top headlines from today:

World & Market

- Dow ends up 1.1% to score best session since day after U.S. election

- Calmer Trend Continues For Mortgage Rates 30 Yr. Fixed: 7.04% (-0.01% ▼) | 15 Yr. Fixed: 6.41% (0.00% )

- 213K PEOPLE IN THE US FILED FOR UNEMPLOYMENT THIS PAST WEEK BELOW EXPECTATIONS OF 220K

- JPMorgan; Investors can expect the rally in US equities to keep rolling next year, even after a furious run that has pushed the S&P 500 Index up more than 50% since the start of 2023

- FED’S GOOLSBEE: I’VE GOTTEN MORE COMFORT THAT WE’RE NOT CRASHING THROUGH FULL EMPLOYMENT

- A Florida man has been charged with plotting to bomb the New York Stock Exchange this week, FBI says – AP

2024 Politics

- JOE BIDEN TURNS 82 YEARS OLD, A FIRST FOR A SITTING US PRESIDENT (Reuters)

- Donald Trump will make a $400,000 salary as president, per FORTUNE.

- TRUMP PLANS TO REVIVE KEYSTONE XL PIPELINE, REPORTS POLITICO.

- TRUMP LIKELY TO CHOOSE MARTY MAKARY TO LEAD FOOD AND DRUG ADMINISTRATION – SOURCES

- Bill O’Reilly says Donald Trump Cabinet will have zero policy input

- An NBC News analysis of housing and voting data show that the counties where it’s most difficult to buy a home saw the biggest shifts toward Trump.

- The House Ethics Committee votes against releasing Matt Gaetz classified Ethics report

Conflict

- RUSSIAN AMBASSADOR: UK DIRECTLY INVOLVED IN WAR IN UKRAINE

- RUSSIA FIRED AN INTERMEDIATE-RANGE BALLISTIC MISSILE, NOT AN ICBM, AT UKRAINE ON THURSDAY, A U.S. OFFICIAL TELLS REUTERS, CITING INITIAL INDICATIONS

- US, Taiwan Sign $329 Million in Weapons Deals: Taipei Times

- *US SAYS IT REJECTS ICC ARREST WARRANT FOR NETANYAHU

- US OFFICIAL: RUSSIA STRIKE ON UKRAINE WAS ‘EXPERIMENTAL’ MEDIUM-RANGE BALLISTIC MISSILE, NOT ‘A GAME CHANGER’

- The US says its forces are backing Philippine military operations in the disputed South China Sea, where Manila and Beijing have clashed over competing claims

key headlines we care about:

- A piece of duct tape and a banana have sold for $6.2 million at a Sotheby’s New York art auction (We deserve a meteor….)

- The Pentagon failed its 7th audit in a row, losing track of $2.5 trillion (–and my credit score still gets hit for a late college rent payment in 1998)

- REPORTER SAYS, ‘FALSE ALARM,’ AMBULANCES WERE PART OF J.D. VANCE’S MOTORCADE — INDEPENDENT (People using any headline to distract from being with out of town guests.)

- $7.13 trillion asset manager Charles Schwab says they will offer spot crypto ETFs “when the regulatory environment changes.” (In other words. “once the current guy is fired…)

THROWBACK THURSDAY

Wait, what?

