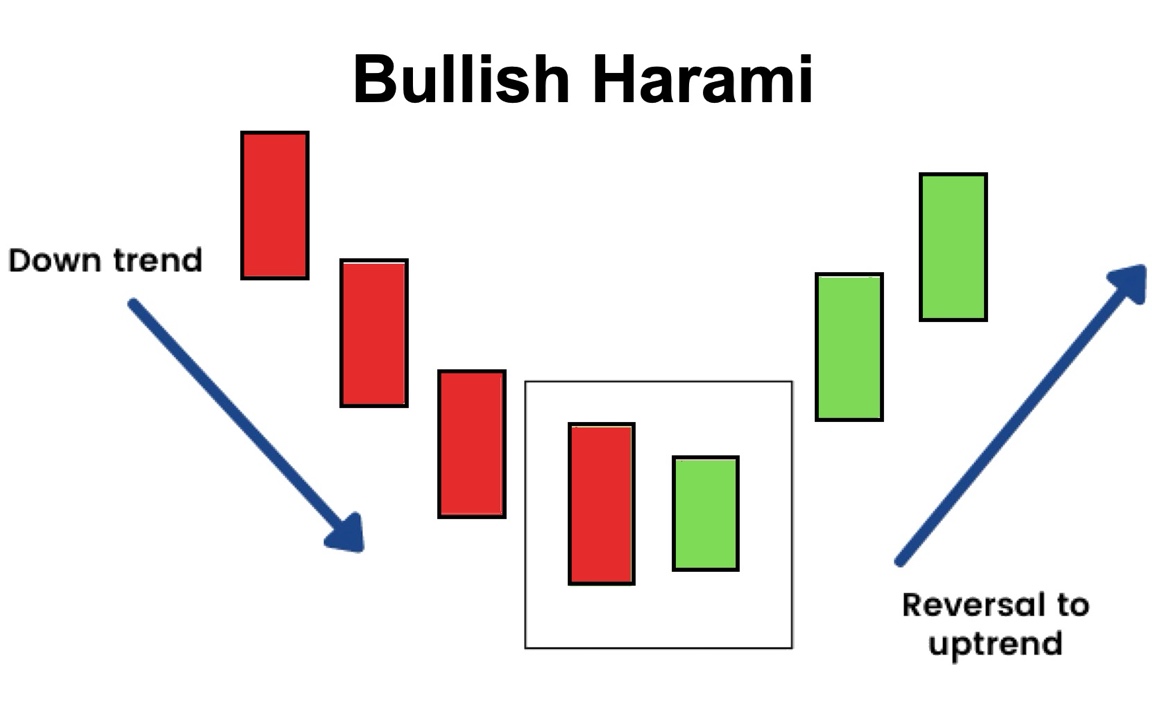

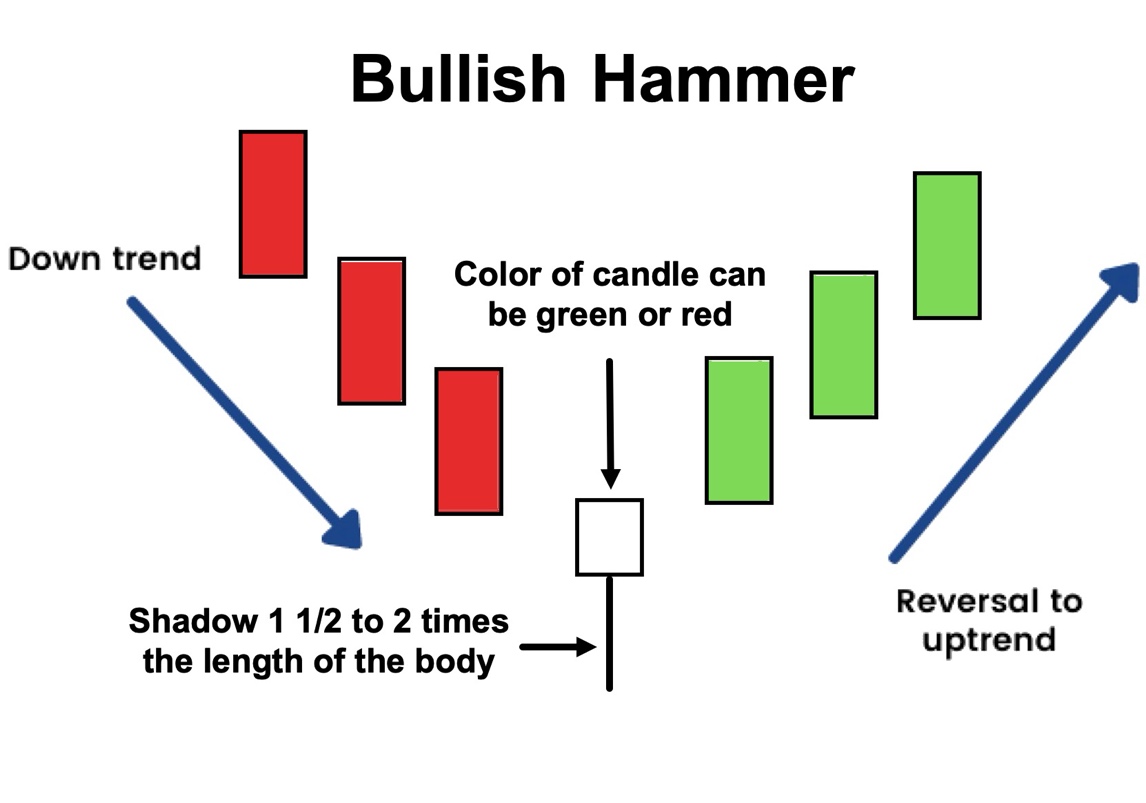

While it takes some time to learn the candle patterns that lead to bullish moves in the VIX, once you learn what they look like, the patterns will be easy to find on the charts. Bullish Engulfing Candles, Bullish Haramis, and Hammer Candles are just a few of the patterns I rely on and 80% of the time they are followed by a rally in the VIX.

Three ways to trade the VIX after a bullish candle shows up:

- When initiating a bullish directional trade, I usually buy slightly out-of-the-money call options, in UVXY or VXX, with at least 2 to 3 months until expiration. While this is NOT a long-term buy and hold strategy, I like to give myself enough time for the bullish candle pattern to play out. After the VIX has rallied, I will be quick to take profits by closing out of the position.

- I also like selling short-term (weekly) out-of-the-money put spreads in UVXY and VXX, that offer a 30-50% ROI on the margin requirement. My objective is to allow the out-of-the-money put spreads to expire worthless. If the market moves against me, I will roll the spreads out to a later expiration.

- My favorite strategy is to buy diagonal calendar put spreads on SPY, when the VIX is looking bullish. This would involve buying in-the-money or out-of-the money leap puts, while simultaneously selling out-of-the-money short-term puts to help pay down the cost basis of the puts we own on the long side of the spread.

NOTE: I do NOT recommend you trade these strategies until you are fully aware of the risks involved. I would suggest that you paper trade until you are comfortable with the strategies.

For more information pertaining to the above strategies, feel free to email me at AJMembers@stickytrades.com.