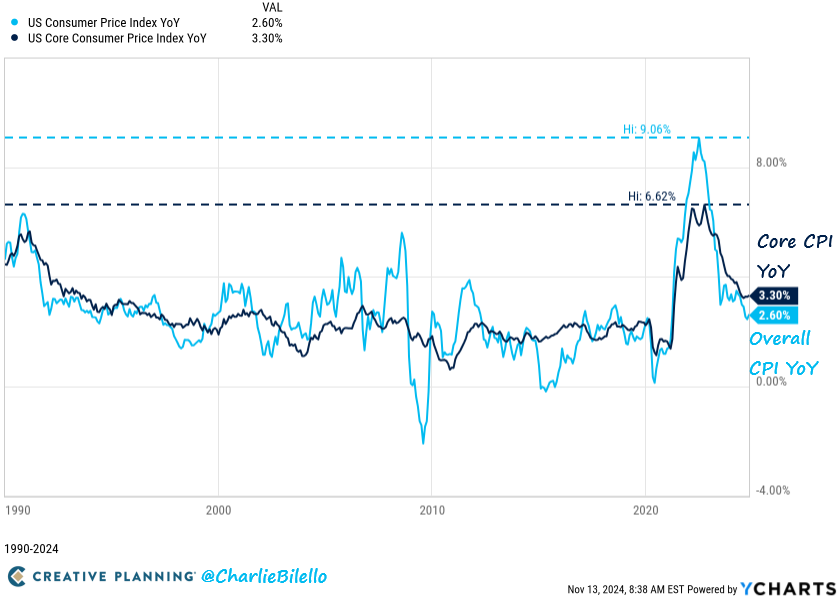

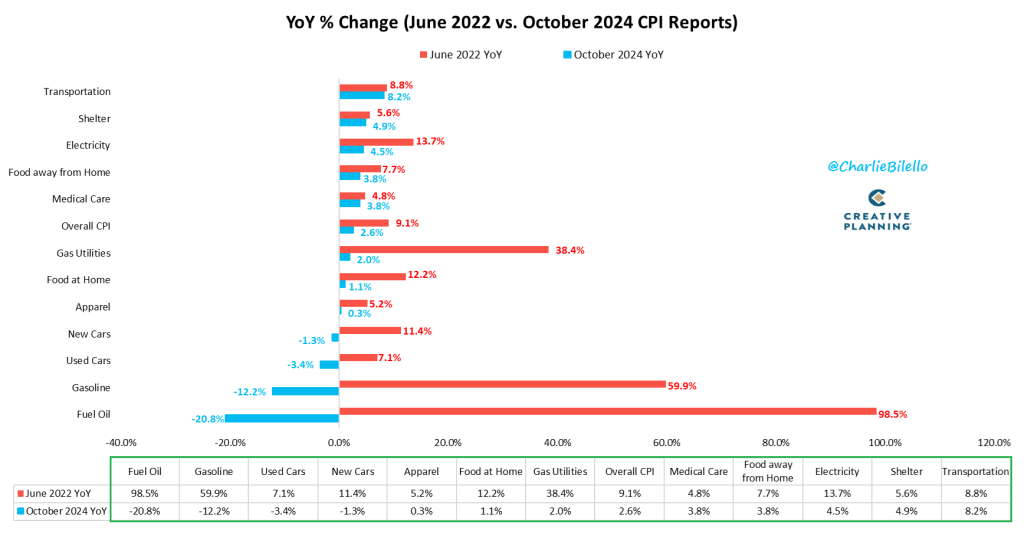

While the rate of inflation may have moved lower over past few years, it doesn’t seem to be going away anytime soon.

That much is clear from the October CPI report, which showed Overall CPI moving up to 2.6% and Core CPI (excludes Food/Energy) moving up to 3.3%.

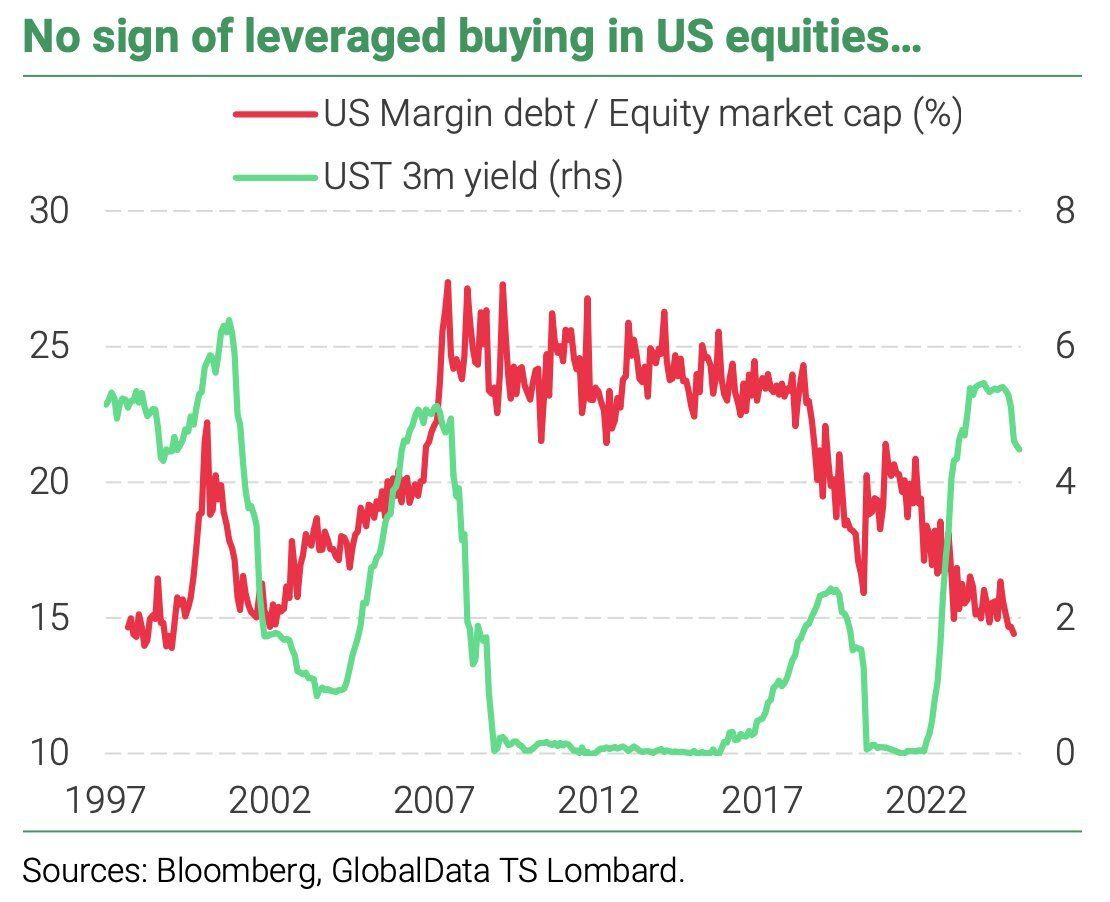

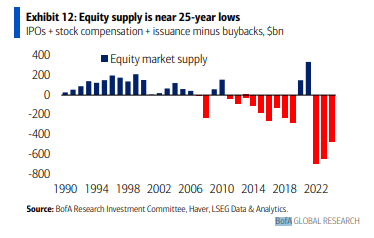

The bull market has legs. Leveraged buying of stocks is at a 25 year low.

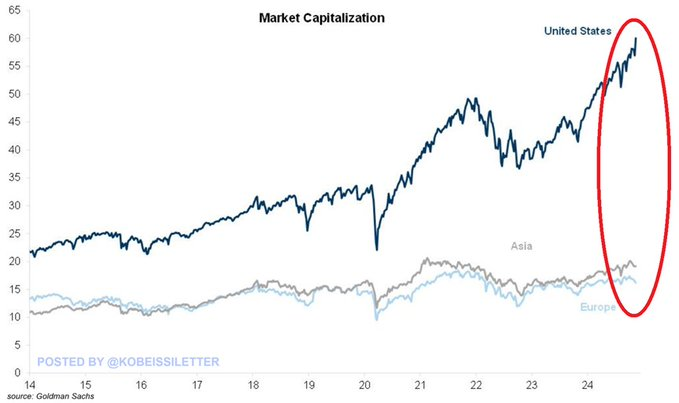

Total US market cap is now $27 TRILLION larger than Asian and European COMBINED.

Like it was yesterday..

Global Politics

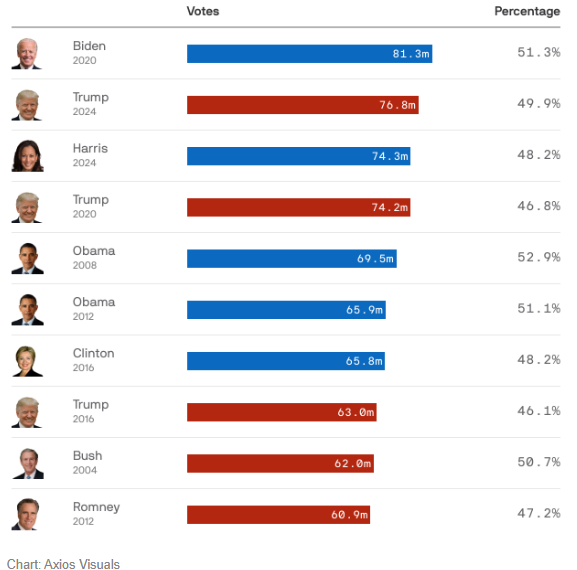

Top US Presidential Popular Vote Totals

Matt Gaetz withdraws from consideration to be attorney general

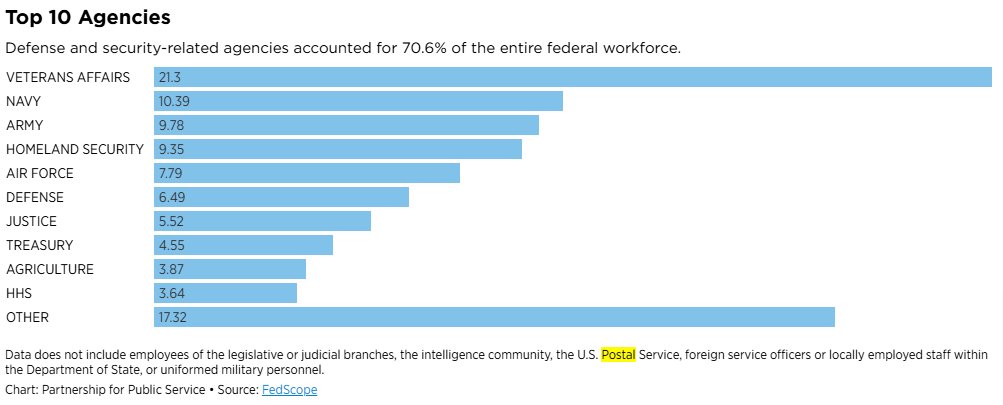

Vivek & Elon write: “A drastic reduction in federal regulations provides sound industrial logic for mass head-count reductions across the federal bureaucracy.” Of the 2m civil servants ~65% work for DHS, Vets, and DoD. So, I doubt a big percentage of feds make/enforce regs.

Urge to do chores meet resistance…

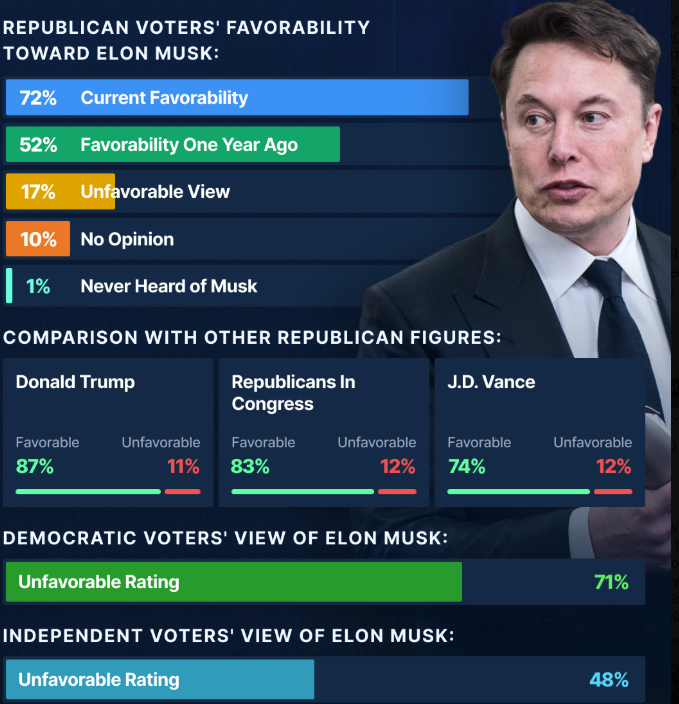

Elon Musk’s Political Favourability; Benzinga

Among the major components in CPI, Transportation has shown the biggest increase over the past year, rising 8.2%.

FYI

BoA (Woodward): “the net supply of US equities has shrunk -$473bn. The steady growth of buybacks, a key source of demand, has overwhelmed sources of new supply such as share issuance, IPOs, and stock-based compensation.”

If you are under a certain age, let me ASSURE you this apple pie was served at the surface temperature of the planet mercury

Click HERE for a market recap

on this day in history:

Today in History

1979 Mob burns down US embassy in Pakistan

The mob was allegedly incensed by a rumor that the United States was involved in an attack on a mosque in the holy city of Mecca.

1964 Verrazano Narrows Bridge opens in NYC

The suspension bridge connects Staten Island and Brooklyn in New York City and at the time of its opening, it was the world’s longest suspension bridge, until the Humber Bridge in the UK opened in 1981.

1962 War between China and India ends

The month long war began over a border dispute between the two countries and ended with a unilateral ceasefire by the Chinese.

1941 Tweety Bird makes its debut

The fictional cartoon canary also just called Tweety made his first appearance in A Tale of Two Kitties, a Warner Bros. Merrie Melodies cartoon. Tweety was created by animator Bob Clampett who worked on Loony Tunes cartoons.

1920 Bloody Sunday in Ireland

A key event in the Irish War of Independence, which was a conflict between the British government and Irish revolutionaries in Ireland, Bloody Sunday began with the killings of 14 people by the Irish Republican Army (IRA) under the leadership of Michael Collins. Two other violent incidents against civilian and IRA members during the day added to the death count, which was over 30 by the end of the day.

birthdays & deaths:

Births On This Day, November 21st

1969 Ken Griffey, Jr.

American baseball player

1965 Björk

Icelandic singer-songwriter, producer, actress

1845 Goldie Hawn

American actress

1854 Pope Benedict XV

1694 Voltaire

French philosopher

Deaths On This Day, November 21st

2012 Ajmal Kasab

Pakistani terrorist

1996 Abdus Salam

Pakistani physicist, Nobel Prize laureate

1970 C. V. Raman

Indian physicist, Nobel Prize laureate

1959 Max Baer

American boxer, acto

1899 Garret Hobart

American lawyer, politician, 24th Vice President of the United States

company news/earnings:

Analyst Actions

NVDA Cantor Fitzgerald Reiterates Overweight on NVIDIA, Maintains $175 Price Target

SNOW Wells Fargo Maintains Equal-Weight on Snowflake, Raises Price Target to $150

UPGRADES

$ACRS Upgraded to Overweight at Cantor

$AU Upgraded to Sector Perform at Scotiabank; PT $30

$DTM Upgraded to Buy at Citi; PT $115

$EVTC Upgraded to Equal-Weight at Morgan Stanley; PT $35

$PANW Upgraded to Buy at Rosenblatt Securities Inc

$PEB Upgraded to Buy at Compass Point; PT $17

$PLL Upgraded to Neutral at Macquarie; PT $13.50

$SAGE Upgraded to Sector Perform at RBC; PT $4

$SFL Upgraded to Buy at Fearnley; PT $13

DOWNGRADES

$ADNT Downgraded to Neutral at BofA

$GOGL Downgraded to Hold at Pareto Securities; PT $12.50

$GRAB Downgraded to Hold at China Renaissance; PT $5.40

$THG Downgraded to Neutral at Janney Montgomery; PT $176

$IR Downgraded to Sell at CFRA

$NIO ADRs Downgraded to Neutral at Macquarie; PT $4.80

$PYXS Downgraded to Market Perform at William Blair

$ROL Downgraded to Sell at CFRA

$TGT Downgraded to Hold at HSBC; PT $138

$TRV Downgraded to Neutral at Janney Montgomery; PT $280

$ULTA Downgraded to Market Perform at William Blair

$WMT Downgraded to Hold at DZ Bank; PT $91X

$XPEV ADRs Downgraded to Neutral at Goldman; PT $12.50

$ZIM Downgraded to Sell at Fearnley; PT $20

INITIATIONS

$FDMT Initiated at New Underweight at Morgan Stanley; PT $8

$AER Reinstated Buy at Goldman; PT $119

$AL Reinstated Buy at Goldman; PT $65

$AMTM Initiated at New Outperform at Raymond James; PT $30

$APLS Initiated at New Equal-Weight at Morgan Stanley; PT $31

$GEV Initiated at New Overweight at Wells Fargo; PT $385

$IGIC US Initiated at New Outperform at Oppenheimer; PT $30

$MRX Initiated at New Buy at HSBC; PT $33

$MRUS Initiated at New Buy at Goldman; PT $73

$NBN Initiated at New Market Perform at KBW; PT $102

$SDST Initiated at New Buy at Roth Capital Partners; PT $13

$TMO Initiated at New Buy at CMB International; PT $670

$UMBF Initiated at New Overweight at Morgan Stanley; PT $156

$VERA Initiated at New Overweight at Wells Fargo; PT $70

Earnings

$BEKE KE Holdings Inc. reported earnings Q3 FY2024 results ended September 30th, 2024 – Net revenues: $3.2B, +26.8% YoY – Net income: $167M, relatively flat YoY – Gross Transaction Value (GTV): $105.0B, +12.5% YoY – Number of stores: 48,230, +12.1% YoY

$BIDU Baidu reported earnings Q3 FY2024 results ended September 30th 2024 – Total Revenue: $4.78B (RMB 33.6B), -3% YoY – Operating Income: $844M (RMB 5.9B), -6% YoY – Net Income: $1.09B (RMB 7.6B), +14% YoY – EPS (ADS): $3.08 (RMB 21.60), +19% YoY – Non-GAAP Operating Income: $999M (RMB 7.0B), -8% YoY – Free Cash Flow: $376M (RMB 2.6B)

$BJ BJ’s Wholesale Club reported earnings Q3 FY2024 results ended November 2nd 2024 – Revenue: $5.10B, +3.5% YoY – Net Income: $155.7M, +19.4% YoY – EPS: $1.17 vs $0.97 YoY – Comp Sales: +3.8% YoY (ex-gas)

$DE Deere & Company reported earnings Q4 FY2024 results ended October 27th 2024 – Revenue: $11.14B, -28% YoY – Net Income: $1.25B, -47% YoY – EPS: $4.55 vs $8.26 YoY – Full Year Net Income: $7.1B, -30% YoY

$IQ iQIYI Inc. reported earnings Q3 FY2024 results ended September 30th 2024 – Revenue: $1.0B, -10% YoY – Net income: $32.7M, -52% YoY – Operating income: $34.0M vs $106.4M in Q3 2023 – Operating margin: 3% vs 9% in Q3 2023

$PDD PDD Holdings reported earnings Q3 FY2024 results ended September 30th 2024 – Revenue: $14.16B, +44% YoY – Net Income: $3.56B, +61% YoY – Diluted EPS (ADS): $2.41 vs $1.06 YoY – Operating Profit: $3.46B, +46% YoY

$WMG Warner Music Group reported earnings Q4 FY2024 results ended September 30th 2024 – Total Revenue: $1.63B, +3% YoY – Digital Revenue: $1.07B, flat YoY – Net Income: $48M, -69% YoY -Operating Income: $143M, -33% YoY – Adjusted OIBDA: $353M, +11% YoY – Free Cash Flow: $271M, -10% YoY

FYI

Bluesky, an app that has drawn attention as a possible X rival, has amassed a total of 20 million users to date.

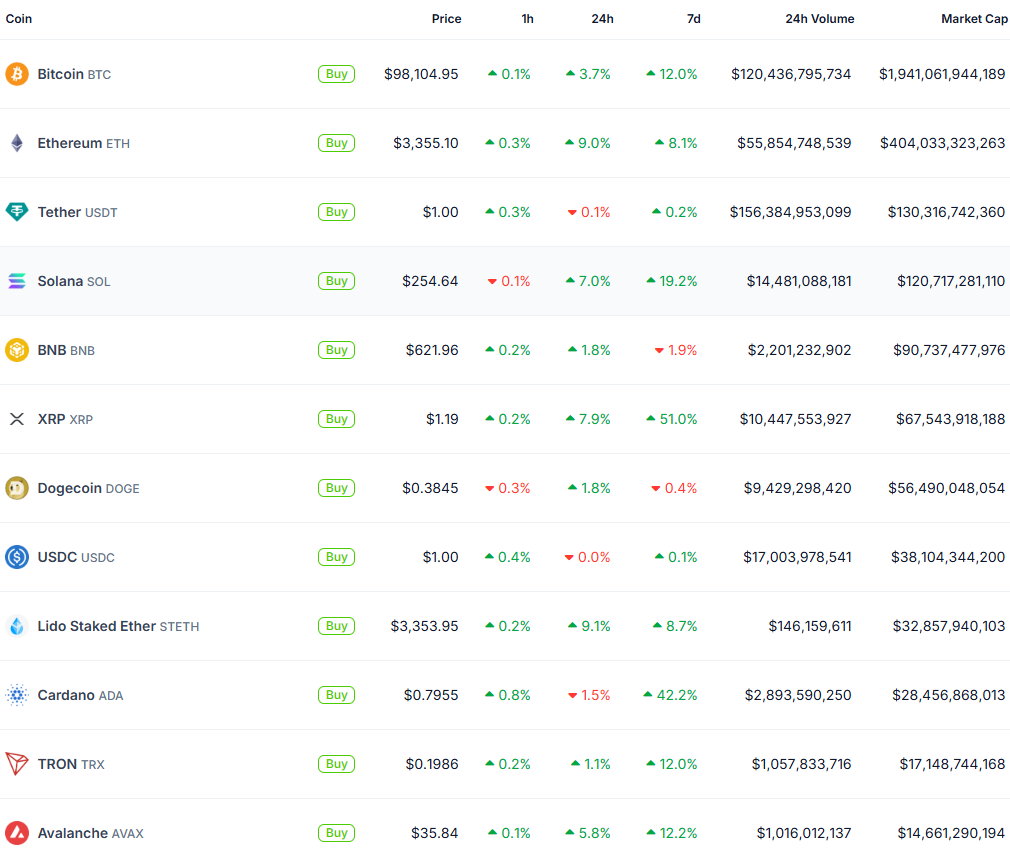

Michael Saylor’s MicroStrategy Bitcoin investment surpasses $15 billion profit.

US SEC: CHAIR GENSLER IS TO DEPART AGENCY ON JANUARY 20TH.

Amazon Likely To Be Investigated Under EU’s Digital Markets Act In 2025 – RTRS Sources – Antitrust Regulators Are Building Case For Investigation

SPAIN RAISES BANK TAX RATE TO AS MUCH AS 7%

Fed’s Collins sees more rate cuts ahead for US central bank

Fed’s Bowman says rate cuts are concerning

FED’S GOOLSBEE SAYS IT MAY MAKE SENSE TO SLOW PACE OF INTEREST RATE CUTS AS U.S. CENTRAL BANK GETS CLOSE TO WHERE RATES WILL SETTLE

CITADEL’S GRIFFIN SAYS NOT PLANNING TO TAKE CITADEL SECURITIES PUBLIC RIGHT NOW

FED’S GOOLSBEE: I’VE GOTTEN MORE COMFORT THAT WE’RE NOT CRASHING THROUGH FULL EMPLOYMENT, SAYS LABOR MARKET IS MOVING INTO STABLE, FULL EMPLOYMENT

GOOLSBEE: OVER THE NEXT YEAR, IT FEELS LIKE RATES WILL END UP A FAIR BIT LOWER THAN WHERE THEY ARE TODAY

GOOLSBEE: INFLATION IS ON ITS WAY DOWN TO 2%; LABOR MARKET IS CLOSE TO STABLE FULL EMPLOYMENT

EUROZONE CONSUMER CONFIDENCE FLASH ACTUAL -13.7 (FORECAST -12.4, PREVIOUS -12.5

A Florida man has been charged with plotting to bomb the New York Stock Exchange this week, FBI says – AP

BRAZIL FEDERAL POLICE FIND EVIDENCE THAT FORMER PRESIDENT BOLSONARO KNEW ABOUT PLOT TO KILL LULA, POLICE SOURCES SAY

U.S EXISTING HOME SALES (OCT) ACTUAL: 3.96M VS 3.84M PREVIOUS; EST 3.95M

U.S EXISTING HOME SALES (MOM) (OCT) ACTUAL: 3.4% VS -1.0% PREVIOUS

DOJ SEEKS TO PROHIBIT GOOGLE FROM BUYING OR INVESTING IN ANY SEARCH RIVALS, QUERY-BASED AI PRODUCTS OR AD TECH

Dollar pulls ahead as markets focus on Trump policies, Fed outlook

Gold climbs to over 1-week high on safe-haven demand

U.S. CRUDE OIL FUTURES SETTLE AT $70.10/BBL, UP $1.35, 1.96%

NYMEX WTI CRUDE JANUARY FUTURES SETTLE AT $70.10 A BARREL, UP $1.35, 1.96%.

NYMEX NATURAL GAS DECEMBER FUTURES SETTLE AT $3.3390/MMBTU.

NYMEX GASOLINE DECEMBER FUTURES SETTLE AT $2.0594 A GALLON.

NYMEX DIESEL DECEMBER FUTURES SETTLE AT $2.2744 A GALLON.

Canada Industrial Product Price (M/M) Oct: 1.2% (est 0.9%; prev -0.6%; prevR -0.8%) – Raw Materials Price Index (M/M) 3.8% (est 2.5%; prev -3.1%; prevR -3.2)

Japan exports rise more than expected in October, rebounding from 43-month low

U.S INITIAL JOBLESS CLAIMS ACTUAL: 213K VS 217K PREVIOUS; EST 220K

LOWEST SINCE WEEK OF MAY 24, 2024

U.S CONTINUING JOBLESS CLAIMS ACTUAL: 1908K VS 1873K PREVIOUS; EST 1880K

U.S PHILADELPHIA FED MANUFACTURING INDEX (NOV) ACTUAL: -5.5 VS 10.3 PREVIOUS; EST 8.0

US Philly Fed Employment* (Nov) 8.6 (Prev. -2.2)

US Philly Fed New Orders* (Nov) 8.9 (Prev. 14.2)

US Philly Fed Prices Paid* (Nov) 26.6 (Prev. 29.7)

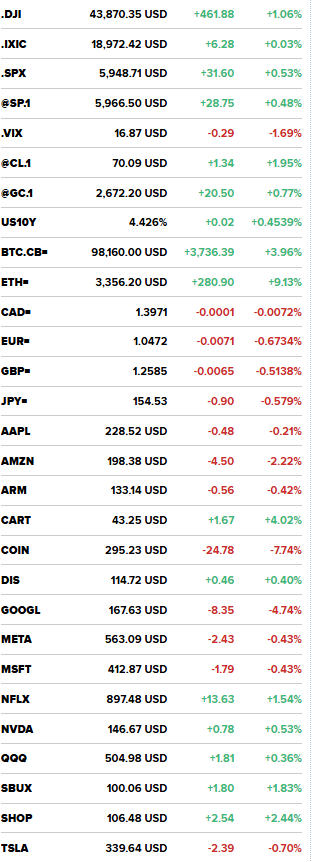

Dow ends up 1.1% to score best session since day after U.S. election

US markets closed: ⬆ S&P 500 – 5,948.70 (+0.53%) ⬆ DOW 30 – 43,870.35 (+1.06%) ⬆NASDAQ – 18,972.42 (+0.03%) ⬆ Russell 2000 – 2,366.98 (+1.78%) ⬇ CBOE Volatility – 16.94 (-1.28%)

DOW JONES UNOFFICIALLY CLOSES UP 468.12 POINTS, OR 1.08%, AT 43,876.59

S&P 500 UNOFFICIALLY CLOSES UP 31.49 POINTS, OR 0.53%, AT 5,948.60

NASDAQ UNOFFICIALLY CLOSES UP 9.72 POINTS, OR 0.05%, AT 18,975.86

European stocks close higher; JD Sports slumps 16% on profit warning

Asia markets fall as investors assess Nvidia results; Adani Group companies plunge